Agricultural and construction equipment maker Deere (NYSE:DE) is scheduled to announce its fiscal fourth-quarter results on Wednesday, November 22. There are concerns about macro pressures and high interest rates impacting demand. That said, some analysts expect Deere to be resilient compared to its rivals.

Expectations from Deere’s Q4 Earnings

Deere exceeded analysts’ expectations in the first three quarters of Fiscal 2023, reflecting strong execution. The company’s Q3 FY23 earnings per share (EPS) of $10.20 reflected about a 66% year-over-year jump and easily surpassed analysts’ expectations of $8.22. The company upgraded its full-year outlook following upbeat third-quarter results, but investors remained unimpressed due to concerns about slower sales ahead.

Coming to Fiscal Q4 expectations, analysts expect the company’s net sales to decline about 5% year-over-year to $13.6 billion. However, they project EPS to increase slightly to $7.46 from $7.44 in the prior-year quarter.

On Monday, HSBC analyst Helen Fang initiated coverage of Caterpillar (NYSE: CAT) and Deere with Hold and Buy rating, respectively. The analyst thinks that the U.S. is poised to sustain its position as the world’s leading construction machinery market. That said, the analyst highlighted some challenges, including rising second-hand inventory and a moderation in recent orders.

The analyst expects the U.S. to remain the largest end-market in 2023- 2025, backed by construction spending, non-residential construction, and US infrastructure bills. Between Caterpillar and Deere, HSBC prefers Deere, given that its agricultural machines and construction machines account for 72% and 21% of its 2023 estimated sales, respectively. The analyst believes that Deere is best positioned to capture the continued North American agricultural equipment upcycle with a dominant 60% market share.

Is Deere a Good Stock to Buy Now?

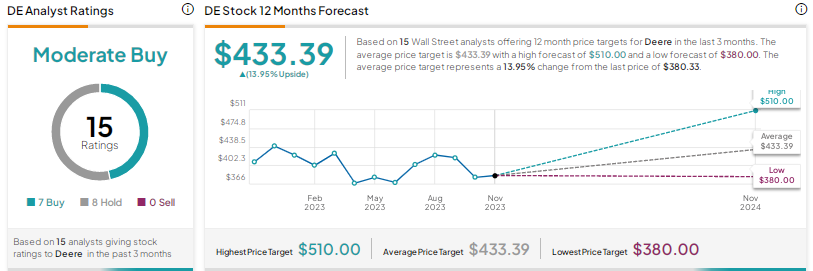

Wall Street is cautiously optimistic on Deere, with a Moderate Buy consensus rating based on seven Buys and eight Holds. The average price target of $433.39 implies 14% upside potential. Shares have declined more than 11% year-to-date.

Insights from Options Trading Activity

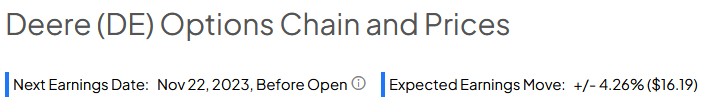

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 4.26% move on Deere’s earnings. DE shares have averaged a (0.74)% move in the last eight quarters. In particular, the stock declined 5.3% in reaction to the company’s Q3 FY23 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Conclusion

Wall Street expects a tough macro backdrop and growing inventory of used equipment to impact Deere’s Q4 FY23 performance. Overall, investor sentiment is cautious ahead of the upcoming results.