Roblox (NASDAQ:RBLX) stock has been stuck in a funk ever since shares fell in late 2021 and early 2022. It was a steep sell-off that set the stage for a broader pullback across various high-tech growth companies. At its worst, the stock shed more than 80% of its value. Now that the stock has had over a year to settle, putting a halt to its initial free-fall, I do believe it’s a good time to give the video-gaming play a second look as it settles near the $40 range while most investors overlook the longer-term potential of the Metaverse.

With so much hype and expectation now squeezed out of the stock, I’m inclined to take a more bullish stance on Roblox as we all start talking a bit more about the Metaverse and its longer-term potential.

Renewed Metaverse Enthusiasm Could be Hugely Beneficial for Roblox Stock

Meta Platforms (NASDAQ:META) helped spark initial metaverse hype when it decided to shift gears and go after the new medium of growth. Though Meta still seeks to become a pioneer in the Metaverse (or spatial computing), a lot of enthusiasm has shifted over to other trends, including AI.

Undoubtedly, AI seems so much closer to entering its prime, and with that comes monetization (or money-saving) opportunities that may be realizable over a nearer-term time horizon. As for the Metaverse, it’s tough to tell when the “gold rush” will begin. It’s this uncertainty that’s kept the broader basket of metaverse (or VR/AR) stocks from blasting off. Should the Metaverse become a hot topic again, though, Roblox is one of the names that could quickly heat up.

In any case, Roblox is still investing with growth in mind. The mentality in this high-rate environment has been all about cost cuts and driving up efficiencies. When it comes to the Metaverse, I do not believe there is time to follow the herd with regard to capital allocation. The Metaverse may be much closer to “taking off” than many realize.

Don’t Count on a Sudden “Tipping Point” for the Metaverse and Spatial Computing

Just look back to a year ago when many people were oblivious to LLMs (Large Language Models) like ChatGPT. These days, LLMs (or AI-powered chatbots) are the talk of the town, with many firms that need to get in on the action or risk being left behind as the so-called “Fourth Industrial Revolution” plays out.

It’s never easy to tell when the tipping point will be. For the Metaverse and spatial computing, I don’t think there will be one. Instead, the adoption of devices could take place steadily over time. Apple (NASDAQ:AAPL) and its Vision Pro spatial computer may be the device that advances the field by leaps and bounds over the next two to three years.

Doubt Apple, if you will, but the company seems to know when to bet big on a specific emerging technology. Though I don’t expect Apple Vision Pro will be the device that propels spatial computing to the forefront, I do believe that successors to the headset (cheaper and more capable iterations) could. That could kick off a gradual trend that lifts all boats in the VR/AR waters. Roblox seems like one of the ships that could ascend well before we’re all “plugged into” some sort of metaverse.

Roblox Stock: An Undercover Metaverse Story

Last month, Roblox stock got a bid of confidence for Canaccord Genuity analyst Jason Tilchen, who started the stock as a “Buy” alongside a $48 price target. Roblox “has evolved to become one of the leading destinations for immersive gaming and social interactions in persistent virtual worlds,” stated Mr. Tilchen in his bullish note. He also praised the company for investing in future growth. I think Tilchen is right on the money — Roblox is a metaverse story, perhaps one of the most intriguing.

If Apple is the hardware way to play VR/AR, Roblox is likely the way to play it from the software side. For now, the stock is being punished for posting ugly losses. In a rise-rate world, these losses seem that much more disgusting.

As interest rates eventually come down (most likely) and the masses become increasingly interested in spatial computing, I expect Roblox may be on the cusp of a multi-year cycle of impressive growth. If that’s the case, the 10.4 times price-to-sales (P/S) multiple doesn’t do the stock justice — not when you have Nvidia (NASDAQ:NVDA), an AI and omniverse play, going for over 40 times P/S.

Rather than a traditional value play, I consider RBLX stock a misunderstood growth story, which may as well be as good as a value stock through the eyes of investors who seek to maximize the bang for their investment buck.

Is RBLX Stock a Buy, According to Analysts?

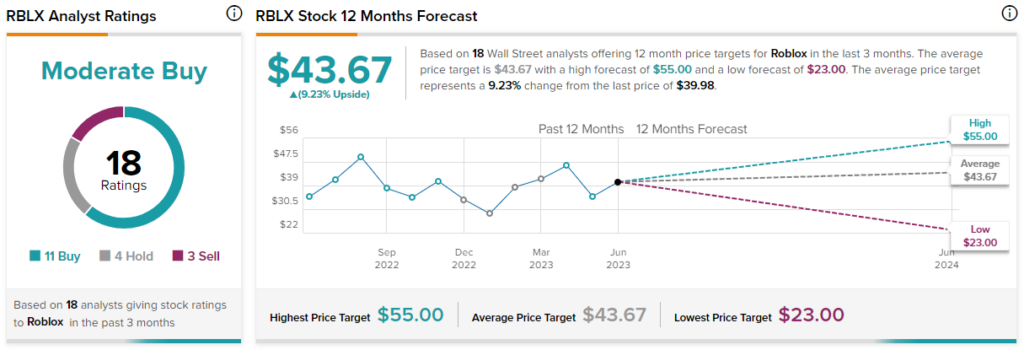

Turning to Wall Street, RBLX stock comes in as a Moderate Buy. Out of 18 analyst ratings, there are 11 Buys, four Holds, and three Sells.

The average Roblox price target is $43.67, implying upside potential of 9.2%. Analyst price targets range from a low of $23.00 per share to a high of $55.00 per share.

Conclusion

Given the growth potential in the Metaverse arena, it’s a mystery as to why Roblox stock has dragged its feet. Perhaps investors are placing too much emphasis on near-term financials than the longer-term prospects that seem to be improving with time.

Unsurprisingly, Roblox also stands to gain from the rise of AI. The Roblox platform, supercharged with AI, could give its developers a real shot in the arm. AI can help lower barriers to entry, helping Roblox gain more developers. Further, AI will provide developers with more capability and efficiency, allowing them to create more immersive experiences. Altogether, AI looks to be a force that can accelerate growth and possibly be the driving force that helps bring spatial computing to the forefront.