Kraft Heinz (NASDAQ:KHC) offers a superior combo right now for investors who like to collect dividends and take advantage of a real bargain. Sure, the market doesn’t like Kraft Heinz today, but I invite to you to focus on the long term. I am bullish on KHC stock, and I consider the market’s very negative response to Kraft Heinz’s quarterly press release to be an overreaction.

You surely know Kraft Heinz for the company’s wide variety of food items found in America’s grocery stores, including Heinz ketchup and, of course, Kraft macaroni and cheese. The nation might be obsessed with weight-loss drugs, but Americans are still eating plenty of junk food.

However, high consumer prices may have slowed down the rate at which people consume Kraft Heinz’s products. The market recognizes this and has decided to punish Kraft Heinz, but don’t panic sell your KHC stock until you’ve actually reviewed the company’s results and forward guidance.

Kraft Heinz Continues Its Stellar Earnings Track Record

First of all, Kraft Heinz has an amazingly consistent track record of beating analysts’ quarterly EPS projections. The company just continued this track record with fourth-quarter 2023 earnings of $0.78 per share, slightly beating the consensus estimate of $0.77 per share.

That’s probably not something to write home about, but it’s good news, nonetheless. Furthermore, Kraft Heinz declared a regular quarterly dividend of $0.40 per share, which translates to a 1.17% yield per quarter, with the share price around $34.20. That would be a 4.68% forward annual yield, which easily outpaces the consumer defensive sector average annual dividend yield of 2.125%.

Clearly, Kraft Heinz’s board of directors doesn’t think the company is in deep trouble if it’s prepared to pay such a healthy dividend. Still, despite the good news I just mentioned, the market decided to give KHC stock a 6% haircut today.

We’ll get to the possible reasons in a moment, but first, consider what this could mean for value-focused investors. Kraft Heinz’s trailing 12-month price-to-earnings (P/E) ratio is currently around 14.7x, which is quite reasonable. For comparison, the sector median P/E ratio is slightly above 20x.

Kraft Heinz’s Soft Mac-and-Cheese Sales Take a Toll

You’ll surely be amazed to discover that low sales of macaroni and cheese, of all things, was a main contributor to Kraft Heinz’s slight fall-off in quarterly sales. Apparently, a reduction in food-stamp benefits caused a decline in purchases of Kraft Heinz’s famous macaroni and cheese.

Persistent inflation was another contributing factor, no doubt. Kraft Heinz CEO Carlos Abrams-Rivera seemed to acknowledge this, stating, “In the fourth quarter, the industry faced headwinds that were driven by ongoing consumer pressure.”

To deal with the impact of inflation, Kraft Heinz ended up raising its products’ prices by 3.7%. Sometimes, U.S. consumers just absorb rising food prices and keep on buying the products anyway. This evidently wasn’t the case in 2023’s fourth quarter, though.

Kraft Heinz’s Q4-2023 international sales were almost flat on a year-over-year basis. However, the company’s U.S. sales declined by 9.1%.

Still, Abrams-Rivera remains optimistic. Concerning persistent food-price inflation and the aforementioned food-stamp issue, the Kraft Heinz CEO assured, “Looking ahead, we expect some of these pressures to dissipate, particularly as the reduction in SNAP [food-stamp program] benefits is lapped.”

More than anything else, the market is certainly unhappy with Kraft Heinz’s forward guidance. For Fiscal Year 2024, the company anticipates year-over-year organic net sales growth of 0% to 2%, as well as adjusted EPS growth of 1% to 3%. However, now that the market is angrily expressing its discontent, Kraft Heinz may be able to clear the low bars that it has set for itself in 2024.

Is Kraft Heinz Stock a Buy, According to Analysts?

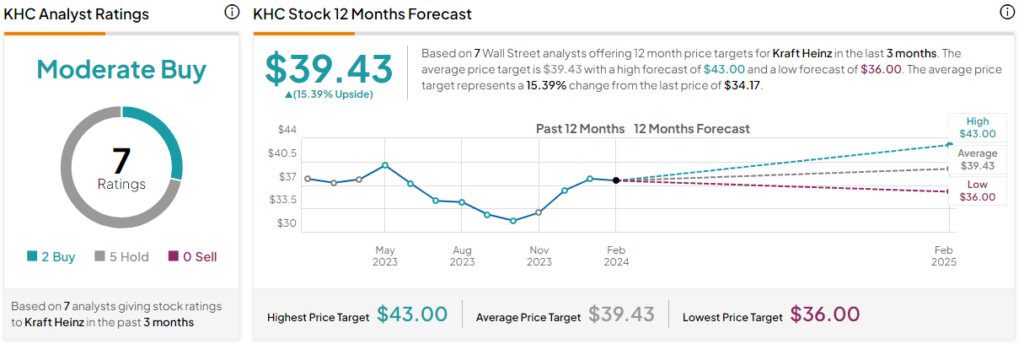

On TipRanks, KHC comes in as a Moderate Buy based on two Buys and five Hold ratings assigned by analysts in the past three months. The average Kraft Heinz stock price target is $39.43, implying 15.4% upside potential.

Conclusion: Should You Consider Kraft Heinz Stock?

Whether you appreciate good value or like to collect generous dividend distributions, Kraft Heinz has something special to offer today. The company actually beat analysts’ quarterly EPS estimate, and Kraft Heinz’s CEO remains fairly confident that consumer price pressures will ease.

Granted, Kraft Heinz’s forward guidance doesn’t call for robust growth. That’s today’s projection, though, and it may just be a setup for Kraft Heinz to deliver positive surprises later on. Therefore, I see a great dip-buying opportunity with KHC stock and am considering it right now.