Back when Microsoft (NASDAQ:MSFT) was still trying to buy Activision Blizzard, one of the biggest hurdles it ran into was with UK regulatory authorities. Despite this, Microsoft has retracted its prior criticism of the UK. Previously, Microsoft—via president Brad Smith—declared the UK as bad for business. However, a recent interview between Smith and the BBC showed a clear change of heart.

Smith detailed how the opposition from British regulators forced Microsoft to modify its acquisition and take some more “consumer friendly” stances, starting with some clear changes that would protect cloud-based gaming. It was clear that the Competition and Markets Authority in the UK, Smith noted, had concerns about keeping Activision games available on multiple platforms, and the pushback accordingly made those concerns more clearly addressed.

One Loss, Several Wins

While this might have been a bitter pill for Microsoft, it’s got quite a bit more to roll out, and that should help soften the blow. Or rather, should have helped, given that Microsoft is trading lower right now. It’s recently brought out Intelligent Recap for Copilot, useful for those who use Copilot in conjunction with Microsoft Teams. Intelligent Recap allows for easier search functions, letting users focus on timeline markers or even when a user’s name is mentioned in a video meeting. Microsoft also released some improvements to its dotnet-coverage tools. With the new improvements, users can cover code, merge coverage reports, and more, all from one tool.

What is the Stock Price Prediction for Microsoft?

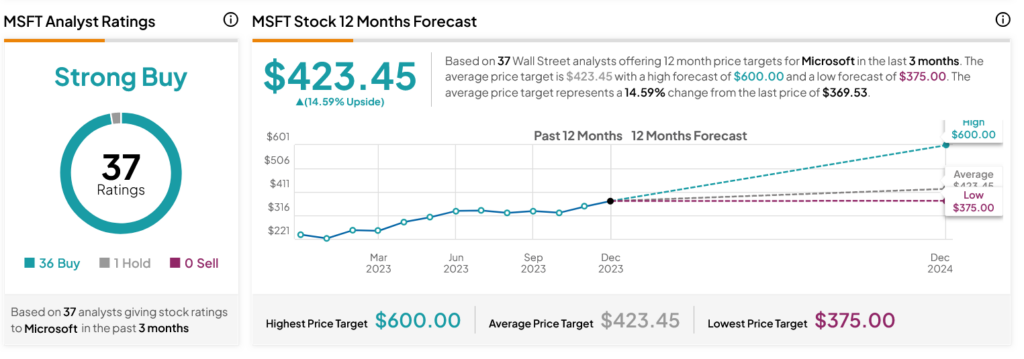

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 36 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 55.17% rally in its share price over the past year, the average MSFT price target of $423.45 per share implies 14.59% upside potential.