On February 28, 2024, LanzaTech Global Inc (LNZA, Financial) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. LanzaTech, a pioneer in carbon recycling, transforms waste carbon into sustainable raw materials for consumer goods, aiming to reduce reliance on virgin fossil fuels.

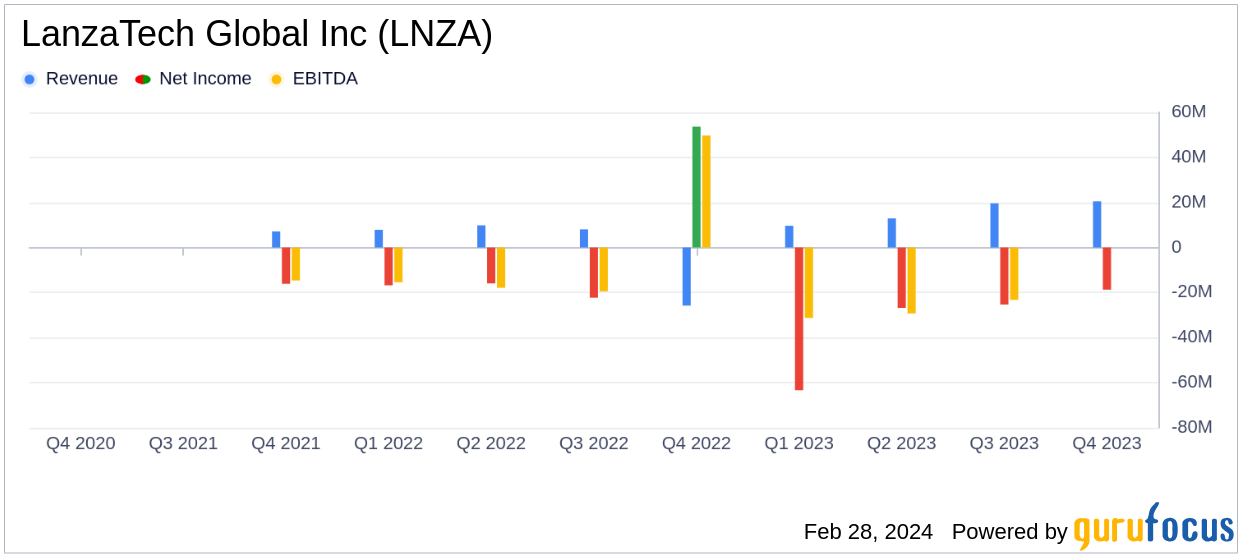

The company reported a significant increase in revenue for both the fourth quarter and the full year, with Q4 revenue rising to $20.5 million, a 77% increase over the same period in 2022. The full year revenue saw a 68% increase to $62.6 million. This growth was primarily driven by the core Biorefining, carbon capture, and utilization business, which grew 103% year-on-year in the fourth quarter.

Gross profit for Q4 was $8.5 million, marking a 238% increase over the prior year's quarter, with gross margin improving to 41%. The full year gross profit was $17.7 million, a 95% increase from the previous year. This improvement in gross margin was attributed to a shift in revenue mix towards higher margin engineering services and royalty revenues.

Despite the revenue growth, LanzaTech reported a net loss of $(18.7) million for Q4, which was an improvement compared to a net loss of $(21.4) million in Q4 2022. The full year net loss widened to $(134.1) million from $(76.4) million in the previous year. Adjusted EBITDA for Q4 showed a sequential improvement, resulting in a full year Adjusted EBITDA of $(80.1) million.

LanzaTech's liquidity position remained strong with $121.4 million in cash, restricted cash, and investments at the end of 2023. The company also reported a reduced quarterly cash burn of $15.4 million for Q4.

For the full year 2024, LanzaTech anticipates revenue to be between $90 million and $105 million with Adjusted EBITDA between $(65) million and $(55) million. The company noted that it does not expect to achieve positive Adjusted EBITDA by the end of 2024 due to an elongation of the project development life cycle and macroeconomic factors.

Operational highlights for the year included the start-up of three new commercial-scale plants and the opening of the world’s first ethanol-to-sustainable aviation fuel facility. The company also made progress in research and development, particularly with new bacterium strains capable of producing Isopropyl Alcohol (IPA).

In response to the financial performance, CEO Jennifer Holmgren expressed confidence in the leadership team's ability to execute the business plan and continue the path toward profitability. LanzaTech also announced an organizational streamlining initiative aimed at reducing operating expenses and driving efficiencies, which includes a reduction in the size of the executive team by 33% and a workforce reduction of approximately 5%.

The company will host a conference call to discuss these results and provide further insights into its strategies and outlook.

For value investors and potential GuruFocus.com members, LanzaTech's commitment to operational efficiency and strategic growth, despite the challenges faced, presents an interesting case study in the waste management industry. The company's innovative approach to carbon recycling and its potential for long-term sustainable growth are key factors to consider when evaluating its financial health and investment potential.

For more detailed financial information and future updates on LanzaTech Global Inc (LNZA, Financial), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from LanzaTech Global Inc for further details.