In the early stages of the decade, amid the rise of electric vehicles and the grip of the Covid-19 pandemic on the world, Nikola (NASDAQ:NKLA) stood out as a major player.

Yet, behind the scenes, doubts began to brew. Accusations of misleading investors and overhyping the company’s technology started to surface, casting shadows over Nikola’s once-promising trajectory.

Last year, these suspicions were substantiated as former CEO and founder Trevor Milton was convicted of fraud, leading to a four-year prison sentence.

For those investors who have stuck around, it’s an understatement to say the past few years have been no fun either, given NKLA stock now sits 99% below the June 2020 peak.

Meanwhile, Nikola has been trying to put its past behind it. Now boasting an entirely different management team, it has gotten down to the business of making and selling some trucks.

With Nikola’s Q1 readout slated for next Tuesday (May 7), it looks like it has sprung a bit of surprise on that front, according to D.A. Davidson’s Michael Shlisky.

The analyst expected Nikola to deliver 31 FCEV trucks in the quarter, but it delivered 40, the better-than-expected haul necessitating a change to Shlisky’s model. As such, Shlisky now expects revenue of $15 million (vs. $13.6 million before), above consensus at $14.3 million. On adj. EBITDA, Shilsky now has -$92.9 million (compared to -$90.9 million before) while the Street calling for -$89.5 million.

Going by conversations with management, Shlisky notes that the average selling price for the truck this year might be under the $400,000 expected. The analyst also points out that toward the end of Q1, the company opened hydrogen stations in Canada and Southern California, but that it was “likely too late to realize much revenue.”

“We’re pleased to hear customers are buying the product,” says Shlisky on the progress being made, “but it’s too early to jump in given funding, legal and customer-experience uncertainties.”

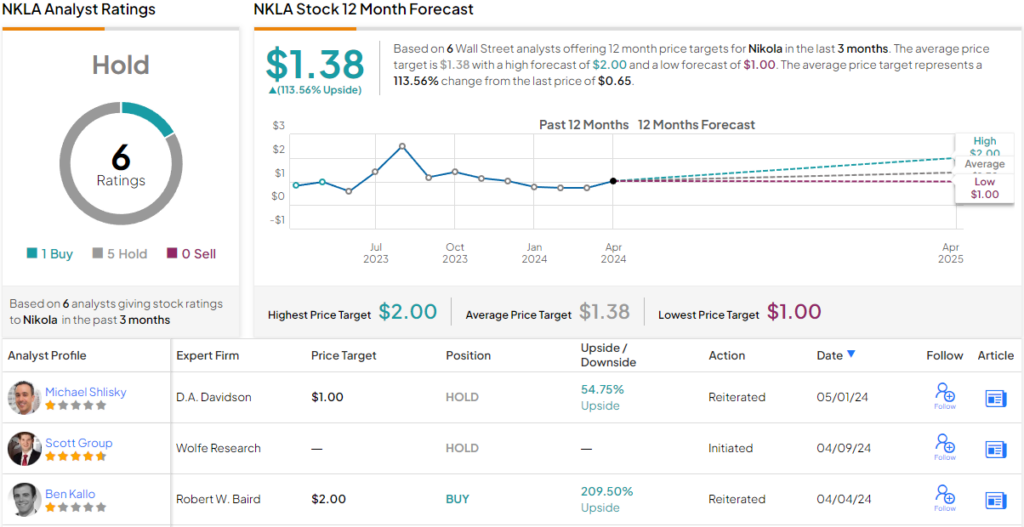

To this end, Shlisky rates NKLA shares a Neutral, although he might as well have said Buy, given his $1 price target implies the shares will climb 54% higher over the next year. (To watch Shlisky’s track record, click here)

Most other analysts also remain on the sidelines for now; RIVN’s Hold consensus rating is based on 5 Holds and 1 Buy. That said, the other fencesitters also seem to think the shares are undervalued; going by the $1.38 average target, a year from now, investors will be pocketing returns of 113.5%. (See Nikola stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.