Entertainment giant Walt Disney (NYSE:DIS) is in the midst of activist investor drama as another hedge fund, ValueAct Capital, builds a large stake in it. As per multiple reports and as discussed by CNBC anchor David Faber, ValueAct has steadily built up a stake worth roughly $1 billion in Disney in the third quarter. The share buying began in the summer, when the strike between Hollywood Studios and the actors/writers’ guild began. ValueAct continues to buy more shares of Disney as it sees the stock as undervalued. DIS stock gained 3.1% on the news, closing at $93.93 on November 15.

Interestingly, ValueAct’s Co-CEO Mason Morfit is seen as a “friendly” investor and counselor to the companies in which the fund invests. Morfit is said to be supportive of Disney’s current strategy. Moreover, he believes that Disney’s stock price should double in the future.

The news follows reports of another activist investor, Nelson Peltz’s Trian Fund, adding to its Disney stake in Q3. Peltz has been waging a proxy fight with Disney for months and is seeking multiple board seats. Peltz has also won the support of Isaac Ike Perlmutter, ex-CEO of Marvel Entertainment in his fight.

With ValueAct’s surprising entry, Disney’s shareholders now have a choice between two contrasting activist investors. Considering their historical work styles, Disney may add Morfit to its board to ensure a more pleasant and seamless turnaround for the company.

Is Disney a Buy, Sell, or Hold?

Yesterday, Deutsche Bank analyst Bryan Kraft cut the price target on DIS to $115 from $120 while maintaining a Buy rating. Kraft believes Disney has “turned the corner” in its Q4FY23 results, but streaming profitability remains a challenge.

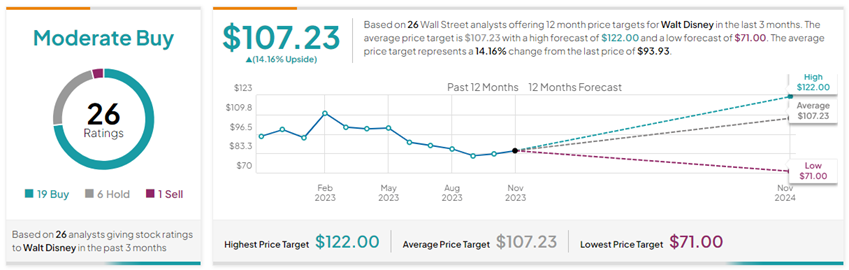

On TipRanks, Disney has a Moderate Buy consensus rating based on 19 Buys, six Holds, and one Sell rating. The average Walt Disney price forecast of $107.23 implies 14.2% upside potential from current levels. Year-to-date, DIS stock has gained 5.6%.