So far, 2023 has turned out to be a profitable year for Netflix (NASDAQ:NFLX) shareholders. On the contrary, Walt Disney (NYSE:DIS) stock has disappointed investors with its better-than-expected Q3 earnings, failing to lift its stock price higher. Though investors’ sentiment differs significantly for NFLX and DIS stocks, UBS analyst John Hodulik anticipates that a difficult operating environment in the second half of the year will present hurdles for media and entertainment companies, including these sector leaders.

In a note to investors dated August 28, the analyst highlighted that the companies operating in this space have increased prices and are focusing on cutting costs to drive efficiency. Nevertheless, the analyst pointed out that there is still uncertainty regarding user growth.

Against this backdrop, let’s examine the recommendations from Wall Street analysts for Netflix and Disney stocks.

Is Netflix Stock Expected to Rise?

Netflix stock has gained nearly 42% year-to-date, outperforming the S&P 500 Index (SPX). In addition, analysts’ average price target suggests further upside. However, the upside in NFLX stock remains capped.

Netflix will likely benefit from its ability to effectively implement growth measures, including the crackdown on password sharing and the launch of ad-supported plans. All these steps are aimed at driving its financial performance.

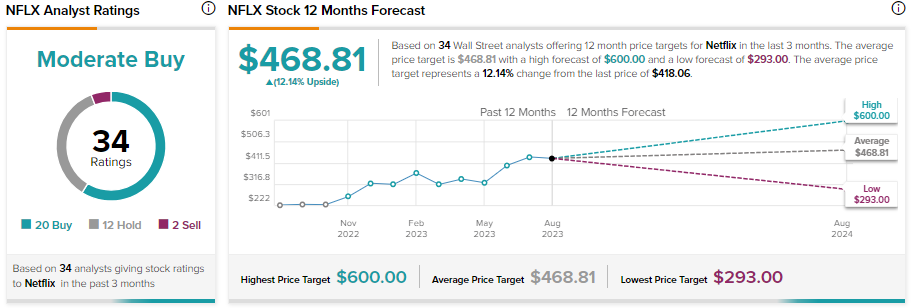

Although Netflix is heading in the right direction, heightened competition and uncertainty over customer additions, pricing, and churn rate remain concerns. Given these uncertainties, analysts maintain a cautiously optimistic outlook on Netflix stock. It has received 20 Buy, 12 Hold, and two Sell recommendations for a Moderate Buy consensus rating. These analysts’ 12-month average price target of $468.81 implies 12.14% upside potential from current levels.

Is Disney Stock a Buy or a Hold?

Disney stock has failed to impress so far this year. Even so, its focus on driving profitability in its direct-to-consumer business through price increases and the ramp-up of the Disney+ ad tier are positives. The company managed to cut losses in the direct-to-consumer business during the most recent quarter. Moreover, the company believes that its direct-to-consumer business will achieve profitability by the end of 2024.

Also, Disney’s Parks and Experiences business is driving its earnings and cash flows, which is encouraging. Investors should note that activist investor Nelson Peltz’s Trian Fund Management increased its holdings in DIS stock in the second quarter of 2023. The move comes after the billionaire investor ended the proxy fight with Disney’s management.

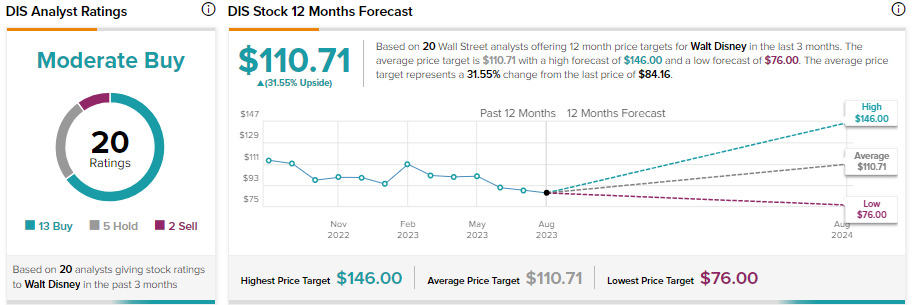

While Peltz made peace with Disney’s management, analysts remain cautiously optimistic about Disney stock. With 13 Buy, five Hold, and two Sell recommendations, Disney has a Moderate Buy consensus rating on TipRanks. Analysts’ average 12-month price target of $110.71 implies 31.55% upside potential from current levels.

Bottom Line

Both Netflix and Disney are taking measures to strengthen their financial performance and drive profitability. However, heightened competition and macro weakness add uncertainty over future user growth, keeping analysts cautiously optimistic about their prospects.