Wynn Resorts Ltd (WYNN, Financial) experienced a daily loss of -2.95%, and its 3-month performance reveals a decrease of -8.17%. The company reported a Loss Per Share of 0.16. But is the stock modestly undervalued? This analysis delves into the valuation of Wynn Resorts, providing investors with a comprehensive understanding of its financial health and growth prospects.

Understanding Wynn Resorts

Wynn Resorts Ltd (WYNN, Financial) operates luxury casinos and resorts, founded in 2002 by former CEO Steve Wynn. The company manages four megaresorts: Wynn Macau and Encore in Macau, and Wynn Las Vegas and Encore in Las Vegas. Additionally, Wynn Resorts operates Wynn Interactive, a digital sports betting and iGaming platform. The company's revenue in 2019 was primarily derived from Macau (76%), with Las Vegas contributing 24%.

Valuation: The GF Value

The GF Value is a proprietary valuation model that calculates a stock's intrinsic value. It incorporates historical trading multiples, an adjustment factor based on past performance and growth, and future business performance estimates. If the stock price significantly deviates from the GF Value Line, it may indicate overvaluation or undervaluation, influencing the stock's future returns.

For Wynn Resorts (WYNN, Financial), the GF Value suggests that the stock is modestly undervalued. Given its current price of $96.96 per share, long-term returns are likely to be higher than its business growth.

Financial Strength

Investing in companies with robust financial strength reduces the risk of permanent loss. The cash-to-debt ratio and interest coverage are critical indicators of financial health. Wynn Resorts has a cash-to-debt ratio of 0.29, which is lower than 60.43% of companies in the Travel & Leisure industry. This indicates that the financial strength of Wynn Resorts is relatively weak.

Profitability and Growth

Investing in profitable companies is generally less risky, especially those demonstrating consistent profitability over time. Wynn Resorts has been profitable for 7 out of the past 10 years, with an operating margin of 6.98%—better than 53.42% of companies in the Travel & Leisure industry.

However, growth is a critical factor in a company's valuation. Wynn Resorts' 3-year average revenue growth rate lags behind 78.07% of companies in the Travel & Leisure industry, and its 3-year average EBITDA growth rate is -26.5%.

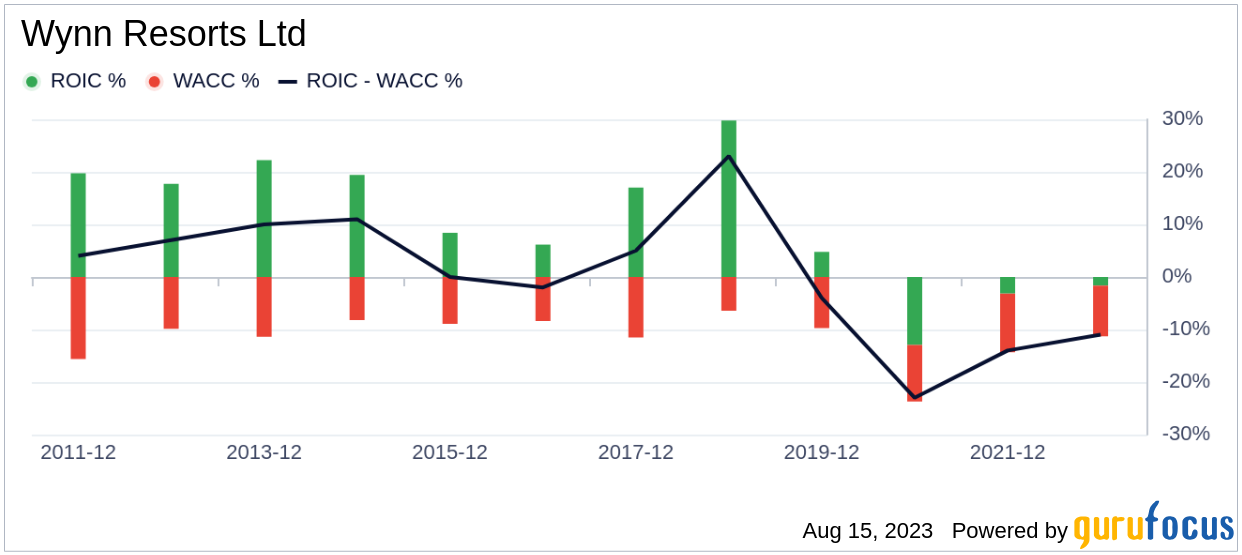

ROIC vs WACC

Comparing the return on invested capital (ROIC) and the weighted average cost of capital (WACC) provides insight into a company's profitability. For the past 12 months, Wynn Resorts' ROIC was 3.71, and its WACC was 8.98, suggesting that the company's returns are not covering its cost of capital.

Conclusion

In conclusion, Wynn Resorts' stock appears to be modestly undervalued. However, the company's financial condition is weak, and its profitability is fair. Its growth ranks lower than 83.11% of companies in the Travel & Leisure industry. For more detailed financial information, check out Wynn Resorts' 30-Year Financials here.

For high-quality companies that may deliver above-average returns, consider the GuruFocus High Quality Low Capex Screener.