Solar stocks such as Sunrun (NASDAQ:RUN), Enphase Energy (NASDAQ:ENPH), and SolarEdge Technologies (NASDAQ:SEDG) closed 19.68%, 7.8%, and 8.44% higher, respectively, on Wednesday. The expectation of rate cuts in 2024 significantly lifted these stocks.

Notably, the U.S. Fed left the benchmark interest rate unchanged once again, raising hopes that it could announce cuts in 2024. A decline in the interest rate environment could spur residential demand for these solar companies, supporting their financials and share prices.

It’s worth highlighting that these solar stocks have significantly underperformed the broader markets year-to-date as a higher interest rate environment weakened residential demand. With this backdrop, let’s look at the Street’s forecast for these companies.

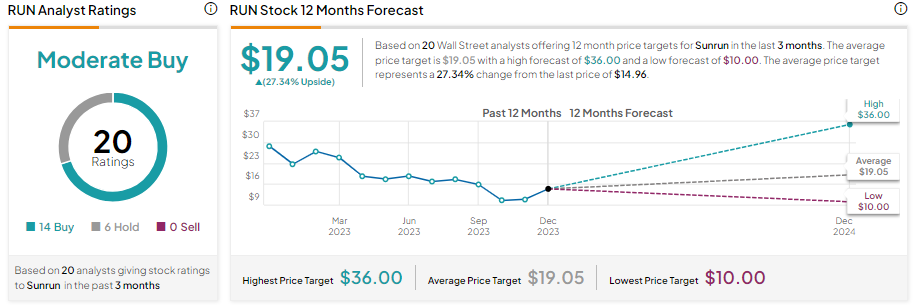

What is the Sunrun Prediction?

The higher interest rates posed challenges for Sunrun and the entire solar industry. Nonetheless, the company is focusing on generating cash and driving the adoption of its storage business. Further, it is adjusting the geographic mix, sales channels, and product offerings to adapt to the high-interest rate environment. However, the challenging macroeconomic environment is keeping analysts cautiously optimistic.

With 14 buy and six Hold recommendations, Sunrun stock has a Moderate Buy consensus rating. The analysts’ average price target of $19.05 implies 27.34% upside potential from current levels.

What is the Future of Enphase Stock?

Enphase is battling a slowdown in demand in the U.S. and Europe due to higher interest rates and macro headwinds. Thus, a rate cut could lead to a recovery in demand and support Enphase’s financials. Moreover, the company is driving down installation times and investing in customer service, which will support long-term growth.

However, the near-term macro headwinds keep analysts cautiously optimistic about ENPH stock. With 14 Buy, 12 Hold, and one Sell recommendations, ENPH stock has a Moderate Buy consensus rating. Further, the analysts’ average price target of $114.20 implies 6.12% upside potential from current levels.

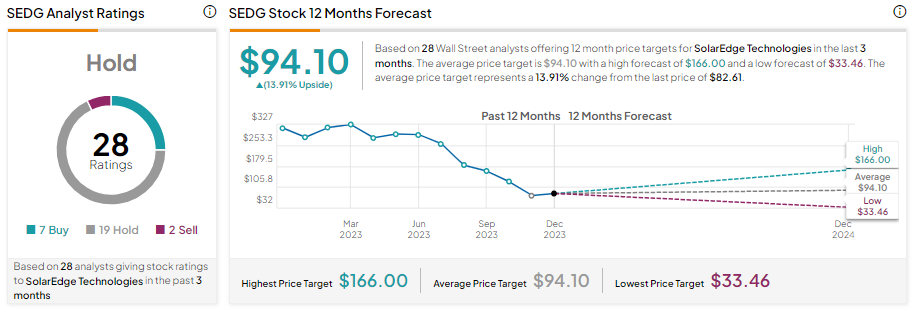

What is the Prediction for SEDG?

SolarEdge Technologies stock has lost substantial value so far this year. Notably, the expected surge in demand led to a significant backlog for its products. However, the higher interest rate environment and macro challenges led to a decline in demand. This led distributors to cancel or push out orders in large numbers, taking a toll on its financial performance.

As the solar market is still adversely impacted by high-interest rates and uncertainties around the pace of demand recovery, analysts remain sidelined on SEDG stock. With seven Buy, 19 Hold, and two Sell recommendations, SEDG stock has a Hold consensus rating. Moreover, analysts’ average price target of $94.10 implies 13.91% upside potential from current levels.