Shares of the global biopharmaceutical giant Pfizer (NYSE:PFE) have been trending lower for quite some time. Meanwhile, on September 6, Pfizer stock hit a new 52-week low of $34.26. Overall, Pfizer stock is down about 31% year-to-date. Despite the substantial decline in value, the uncertainty related to COVID-19 vaccine sales continues to pose challenges and could restrict the recovery in the short term.

Let’s delve deeper.

Lower COVID-19 Vaccine Sales Remain a Major Drag

The COVID-19 pandemic changed its course, indicating declining severity and lower vaccine sales for Pfizer. During the second quarter of 2023, Pfizer’s Comirnaty (COVID-19 vaccine) revenue declined by 82% year-over-year, reflecting a decrease in contracted deliveries and lower demand in international markets.

While the COVID headlines are back again with the new BA.2.86 variant spreading fast, competitive headwinds continue to pose challenges for Pfizer. For instance, Pfizer’s rival Moderna’s (NASDAQ:MRNA) updated COVID-19 vaccine has generated a strong immune response in humans against BA.2.86. This intensifies the competitive pressure on the company.

Jefferies analyst Akash Tewari commented on the new COVID variant on September 6 by stating, “Our analysis suggests the current COVID wave could “peak” by November, or even earlier (October) in certain scenarios.” However, he doesn’t expect the new variant to be as dominant as the earlier ones, thus limiting the upside from vaccine sales.

Against this backdrop, let’s see what the Street recommends for Pfizer stock.

Is Pfizer a Buy, Sell, or Hold?

Given the uncertainty around COVID-19 vaccine sales, Pfizer lowered the upper range of its 2023 revenue guidance. The company expects to deliver revenue of $67-$70 billion in 2023, compared to its earlier guidance of $67-$71 billion. This reflects a significant decline from the prior year. It posted revenue of $100.3 billion in 2022.

Further, Comirnaty revenues are projected to be approximately $13.5 billion, reflecting a year-over-year decline of 64%.

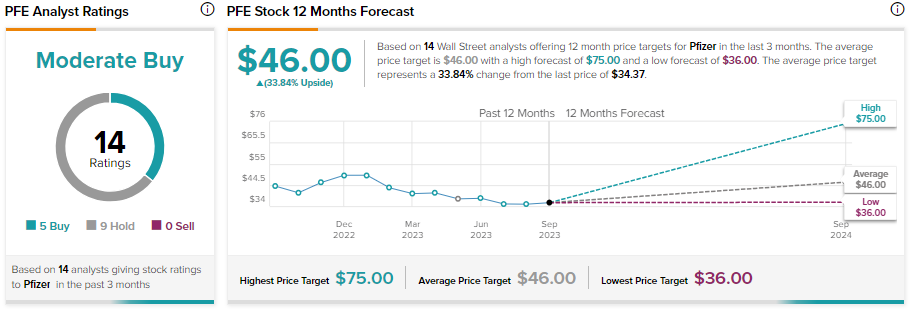

As Comirnaty revenues remain a drag, analysts maintain a cautiously optimistic outlook on Pfizer stock. The stock has received five Buy and nine Hold recommendations for a Moderate Buy consensus rating. Meanwhile, due to the recent decline in its price, analysts’ average price target of $46 implies 33.84% upside potential from current levels.