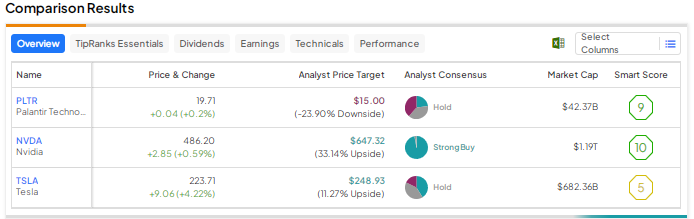

A high interest rate environment generally has an adverse impact on growth stocks. However, analysts remain bullish on several growth stocks based on their potential to thrive despite macro pressures and capture solid opportunities over the long term. Using TipRanks’ Stock Comparison Tool, we placed Palantir (NYSE:PLTR), Nvidia (NASDAQ:NVDA), and Tesla (NASDAQ:TSLA) against each other to find the best growth stock as per Wall Street experts.

Palantir Technologies (NYSE:PLTR)

Palantir shares have rallied by a staggering 207% so far this year, with the data analytics company impressing investors by delivering four consecutive quarters of GAAP profitability. Earlier this month, the company reported better-than-anticipated third-quarter results. Revenue grew 17% year-over-year to $558 million, while adjusted EPS increased to $0.07 from $0.01 in the prior-year quarter.

Palantir raised its full-year revenue and adjusted operating income guidance to reflect solid momentum in its business.

While government contracts continue to account for a significant portion of the company’s revenue, its commercial business is growing at an impressive rate, thanks to the demand for its recently released Artificial Intelligence Platform (AIP). It is worth noting that the company’s domestic commercial customer count increased 12% sequentially in Q3 2023 and has risen tenfold in just three years.

Palantir expects near-term uncertainty in its U.S. government business due to budgetary constraints. That said, it projects the U.S. government business to reaccelerate beyond the current growth rate of 10%, fueled by the rising demand for its artificial intelligence (AI)-backed products.

What is the Target Price for Palantir Stock?

On November 2, Goldman Sachs analyst Gabriela Borges reiterated a Hold rating on PLTR stock and slightly raised the price target to $12 from $11. The analyst is impressed by the level of re-acceleration in Palantir’s U.S. commercial business and the company’s decision to re-center its go-to-market strategy around AIP “bootcamps” (interactive workshops).

Nonetheless, Borges has a Hold rating on the stock as she continues to see better risk-reward in other players in her coverage and intends to assess the sustainability of the AIP-driven growth.

Wall Street has a Hold consensus rating on PLTR stock based on three Buys, five Holds, and five Sells. The average price target of $15 implies a possible downside of 24% from current levels.

Nvidia (NASDAQ:NVDA)

Shares of chip giant Nvidia have skyrocketed nearly 233% year-to-date, thanks to generative AI-induced demand for the company’s graphics processing units (GPUs). The company’s advanced GPUs are the building blocks for the generative AI applications being built by several tech companies across the world.

The 171% year-over-year rise in the company’s Data Center segment revenue in the second quarter of Fiscal 2024 (ended July 30, 2023) clearly reflected the solid demand backdrop for its products. Overall, Nvidia’s Q2 FY24 revenue jumped 101% to $13.5 billion. Moreover, adjusted EPS surged 429% to $2.70 on higher revenue and enhanced margins.

NVDA is scheduled to announce its Q3 FY24 on November 21. Analysts expect the company’s EPS to increase significantly to $3.35 from $0.58 in the prior-year quarter, reflecting continued strength in the top line.

What is the Prediction for NVDA Stock?

Last month, JPMorgan analyst Harlan Sur reaffirmed a Buy rating on NVDA stock with a price target of $600, saying that the company is bolstering its data center market and technology leadership with an accelerated new product cadence. In particular, the company’s new roadmap indicates a reduction in the new product launch timing from a 2-year cadence to a 1-year cadence.

The analyst also pointed out that Nvidia is enhancing its Data Center business through additional market segmentation (cloud/hyperscale/enterprise) by expanding the number of product stock-keeping units (SKUs) that are optimized for varied AI workloads.

With 37 Buys against just one Hold, Nvidia scores Wall Street’s Strong Buy consensus rating. At $647.32, the average price target implies 33.1% upside potential.

Tesla (NASDAQ:TSLA)

Shares of electric vehicle (EV) maker Tesla have pulled back more than 11% over the past month due to concerns over EV affordability in a high interest rate backdrop, declining margins amid competitive pressures, and the delay as well as costs related to Cybertruck.

While CEO Elon Musk is focused on boosting volumes despite the near-term impact of price cuts on profitability, several analysts are increasingly worried about the steep decline in Tesla’s operating margin. In Q3 2023, Tesla’s operation margin fell to 7.6% from 17.2% in the prior-year quarter. Also, the company is losing ground to emerging players in the EV space.

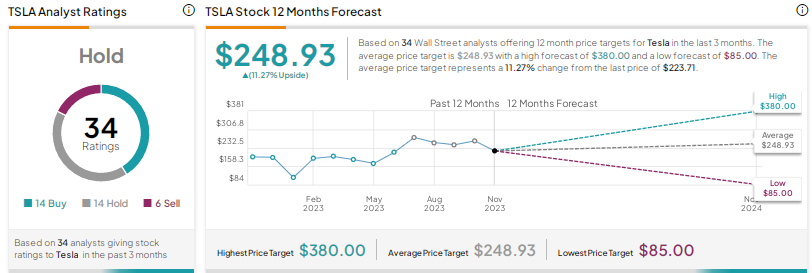

Is TSLA a Buy, Sell, or Hold?

Last week, HSBC analyst Michael Tyndall initiated a Sell rating on Tesla stock with a price target of $146. The analyst sees significant potential in the company’s prospects and ideas. Nonetheless, he is cautious as he expects the timelines to be longer than what the market and valuation reflect.

Tyndall added that while EVs may be the main driver of Tesla’s revenue and earnings currently, the company’s future is about robots, autonomous vehicles, energy storage, and supercomputers. However, he pointed out that the expected cost of capital for these businesses would be way above the company’s average due to the regulatory and technological roadblocks they face.

Including Tyndall, six analysts have a Sell rating on TSLA stock, 14 have a Hold recommendation, while 14 analysts have a Buy rating. Overall, Wall Street has a Hold consensus rating on Tesla stock. The average price target of $248.93 implies 11.3% upside potential. Tesla shares have rallied over 82% year-to-date.

Conclusion

Wall Street is highly bullish on Nvidia, while it is sidelined on Palantir and Tesla. Analysts’ optimism about Nvidia is backed by its solid execution, continued innovation, and the generative AI-led stellar demand for its GPUs. As per TipRanks’ Smart Score System, Nvidia scores a “Perfect 10,” which implies that the stock is capable of outperforming the broader market over the long term.