In a brief market review:

- Maplebear shares began with a rise.

- Disney faced problems after doubling investments in its amusement parks.

- Canadian inflation accelerated due to rising fuel prices.

- Bill Norton of U.S. Bank Wealth Management highlights the importance of the Fed meeting and potential changes in its communication. "Markets are looking for detailed information on the Fed's views on inflation," he says.

Norton also notes that, despite the inflation surge over the past year, achieving the Fed's 2% inflation target will be a challenging task.

The Fed plans to provide its economic forecast, including expectations for interest rates, inflation, and economic growth. This might shed light on the future direction of monetary policy.

Michael Green from Simplify Asset Management points out risks associated with rates: "If the Fed announces the possibility of rate hikes in 2024, the market might perceive it as an aggressive move."

However, financial markets are almost certain (at 99%) that the Fed will maintain its key rate at the current level of 5.25%-5.00%. The likelihood that the rate will remain unchanged at the next meeting in November is 70.9%, according to FedWatch CME data.

The annual inflation increase in Canada, driven by rising gasoline prices, as well as a more significant reduction in new housing construction in the U.S. than expected, have heightened the degree of uncertainty among investors.

Despite the weak initial public offering (IPO) market, some companies have shown activity. For instance, the grocery delivery app Instacart Maplebear Inc made its debut on Nasdaq shortly after the successful launch of chip manufacturer Arm Holdings. As a result, Maplebear shares rose by 12.3%, while Arm Holdings' shares declined by 4.9%.

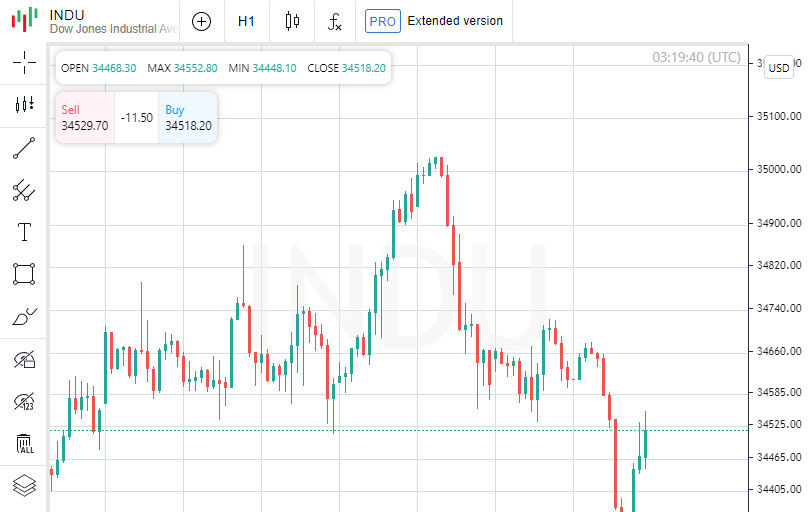

The Dow Jones Industrial Average fell 106.57 points to 34,517.73. The S&P 500 index lost 9.58 points, settling at 4,443.95. The Nasdaq Composite index also went down, shedding 32.05 points to 13,678.19.

Most major sectors of the S&P 500 displayed negative dynamics. The energy and consumer sectors were especially hard hit.

Walt Disney shares felt the pressure after the company announced plans to nearly double its capital investments in its amusement parks over the next decade.

Starbucks Corporation also faced a negative market reaction when TD Cowen analysts downgraded the popular coffee chain's stock.

Auto giants General Motors and Ford Motor Co became the focus of investors as the United Auto Workers union warned of potential strikes starting Friday if current negotiations don't lead to significant progress.

On the NYSE, the number of stocks showing a negative trend outnumbered those with a positive trend by a ratio of 1.67 to 1. On Nasdaq, this figure was 1.47 to 1 in favor of the "bears".

The S&P 500 recorded seven new annual highs and nine lows, while the Nasdaq Composite registered 33 new highs and 257 new lows.

The total volume of stock trading on American exchanges reached 9.60 billion, below the average of 10.05 billion over the last 20 days.

The CBOE Volatility Index, which reflects market expectations regarding fluctuations in the S&P 500 index, increased by 0.79% to 14.11 points.

In commodity markets, gold prices slightly decreased: gold futures for December delivery dropped by 0.05% to $1.00 per troy ounce. At the same time, the price of WTI crude oil for November delivery rose by 0.29% to reach $90.84 per barrel. Brent crude oil futures also increased by 0.23%, hitting $94.65 per barrel.

In the forex market, the EUR/USD pair remained almost unchanged, declining by 0.10% to 1.07, while the USD/JPY rate rose by 0.18%, reaching 147.87.

The dollar index futures lost 0.03%, settling at 104.82.