Deagreez

This article was coproduced with Dividend Sensei.

Most Americans can't imagine ever running a marathon, 26.2 miles.

Less than 1% of Americans ever do.

Now imagine running not 26 miles but 60 miles in a single day.

Now imagine doing it every day for 52 days, 3,100 miles in total.

That's equivalent to running across the US in less than two months.

Would such a feat be impossible?

Even crazy?

Then you've never heard of the Sri Chinmoy Self-Transcendence 3100 Mile Race.

This is a grueling ultramarathon that spans 3,100 miles from the West to the East Coast of the United States.

It's run over 52 days, each day consisting of a 60-mile run.

Can you imagine the kind of Greek god super athlete it must take to accomplish such a superhuman feat?

He must have Captain America's stamina and Wolverine's immune system.

Realty Income (NYSE:O) is like the ultramarathoner of high-yield Ultra SWANs.

It's rather boring and slow growing, but over time, it can accomplish something almost no one else can in its industry. And today, Realty is a screaming bargain.

While the stock market is within 3% of record highs, world-class blue-chips and even Ultra SWANs like Realty Income are trading at their best valuations in years.

Realty Income hit a 5.5% yield, the highest in 3.5 years. You have to go back to the darkest days of the Pandemic when its customers were being forced to close by government fiat.

Do you know what the highest yield during the Pandemic panic was? 6.5%, not that much higher than today.

OK, but why is the market freaking out over an A-rated Ultra SWAN aristocrat REIT?

What dark secrets must be lurking beneath the surface of "the monthly dividend stock" to cause the market such panic?

Let me show you why there are no reasons that any fan of Realty Income shouldn't be using this market freakout as a buying opportunity.

Reason One: The Divided Remains Very Safe

Do you know the most likely reason for Realty taking such a beating in recent months?

Treasury yields have soared in recent weeks due to several factors:

Banks are no longer large buyers (Dodd-Frank made it impossible for them to be market-makers).

Japanese bond buyers can get a relatively higher yield at home (our No. 1 foreign buyer is now not as interested).

China is slowly continuing to sell bonds (as it has for eight years).

China sold some US bonds in 2015 but didn't become a net seller until May 2022.

The Fed's largest QT in history is letting $90 billion per month in US bonds mature without reinvesting (buying) into new ones.

There's also the issue of the economy being much more resilient than expected.

The day before SVB collapsed, Jay Powell was telling the Senate how rates might have to go to 5.75% and stay there a long time.

Two days later, the bond market thought the Fed would stop 1% lower.

Since then, the economy's resilience has caused inflation to get stuck, and the Fed is back to forecasting a 5.5% terminal rate.

OK, but Realty Income doesn't borrow at the Fed Funds rate; no one does other than banks doing overnight lending to each other.

Realty gets its funding based on corporate bonds, indexed to the 10-year Treasury yield.

But here's what Wall Street is getting wrong about Realty Income.

Yes, rising rates, all equal, raise the cost of capital. Realty currently estimates its cost of capital at 5.7%.

But do you know what else rising rates do? It lowers the price Realty is paying for properties.

Realty's historical range for investment spreads is 1% to 1.5%, and today it's 1.12%.

That is what Wall Street doesn't get about Realty. A triple net lease or NNN structure means it is more of a low-risk A-rated financial company than a REIT. Don't think of it as a REIT; think of it as a bank.

How Realty Works And Why Rising Rates Aren't A Major Risk

The Bank of Realty gets financing together when a big customer like Dollar General (DG) needs money and buys DG's free-standing properties. It then leases back the use of those stores to DG for 15 years, with annual inflation-linked escalators.

Dollar General pays the insurance, maintenance, and taxes, and Realty collects pure profit.

Realty's AFFO margin is 77%, meaning 77 cents of every dollar in sales drops straight to the bottom line.

That's much better profitability than almost any of Wall Street's profit-minting machine darlings:

Realty Income: 77% AFFO Yield.

Visa: 61% free cash flow yield.

Mastercard: 45%.

Texas Instruments 29%.

Microsoft: 28%.

The key to Realty's business is sourcing safe, quality deals at a profit.

That's all they must do to remain the most stable and dependable monthly dividend stock on Wall Street and arguably the world.

In 1996, when Realty first IPOed, interest rates were 7%, unimaginable today. But cash flow yields or cap rates were 11%, so the spread was a very healthy 4%.

In 2021, when interest rates bottomed at their lowest in history, 0.5%, so did cap rates at just under 8%. Realty's bond yields were slightly higher, around 2%, and it minted money at a historic investment spread of close to 6%.

That was the highest since 2013. Yes, the spread has compressed a bit since then, but in 2023, it's begun to widen again.

OK, but maybe something is wrong with Realty's property portfolio?

Occupancy rate 99%.

Re-leasing spreads 3.4% (YOY increase in tenants renewing leases).

Same-store NOI growth 2%.

Nothing in Realty's core fundamentals would indicate its tenants are in distress and can't pay their rent.

Management just reported $3.1 billion in acquisitions in Q2, up from $1.5 billion in Q1, bringing the YTD total to $4.8 billion.

The average cap rate is now 6.9% for acquisitions. That means Realty is buying quality properties and averaging a cash flow yield of 6.9%.

Do you know where to find billions of dollars of safe investments that are wildly tax-advantaged, yielding 7%? Realty does.

Can you get $5 billion to invest in those opportunities? Realty's world-class management can.

This year, Realty is guiding for $7 billion in acquisitions.

That's the second highest acquisition year in Realty's history behind 2022's $9 billion.

Realty can now find new investment opportunities, such as NNN properties in the UK and casinos.

Guess who just bought 20% of the Bellagio?

Realty Income.

Is there any better trophy asset on the Vegas Strip?

The Bellagio has 19 restaurants, almost 4,000 rooms, 157,000 square feet of gaming space, and 32 retail stores. It houses a AAA diamond resort and even a fine art gallery.

Vegas is booming once more with 41 million visitors and almost 6 million convention goers, and now Formula 1 and the Super Bowl are coming to town. That's expected to boost the local economy by about $2 billion.

Suppose you want to invest in casinos but love dividends and don't like the BBB-rated balance sheet of VICI Properties. In that case, Realty Income is now the lowest risk A- rated way to invest in Vegas while getting paid rock-solid dividends.

Realty used 6.2-year average duration bonds at an average interest rate of just 3.7% to buy the Bellagio, which comes with a 26-year triple-net lease with MGM Entertainment (MGM).

Now, is MGM investment grade?

No, it is a B+-rated company.

That's because of the high debt MGM is paying down partially using the $950 million they are getting from Realty.

Who is mostly borrowing the money at rates not even the US Treasury can get.

5.2% cash yield on the Bellagio.

vs. 3.7% cost of capital.

1.5% investment spread.

Do you know how A-rated Realty can get a lower interest rate than the US treasury?

Because it's able to borrow in Europe, where rates are just 2.6%.

No other REIT that's 100% US-focused can borrow at the low rates Realty can.

In other words, Realty's borrowing costs in the US are 100% irrelevant to its growth prospects.

What matters is how Realty's global interest rate costs compare to its investment cash yields.

The spread is all that matters regarding Realty's growth rate. And Realty has been maintaining a solid investment spread since 1969.

Yes, Realty has been around for all but nine years that REITs have existed. It's seen interest rates as high as 20%.

Unless you think the Fed will be 21% or higher, there is no reason to worry about Realty.

The Balance Sheet Remains A Fortress

203 REITs are trading on the stock market.

How many have A-credit ratings from two rating agencies?

Just 8, or 4%, and Realty is one of them.

That's because few CEOs can manage Realty's increasingly complex empire better than CEO Summit Roy, who has been in the top job since 2018.

That's five years as the big cheese, but he's been with Realty for 12 years and has decades of experience in real estate.

Realty's debt/EBITDA (leverage) is 5.3X compared to 6X or less considered safe in this industry, where cash flow is contracted for 15 years and casinos as long as 26.

The interest coverage ratio for Realty is 4.6X compared to 2X that's safe for REITs.

Some of Realty's tenants, like Dollar General and Walgreens, are struggling. But those two tenants combined are just 7.6% of its rent, and neither one is struggling enough not to pay the rent, not even close.

Do you know what Realty's AFFO payout ratio is expected next year? 76%.

What's safe in this industry? 90%.

Let's say that Dollar General, Walgreens, even Dollar Tree, and Family Dollar all went bust. None of them could afford to pay the rent.

Then imagine that FedEx and CVS also went bust.

Then throw in AMC and Regal Cinemas.

Now imagine that even though its leases protect it and make it senior in the capital stack to bondholders, Realty collects zero rent from any of these companies, which are almost all investment-grade rated.

That's 20% of Realty's rent, and its payout ratio would rise to 96%, and the dividend would remain safe.

Do you want to know what a real-life apocalypse for Realty would look like?

During the Pandemic, Realty's customers closed down by government order for months.

How much did Realty's AFFO/share fall in 2020? 10%? 20%? 30%?

Try RISING 2%.

$3.22 in 2019.

$3.28 in 2020- the worst recession since the Great Depression +2% AFFO growth.

$3.59 in 2021.

$3.92 in 2022.

$4.00 in 2023.

$4.16 in 2024 - expected recession year +4% consensus growth.

$4.32 in 2025.

$4.62 in 2026

Can you see why income investors don't need to worry about Realty?

What would it take for Realty to see AFFO/share fall more than 24%? For the payout ratio to go above 100%? I can think of one thing:

A zombie apocalypse.

Even in such a doomsday scenario, Realty could always borrow to cover any shortfall in AFFO. Its $3.5 billion in liquidity is almost 2X its annual dividend cost.

The Growth Outlook Hasn't Changed Much Either

In the US, the estimated value of potential NNN properties is $4 trillion.

In Europe, it's also $4 trillion.

And casinos?

That's an extra $231 billion.

How big is Realty?

The world's largest NNN REIT?

$57 billion.

In other words, casinos alone, in just the US and Europe, could quadruple this REIT's size.

The total addressable potential NNN market is around $8.25 trillion, enough to grow Realty by 145X its current size.

Realty will not be able to acquire tens or hundreds of billions very quickly. It's limited by how much capital it can raise from bond investors, a consortium of banks that fund its credit line, and Wall Street's ability to buy its shares ATM (how it funds roughly 32% of its growth).

Realty's growth rate is expected to be around 4% going forward. How long could it grow at 4% before it runs out of triple-net-lease properties to acquire in the US and Europe?

Realty Income can grow at 4% annually for 127 years.

And then it has to start entering new markets to keep growing.

Assuming that there is zero growth in retail properties in the US or Europe ever again, Realty Income has over 100 years of growth runway left.

Valuation: A Wonderful Company At A Fair Price

Quality: 97% low-risk 13/13 quality dividend aristocrat REIT.

Historical fair value: $75.84.

Current price: $55.68.

Discount: 27%.

Our rating: potential very strong buy.

Yield: 5.5%.

Growth: 3.8%.

LT total return potential: 9.3%.

10-year valuation boost: 3.2% per year.

10-year consensus total return potential: 12.5% CAGR vs. 8.1% S&P = 225% vs. 118%.

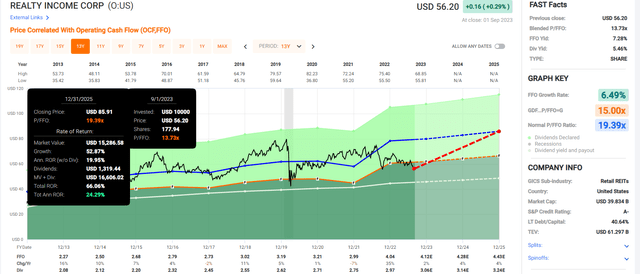

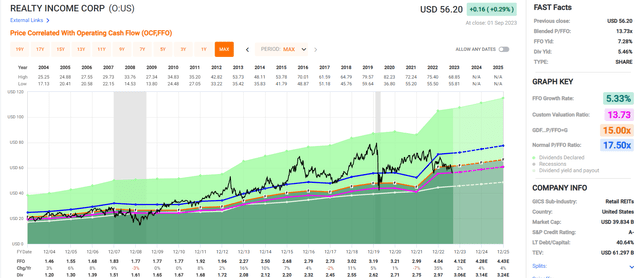

FAST Graphs, FactSet

Historically, Realty growing at such rates was valued at 19 to 20X FFO. Today it trades at 13.3X forward FFO, a 27% discount.

That means that a normally slow-growing Ultra SWAN REIT can now potentially more than triple in 10 years and approximately double the S&P 500's returns.

Rating | Margin Of Safety For Low-Risk 13/13 Ultra SWAN Quality Dividend King | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

Potentially Reasonable Buy | 0% | $74.86 | $76.28 | $75.84 |

Potentially Good Buy | 5% | $71.11 | $72.47 | $72.05 |

Potentially Strong Buy | 15% | $63.63 | $64.84 | $64.47 |

Potentially Very Strong Buy | 25% | $53.34 | $57.21 | $56.88 |

Potentially Ultra-Value Buy | 35% | $48.66 | $49.58 | $49.30 |

Currently | $55.68 | 25.62% | 27.01% | 26.58% |

Upside To Fair Value (Including Dividends) | 39.96% | 42.51% | 41.72% |

Realty Income is a very strong buy, trading at the lowest valuation in 3.5 years.

FAST Graphs, FactSet

Do you know the P/FFO Realty hit in the darkest days of the Pandemic? When it looked like we were in another depression? 13.2! Today, it's 13.7X trailing blended.

You can get Realty's incredible assets, safety, cash flow, and management quality for almost the same meager price you could on March 23rd, 2020!

Risk Profile: Why Realty Isn't Right For Everyone

There are no risk-free companies, and no company is suitable for everyone. You have to be comfortable with the fundamental risk profile.

Risk Profile Summary

Realty Income has been increasing the average quality of its tenants, but about half are not investment-grade. The company has also reduced the overall concentration of its tenants over time.

However, more than half of its net operating income is still concentrated in its top 20 tenants, and six tenants represent more than 3% of its NOI, so issues at any of these top tenants could negatively affect Realty Income's revenue.

Realty Income's properties are generic shells that can attract many possible tenants. However, there is nothing unique about the properties that other developers can't recreate.

Reality Income's dependence on acquisitions to drive growth makes it subject to private and capital markets changes.

Additional competition from well-capitalized investors could drive up prices and force Realty Income to pursue fewer acquisitions, acquire at lower cap rates, or reduce the quality of properties it acquires. Conversely, Realty Income funds acquisitions on regular debt and equity issuances.

- Morningstar

Realty Income's Risk Profile Includes

Theoretical competition risk: low barriers to entry in triple-net-lease space

tenant credit risk: about 60% of tenants are non-rated or non-investment grade.

M&A risk: Realty periodically does large deals like VEREIT and ARCT, and there is always execution risk with these. We also consider Spirit Realty (SRC) a prime-time M&A target for Realty.

High inflation risk: Most leases are locked in with 1.5% annual escalators.

Interest rate risk: could negatively affect its cost of capital.

Share price risk: If the stock price were to remain depressed for long enough, management might not be able to adapt to a higher rate environment.

The Bellagio currently has a 2.8X interest coverage ratio compared to 2X, which is considered safe for this industry. It was 1.9X in December of 2019 before the Pandemic threw everyone for a loop.

In a bad enough recession, the Bellagio might need help to make its rent. However, the way these NNN leases are structured generally protects Realty as its treated as a utility. In other words, paying rent is usually ahead of even bondholders in seniority in the capital stack of a property.

(Remember, VICI Properties (VICI) collected 100% of rent during Covid)

How do we quantify, monitor, and track such a complex risk profile?

By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

We use S&P Global's global long-term risk-management ratings for our risk rating.

S&P has spent over 20 years perfecting its risk model.

which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics.

50% of metrics are industry-specific.

This risk rating has been included in every credit rating for decades.

The risk rating is based on the global percentile of a company's risk management compared to 8,000 S&P-rated companies covering 90% of the world's market cap.

Realty Income Scores 70th Percentile On Global Long-Term Risk Management

S&P's risk management scores factor in things like:

Supply chain management.

Crisis management.

Cyber-security.

Privacy protection.

Efficiency.

R&D efficiency.

Innovation management.

Labor relations.

Talent retention.

Worker training/skills improvement.

Customer relationship management.

Climate strategy adaptation.

Corporate governance.

Brand management.

Realty Income's Long-Term Risk Management Is The 219th Best In The Master List (56th Percentile In The Master List)

Classification | S&P LT Risk-Management Global Percentile | Risk-Management Interpretation | Risk-Management Rating |

BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

Strong ESG Stocks | 86 | Very Good | Very Low Risk |

Foreign Dividend Stocks | 77 | Good, Bordering On Very Good | Low Risk |

Ultra SWANs | 74 | Good | Low Risk |

Realty Income | 70 | Good | Low Risk |

Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

Low Volatility Stocks | 65 | Above-Average | Low Risk |

Master List average | 61 | Above-Average | Low Risk |

Dividend Kings | 60 | Above-Average | Low Risk |

Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

Dividend Champions | 55 | Average | Medium Risk |

Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal)

Realty Income's risk-management consensus is in the top 46% of the world's highest quality companies and similar to that of such other blue-chips as

Hormel Foods (HRL): Ultra SWAN dividend king.

Enterprise Products Partners (uses K-1 tax form) (EPD): Ultra SWAN dividend champion.

Procter & Gamble (PG): Ultra SWAN dividend king.

Parker-Hannifin (PH): Ultra SWAN dividend king.

Nike (NKE): Ultra SWAN.

The bottom line is that all companies have risks, and O is average at managing theirs, according to S&P.

How We Monitor Realty's Risk Profile

18 analysts.

Two credit rating agencies.

20 experts who collectively know this business better than anyone other than management.

"When the facts change, I change my mind. What do you do, sir?"

- John Maynard Keynes

There are no sacred cows, wherever the fundamentals lead, we always follow. That's the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: Wall Street Is Dead Wrong About Realty, So Buy It Today, And You Won't Regret It

Realty Income is currently trading at the best valuation since the Pandemic.

It offers a 225% total return potential over the next decade and boasts the safest and most attractive 5.5% monthly yield on Wall Street.

Right now, fears about high-interest rates have Realty beaten down, but those fears are overblown.

Realty has survived 20% interest rates and has maintained a tight and consistent investment spread since 1969.

This is a management team and corporate culture that knows how to do triple-net-lease right and safely.

You might not think Realty is a rich retirement dream stock, not with its boring business and slow but steady growth rate.

And slow but steady 4% growth is how Realty can turn $1 today into $9,747, adjusted for inflation, 127 years from now.

and be potentially paying $438 per year in dividends, also adjusted for inflation

Realty is a very strong buy today for your retirement portfolio.

And a potential rich retirement dream stock for your kids, grandkids, and great grandchildren.

This is how you build multi-generational wealth with low risk, high yield, and the kind of monthly income dependability financial dreams are made of.

I just bought more shares in Realty Income before publishing this article, and rest assured, I sleep well at night.

In addition, I'm loading up the truck for my kids and grandson (Asher) who will one day be the beneficiary of repeatable sources of income so they can (like me) live the Great American Dream.

As someone who has considerable experience in the net lease sector (over $1 Billion in deals) I consider Realty Income one of the best buying opportunities in my investing career.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.