The SEC’s lawsuit against major exchanges has forced Robinhood to review its token listings procedure. The firm’s legal chief Dan Gallagher told Congress of the development.

Robinhood has begun to review token listings following the United States Securities and Exchange Commission’s (SEC) lawsuits against major exchanges.

The trading platform’s legal chief Dan Gallagher revealed the information to Congress, where he was speaking to the House Agriculture Committee in a meeting focused on digital assets.

Robinhood Focuses on Token Listings Following Lawsuit

Gallagher told Congress that Robinhood would be “actively reviewing” the SEC’s statements “to determine what if any, actions to take.”

The SEC sent shockwaves throughout the crypto world recently when it revealed that it would be suing both Binance and Binance.US, as well as Coinbase. These are some of the biggest exchanges in the world.

Unlike major crypto exchanges, however, Robinhood offers only a small list of tokens. Compared to the hundreds, if not thousands, available on most centralized exchanges, Robinhood offers only 18 tokens to investors.

Click here for our Learn guide to the best crypto exchanges for beginners.

The decision to review token listings is a sign that Robinhood does not want to leave any stone unturned when it comes to compliance.

Major Crypto Players Testify to Congress On Crypto Bill

Robinhood, as well as Coinbase and the United States Commodity Futures Trading Commission (CFTC), testified before Congress in relation to a draft for a crypto bill.

The CTFC official, Chairman Rostin Behnam, stated that there was a strong need for the digital assets market to be regulated.

Coinbase’s Chief Legal Office Paul Grewal said before the testimony that the U.S. was falling behind when it comes to regulation. This is in line with what many in the crypto industry believe.

Coinbase CEO Brian Armstrong has asked for a clear rule book to be published, as opposed to regulation by enforcement.

Robinhood’s Crypto Revenue Down 30% YoY in Q1

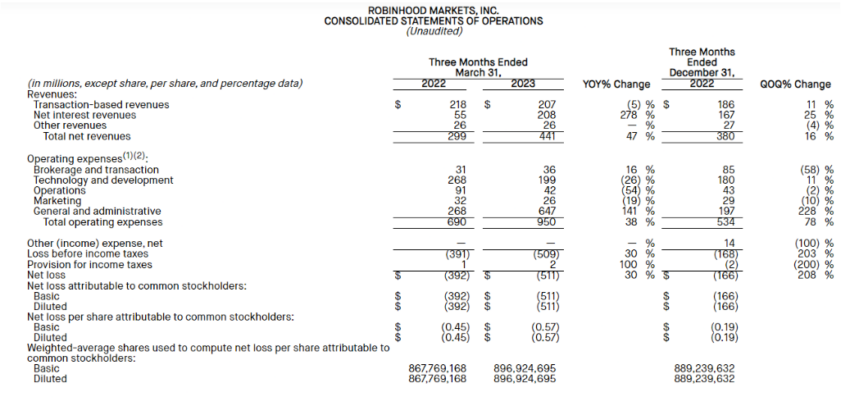

Robinhood’s decision to review token listings may affect its crypto revenue, which is already down 30% YoY in Q1, according to the quarterly report. With respect to crypto, it noted that the number of Robinhood Wallet downloads had crossed 100,000.

The trading revenue for crypto was $38 million for Q1 2023, compared to $54 million for Q1 2022. Compared to last quarter, it only declined by 1%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Source: https://beincrypto.com/robinhood-reviews-token-listings-sec-lawsuits-crypto-exchanges/