The last few years have not been easy for former appliance kingpin General Electric (NYSE:GE). But after a series of measures, it might finally be on a comeback trail. As a result, GE shares managed to close 1.84% higher. The good news for GE came from CFO Rahul Ghal, who offered insight into GE’s current financial position.

Indeed, GE’s engines and other aerospace services are bringing in cash hand over fist, Ghal noted, and that would put GE’s free cash flow figures at the high end of previous guidance. While that’s not as good as some would hope—GE’s free cash flows were projected as “slightly up” at best—the fact that it’s going to reach that target is good enough news on its own.

GE has already had a pretty impressive 2023 so far; it’s already rallied 76% off the levels seen at the close of 2022. Its split into four smaller, independent operations has done well, and its divesting of other assets outright offered some help also. By early 2024, reports note, GE will be exclusively aerospace. And, of course, we already knew about GE’s plans to sell off its stake in AerCap Holdings, which will help shore up the balance sheet and give GE more room to breathe financially.

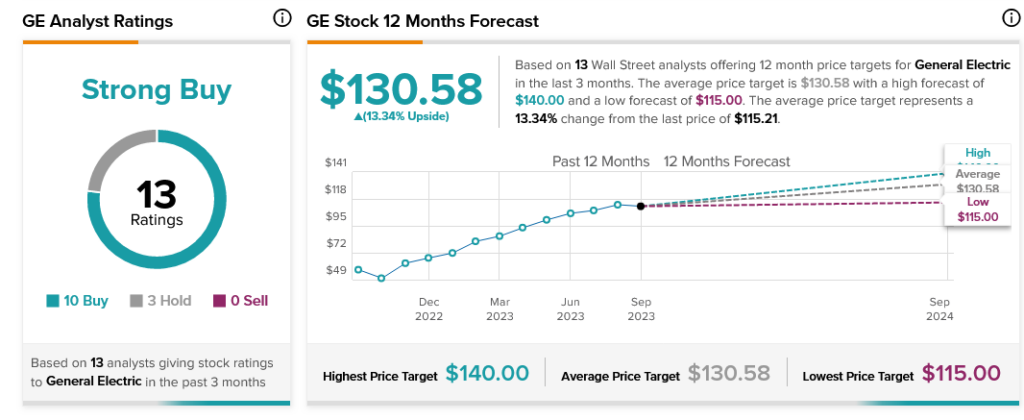

Meanwhile, analysts are very much backing up GE stock. With 10 Buy ratings and three Holds, it’s considered a Strong Buy. Further, GE stock offers investors 13.34% upside potential thanks to its average price target of $130.58.