Futures, Global Markets Drop For Second Day After China Stimulus Disappoints

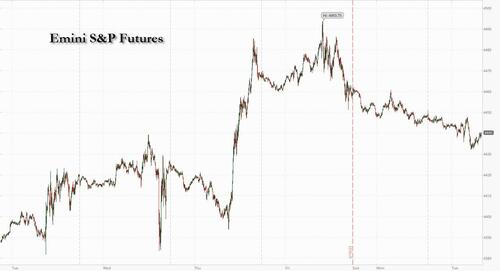

US equity futures and global markets slipped for a second day following Friday's blow-off top and quad-witching reversal, as part of a global risk-off tone sparked by disappointment after investors were left underwhelmed by the latest reduction in the benchmark lending rates at Chinese banks - though bond yields are higher and USD weaker - as the second-quarter rally met resistance from economic headwinds and signs that positioning is overbought and extremely stretched. As of 7:45am ET, S&P futures were down 0.4% while Nasdaq futures dipped -0.3%. MegaCap tech names led the weakness with almost all in the red pre-mkt. Commodities are weaker, but oil and gold rose, while Bitcoin climbed for a second-straight day.

In premarket trading, US-listed Chinese stocks declined after China’s State Council failed to issue specific support measures and banks offered modest rate cuts, disappointing investors who had counted on more policy stimulus as the country’s economic recovery slows. Alibaba shares are down 2.5%, PDD Holdings -4.1%, JD.com -4%. Here are some other notable premarket movers:

- Nike dips 1.5% in premarket trading after Morgan Stanley says inventory problems could weigh on margins in the fourth quarter, even as the bank predicts the sportswear brand will have “mostly in- line” results.

- SoFi Technologies extends losses in premarket trading after the stock slumped 10% on Friday as Piper Sandler, Oppenheimer and BofA downgraded the online personal finance company following its stock surge. Meanwhile, filings showed several SoFi insiders sold shares in the company.

- Lilium shares jump 12% in premarket trading after the electric aircraft maker announced an agreement with Heli-Eastern, a low-altitude general aviation carrier and helicopter service provider, for the purchase of Lilium Jets.

- Philip Morris shares rise as much as 1.4% in US premarket trading after Citi upgraded the tobacco company to buy from neutral. The broker opened a 3-month positive catalyst watch on the stock on expected acceleration in trading momentum following a “lackluster” first quarter.

Investors caught between fear of missing out and concerns markets have run too far, too fast are contending with overblown valuations and economic headwinds. Bullish positioning in US equity futures grew last week, taking it to the most extended levels for the S&P 500 and Nasdaq 100 in data going back to 2010, according to Citigroup strategists. The path of US monetary policy is another wild card. Fed Chair Powell will give his semi-annual report to Congress on Wednesday. Policymakers at the Fed kept interest rates unchanged at their latest meeting but warned of more tightening ahead. Investors also await the outcome of policy meetings in Turkey, the UK and Switzerland.

Weekend news report surrounding Blinken's trip to China were generally positive and indicating that US/China may be attempting to hit a reset in their relationship. This holiday-shortened week is lighter in macro data relative to last week; flash PMIs on Friday the key event this week, while Chair Powell's semi-annual testimony before Congress is the main policy highlight. Given the dearth of catalysts and the potential for significant Equity selling due to month-end rebalancing, is now the time for a pullback asks JPMorgan (we will share the answer in a following post).

Mike Riddell, global macro portfolio manager at Allianz Global Investors, warned the full economic impact of the Fed’s aggressive rate increases has yet to come. “It feels like people are worried, but they’re not actually positioned that way,” Riddell said. “The vast majority of all the rate hikes in this cycle have not yet had any effect. But they will hit, and hit hard.”

The Fed decision last week came with forecasts for higher borrowing costs of 5.6% in 2023, implying two additional quarter-point rate hikes or one half-point increase before the end of the year. That contrasts with market pricing for some 20 basis points of tightening in the remainder of the year.

"We find it hard to get on board with the current excitement" Morgan Stanley' Michael Wilson wrote in a note Tuesday, repeating what he has said for the duration of what is the best start of the year for the Nasdaq in history, keeping his clients from making huge gains, and ensuring that the market will continue to rise. “If second half growth re-accelerates as expected, then the bullish narrative being used to support equity prices will be proven correct. If not, many investors may be in for a rude awakening.”

European stocks and US futures are on the back foot after investors were left underwhelmed by the latest reduction in the benchmark lending rates at Chinese banks. The Stoxx 600 is down 0.4% and on course for a second day of declines with chemicals leading declines after Lanxess AG slumped as much as 18% on a profit warning, dragging shares of peers including BASF SE lower. Here are some notable European movers:

- Sanofi gains as much as 2.8% after the pharmaceutical group defeated Boehringer Ingelheim in an arbitration relating to heartburn medicine Zantac. Morgan Stanley says the decision “brings clarity”

- NKT rises as much as 4.3%, hitting a record high, after Carnegie initiates coverage with a buy rating and says the power cable manufacturer will play a key role in the green energy transition

- Telecom Italia rises as much as 2.8% after Bloomberg reported it’s close to entering into detailed negotiations with KKR over the sale of its network in a deal valued at as much as €23 billion

- Lanxess falls as much as 18% in early trading after the Germany-based specialty chemicals company issued a profit warning. Most other European chemicals stocks including Evonik, Covestro and Solvay also slide

- Neoen’s 2025 improved guidance triggered the biggest jump in its share price since December 2022 with analysts now expecting the average profit forecast for the French energy group to be revised upwards

- Lookers Plc shares jump after Alpha Auto Group agreed to buy the motor vehicle distributor at a premium of about 35% to the closing price

- Getinge falls as much as 6.7%, extending Monday’s 16% plunge triggered by a profit warning, after both Carnegie and Equita downgraded their ratings for the medical technology firm to hold

- Ocado trades 5.4% lower after JPMorgan lowered its price target on the stock citing challenges in traditional supermarkets shifting to automated warehouses, hurting the firm’s growth prospects

Earlier in the session, an index of Asia-Pacific shares slumped amid anxiety about Chinese growth and the lack of fresh stimulus from Beijing. Alibaba Group Holding whipsawed before trading about 1.5% lower following the surprise replacement of its chief executive and chairman.

- Hang Seng and Shanghai Composite declined as markets were disappointed by the latest underwhelming Chinese stimulus after the PBoC cut its benchmark Loan Prime Rates by 10bps to boost liquidity. This was widely expected for the 1-year LPR after similar cuts to short-term funding rates but disappointed those anticipating a deeper 15bps cut for the 5-year LPR which is viewed as the reference for mortgages and in turn, weighed on HK-listed mainland developers.

- Australia's ASX 200 was led higher by gains in the commodity-related sectors and following the RBA Minutes from the June meeting which noted that the arguments were “finely balanced” between a 25bps hike or keeping rates steady at the last meeting, while money markets are currently leaning towards rates being kept unchanged for next month.

- Nikkei 225 was negative although the losses were stemmed and the index held above the 33,000 level with several major Japanese trading houses dominating the list of best performers after Berkshire Hathaway lifted its stake in five of them.

- Indian markets recovered in the last trading hour to close among the best performing large markets in Asia, boosted by gains in technology and financial services companies. The S&P BSE Sensex rose 0.3% to 63,327.70 in Mumbai, while the NSE Nifty 50 Index advanced by a similar magnitude. Indian stocks bucked the weakness in regional stocks, which fell after a lower-than-expected cut in benchmark bank lending rates in China raised fresh concerns over the world’s second-largest economy. The MSCI Asia-Pacific Index closed 0.6% lower. HDFC Asset Management closed 11% higher after Abrdn Investment sold over 10% stake in bunched trade triggering bets on the stock’s possible inclusion in the MSCI Standard Indexes at upcoming review in August. HCL Technologies contributed the most to the Sensex’s gain, increasing 2.7%.

In FX, the Bloomberg Dollar Index is flat while the Japanese yen is the best performer among the G10 currencies, rising 0.2% versus the greenback following some grumbling out of Japanese officials warning that they may intervene in the FX market (they won't). The Aussie dollar is the weakest after some surprisingly dovish RBA minutes.

In rates, treasury futures erased early losses to trade flat. 10Y TSY yields reversed most of the earlier rise which pushed them as high as 3.82%, and were last trading around 3.76% as cash trading resumes following Monday’s public holiday, unchanged from Friday's close; European government bonds rallied across the board, with the sharpest gains for UK gilts and Swiss notes: bunds and gilts outperformed by 5.5bp and 11bp in the sector; long-end-led weakness steepens 2s10s, 5s30s spreads by ~1bp and ~1.5bp on the day.

The Dollar IG issuance slate empty so far, with around $15 billion of new issuance expected for holiday- shortened week. Treasury coupon issuance includes $12b 20-year bond reopening Wednesday and $19b 5-year TIPS reopening Thursday. The US session includes two Fed speakers ahead of Fed Chair Powell’s appearance before House Financial Services panel Wednesday.

In commodities, US crude futures edge higher with WTI rising 0.2% to trade near $71.90 despite the rout in China. Spot gold is little changed around $1,953

To the day ahead now, and data releases include US housing starts and building permits for May, along with the June Philadelphia Fed non-manufacturing gauge and German PPI for May. From central banks, we’ll hear from the Fed’s Bullard, Williams and Barr, as well as ECB Vice President de Guindos, and the ECB’s Rehn, Muller, Vujcic and Simkus.

Market Snapshot

- S&P 500 futures down 0.4% to 4,436.25

- STOXX Europe 600 down 0.3% to 460.49

- MXAP down 0.6% to 167.49

- MXAPJ down 0.8% to 529.01

- Nikkei little changed at 33,388.91

- Topix down 0.3% to 2,283.85

- Hang Seng Index down 1.5% to 19,607.08

- Shanghai Composite down 0.5% to 3,240.37

- Sensex little changed at 63,114.33

- Australia S&P/ASX 200 up 0.9% to 7,357.83

- Kospi down 0.2% to 2,604.91

- German 10Y yield little changed at 2.48%

- Euro up 0.1% to $1.0933

- Brent Futures up 0.6% to $76.54/bbl

- Gold spot up 0.1% to $1,953.39

- U.S. Dollar Index down 0.12% to 102.40

Top Overnight News

- China lowered its 1 and 5-year Loan Prime Rates by 10bp each, a move that was expected and one which some economists fear doesn’t go far enough to bolster the economy. WSJ

- China is in talks to open a military training facility in Cuba, a move that could result in Chinese troops being stationed just 100 miles off Florida’s coast. WSJ

- Four US lawmakers will travel to Detroit today to press the chief executives of Ford and General Motors to cut their supply chains’ reliance on China, especially in electric-vehicle batteries. BBG

- Sec of State Blinken met with Chinese President Xi yesterday, an encouraging encounter and one that suggests the relationship is now on a (slightly) better track than before (Xi said it was “very good” that the two countries achieved progress in stabilizing ties). BBG

- Australian monetary official says the country’s unemployment rate needs to hit 4.5% (about 100bp higher than where it currently stands) with the economy growing at a below-trend pace for inflation to return to target. BBG

- Germany’s PPI cools far below expectations in May, coming in at +1% Y/Y (vs. the Street’s +1.7% forecast, and down from +4.1% in April (this number peaked at +45.85% back in Aug of 2022). RTRS

- ECB Chief Economist Philip Lane pushed back against talk of a Sept rate hike, saying there’s no reason to commit to action that far in the future. BBG

- SoftBank is set to win big from the AI revolution thanks to its early investments, Masayoshi Son said in his first public appearance in seven months. He told shareholders that he speaks with OpenAI CEO Sam Altman "several times a week." BBG

- Alibaba Group said that Joseph Tsai will take over from Daniel Zhang as chairman while Eddie Wu will succeed Zhang as CEO in September, as the Chinese e-commerce giant undergoes a major reorganization. WSJ

- 10) The S&P 500 index-level return on equity (ROE) both including and excluding Financials remains in the 97th percentile vs. history. Trailing 4 quarter ROE at the index level fell for four consecutive quarters before rising in 1Q by 34 bp to 20.4%. However, the ROE remains well below its year-ago level of 21.9% and its peak of 22.1% reached in 4Q 2021

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly lower with risk appetite subdued in the absence of a lead from Wall St due to the Juneteenth holiday and as markets digested the PBoC’s cuts to its benchmark lending rates. ASX 200 was led higher by gains in the commodity-related sectors and following the RBA Minutes from the June meeting which noted that the arguments were “finely balanced” between a 25bps hike or keeping rates steady at the last meeting, while money markets are currently leaning towards rates being kept unchanged for next month. Nikkei 225 was negative although the losses were stemmed and the index held above the 33,000 level with several major Japanese trading houses dominating the list of best performers after Berkshire Hathaway lifted its stake in five of them. Hang Seng and Shanghai Comp. declined despite the PBoC’s liquidity boost and 10bp cuts to its benchmark Loan Prime Rates. This was widely expected for the 1-year LPR after similar cuts to short-term funding rates but disappointed those anticipating a deeper 15bps cut for the 5-year LPR which is viewed as the reference for mortgages and in turn, weighed on HK-listed mainland developers.

Top Asian News

- US President Biden said US-China relations are on the right trail, according to Reuters.

- US Secretary of State Blinken said he is deeply concerned about the three Americans wrongfully detained in China, according to CBS.

- Chinese Premier Li held talks with the German business sector on Monday in which the meeting discussed the economic situation in China and globally, technology development trends, and views on so-called “de-risking”, according to Global Times.

- Japan's Foreign Ministry called on China to take seriously WTO findings that China's anti-dumping measures on Japan's stainless steel are inconsistent with the WTO agreement, according to Reuters.

- RBA Minutes from the June meeting stated that the Board considered a rate rise of 25bps or holding steady and reconsidering at a later meeting, while arguments were finely balanced but the Board decided the case for an immediate hike was stronger. RBA noted the increase would provide greater confidence that inflation would return to target over the period ahead, while it stated the balance of risks on inflation shifted to the upside compared with a month earlier and lags in the transmission of monetary policy meant there is a risk that past tightening could lead to a sharper economic slowdown.

European bourses are under pressure, Euro Stoxx 50 -0.4%, with broader macro updates somewhat light ahead of more Central Bank speak. Sectors are mainly in the red with Chemicals lagging after a Lanxess profit warning while Health Care outperforms after a favourable Sanofi litigation update. Stateside, futures are softer with pressure picking up as the European morning progresses and the ES moves below 4450, ES -0.4% ahead of Fed speak incl. voters Williams & Barr before Powell on Wednesday/Thursday. Adobe (ADBE) USD 20bln deal to acquire Figma is under threat from EU investigation, according to FT. Lockheed Martin (LMT) has raised concerns to the FTC and US DoD about L3harris' (LXH) acquisition of Aerojet Rocktdyne (AJRD).

Top European News

- ECB’s de Guindos said there is no doubt that inflation will ease but also noted the slowdown in core inflation may be limited, according to Bloomberg.

- ECB's Stournaras said a further decrease in inflation is expected and they cannot exclude a further hike but cannot say now and decisions are data-driven. Furthermore, Stournaras responded that it might be six months or a year and it depends on the data when asked about keeping rates at the terminal and said they are definitely close to the end of rate hikes.

- EU is to focus on export controls and critical technology in its security plan, according to Bloomberg.

- EU countries failed to agree on a deal on power market reforms and talks will continue after Monday.

- NHC said Tropical Storm Bret is expected to strengthen and interests in the Lesser Antilles should monitor the system, while it added that Bret could become a hurricane in a couple of days and is about 1,210 miles east of the southern Windward Islands.

- The European Commission will today ask EU member countries to contribute "tens of billions of euros more" to top up the Union’s budget for 2024-2027, according to Politico.

FX

- DXY drifts after a small extension of recovery rally to 102.620, but keeps sight of 102.500 as US markets return from the Juneteenth holiday.

- Yen rebounds sharply and swiftly after a false break below 142.00 vs Dollar where decent circa 2bln option expiry interest resides.

- Aussie loses 0.6800+ status against Greenback as RBA minutes reveal finely balanced 25bp June hike.

- Euro defends 1.0900 vs Buck again and probes Fib resistance, Pound pulls back from just over 1.2800 against Dollar on the eve of UK CPI data.

Fixed Income

- Bunds and Gilts bounce further from Monday's lows in consolidative trade before topping out ahead of 133.00 and just over 94.50 respectively.

- US Treasuries pare catch-up losses in response as T-note hovers above worst levels within 112-23/113-07+ range.

- 2 and 5 year German and UK supply reasonably well received, but not snapped up given 3%+ and close to 5% respective yields.

- UK sells GBP 3.75bln 4.50% 2028 Gilt; b/c 2.39x, average yield 4.932% and tail 0.7bps.

- Germany sells EUR 4.488bln vs exp. EUR 5.5bln 2.80% 2025 Schatz: b/c 1.4x (prev. 1.30x), average yield 3.15% (prev. 2.82%) & retention 18.4% (prev. 18.52%)

Commodities

- Crude benchmarks are essentially flat after paring opening losses which seemingly emanated from ongoing Chinese growth concerns with more desks downgrading their 2023 view while the PBoC cut its LPRs.

- WTI and Brent are currently in proximity to the USD 72.00/bbl and USD 77.00/bbl marks, towards the top-end of their respective ranges.

- Spot gold is relatively rangebound in-fitting with relatively contained action for the DXY thus far, with the 100-DMA in proximity at USD 1942/oz. Conversely, base metals remain subdued continuing APAC performance given economic concerns out of China and a shallower-than-expected 5yr LPR cut.

- Seaborne shipments of June-loading Russian Urals oil to China fell 50% for June 1st-19th M/M.

- Qatar is set to strike a second big LNG supply deal with China, according to FT.

- China 2023 Crude Oil demand is seen at 740mln metric tons, +3.5% Y/Y, according to CNPC Research. Diesel demand is seen reaching 98.9% of 2019 level. Kerosene demand around 95% of 2019 level. Gasoline demand seen up 0.8% vs 2019 level.

Geopolitics

- Beijing plans a new training facility in Cuba which raises the prospect of Chinese troops on America's doorstep, according to WSJ.

- Ukraine's Deputy Defence Minister said the biggest blow in Ukraine's offensive is yet to come, while he added that it is difficult to advance and Ukraine must prepare for a tough duel, according to Reuters.

- Kyiv is in talks with Western arms manufacturers to boost output and set up production in Ukraine, according to Reuters.

- EU is readying a EUR 50bln Ukraine package, according to Bloomberg,

- EU report on Ukraine's membership bid said Kyiv has met 2 out of the 7 conditions to start formal accession talks, according to Reuters citing sources.

- US President Biden said the threat of Russian President Putin using tactical nuclear weapons is 'real', according to Reuters.

- Russian Defence Minister says Ukraine plans to hit Crimea with Himars and Storm Shadows, according to Tass; says the use of these weapons would mean full-scale involvement of the US and the UK in the Russia-Ukraine conflict.

US Event Calendar

- 08:30: May Building Permits, est. 1.43m, prior 1.42m, revised 1.42m

- May Building Permits MoM, est. 0.6%, prior -1.5%, revised -1.4%

- May Housing Starts, est. 1.4m, prior 1.4m

- May Housing Starts MoM, est. -0.1%, prior 2.2%

- 08:30: June Philadelphia Fed Non-Manufactu, prior -16.0

DB's Jim Reid concludes the overnight wrap

The last 24 hours have been fairly quiet for markets given the US holiday, but bonds and equities were soft yesterday which partly reflects a weaker end to the US session before the long weekend. Nevertheless it was enough to see the STOXX 600 (-1.02%) post its worst start to a week since the turmoil in March. Asian markets are on the softer side as well.

Here in the UK, we experienced the sharpest end of the bond selloff, with yields on 2yr gilts (+14.2bps) closing at a post-2008 high of 5.06%. Likewise, the 10yr gilt yield (+7.9bps) closed at its highest level since the mini-budget turmoil last October at 4.48%, and is now just a few basis points shy of surpassing that milestone too. Remember that 2yr gilt yields have risen by more than 100bps since the massive upside surprise in last month’s CPI print, and that’s been filtering through to the mortgage market. In fact, there were plenty of domestic headlines on the issue well outside the financial press yesterday, since Moneyfacts reported that the average 2yr mortgage rate was now above 6% for the first time since the aftermath of the mini-budget. You’d have to go back to pre-GFC days for the last time mortgage rates were that high before that very brief period last year. This is real stored up potential pain as the slow refinancing wave materialises over the next few quarters.

The latest moves come as investors are still repricing their expectations for the Bank of England base rate, particularly after the very strong employment data last week. One particular milestone from yesterday was that for the first time since the mini-budget turmoil, overnight index swaps were pricing in a 6% base rate as more likely than not by the close, and not just on an intraday basis. This positioning comes ahead of a pivotal few days for UK macro, since we’ll get the May CPI release first thing tomorrow, and then the Bank of England’s latest policy decision on Thursday, where another 25bp hike is widely expected.

These themes were also evident across Europe, since investors grew in confidence that the ECB would deliver another hike after July in September, which if realised would take their deposit rate up to 4%. In part, that was thanks to remarks from Isabel Schnabel of the ECB’s Executive Board, who gave a speech titled “The risks of stubborn inflation”, where she said they should “err on the side of doing too much rather than too little”. There was less conviction elsewhere from other members of the Governing Council, but none were ruling out the possibility of a September hike either. For instance, chief economist Lane said that “September is so far away, let’s see in September”. Otherwise, Slovakia’s Kazimir said that September was “open and it remains to be seen what will be done”, and Lithuania’s Simkus said it was “still too early” to make a judgement on that meeting.

This backdrop led to a fresh selloff in European sovereign debt, with yields on 10yr bunds (+4.3bps), OATs (+5.8bps) and BTPs (+8.6bps) all moving higher on the day. And at the front-end of the curve, we also saw the 2yr German yield (+3.5bps) hit a post-SVB high of 3.13%. But all this news of higher rates served to knock equities back, with the major indices all losing ground across the continent. For example, the STOXX 600 (-1.02%) lost a decent amount of ground, whilst it was much the same story for the DAX (-0.96%), the CAC 40 (-1.01%) and the FTSE MIB (-0.39%).

In overnight trading, S&P 500 (-0.23%) and NASDAQ 100 (-0.21%) futures are inching lower after the holiday, with yields on 10yr USTs (+3.31bps) moving higher and trading at 3.79% after being closed yesterday. Fed funds futures have also moved in a slightly more hawkish direction since Friday’s close with the rate priced in for the December meeting up another couple of basis points to what would be a post-SVB closing high of 5.22%.

Asian equity markets are also declining this morning with the global risk softness. The People’s Bank of China (PBOC) have slightly added to the weaker sentiment as they have delivered a smaller Loan Prime Rate (LPR) cut than expected despite deepening struggle in housing market. They cut the 1yr and 5yr loan prime rates by 10 basis points to 3.55% and 4.2% respectively, with the market expecting the latter, a key benchmark for mortgages, to be cut 15bps. Nevertheless they have eased these for the first time in 10 months as the country’s post-pandemic rebound is stalling. The move came after monetary policymakers cut two other key rates last week while injecting billions into financial markets and contrasting China with their peers in the West.

As I check my screens, the Hang Seng (-1.50%) is leading losses with the Nikkei (-0.62%) and the KOSPI (-0.17%) also trading in the red. Elsewhere, in mainland China, the Shanghai Composite (-0.18%) is trading on a negative footing with the CSI (-0.03%) just below flat.

There was plenty happening on the geopolitical scene yesterday, since US Secretary of State Blinken met with Chinese President Xi on his visit to Beijing. The fact the two met was seen as a positive sign, and Blinken said to reporters after that “My hope and expectation is we’ll have better communications, better engagement going forward”. Blinken will now be travelling to London for the Ukraine Recovery Conference, which will feature appearances from European Commission President Von der Leyen, as well as UK PM Sunak.

Staying on politics, today will also see the European Commission present its economic security strategy, which comes ahead of next week’s summit of EU leaders in Brussels. This is a topic that’s risen up the agenda over the last couple of years, particularly given the issues caused by Europe’s dependence on Russian gas and growing US-China tensions. For those interested in more, our research colleagues in Frankfurt have just published a pack running through the EU Green Deal Industrial Plan (link here). It’s a great primer on the topic

Another European story of interest that could have important implications for the German economy has been the declining water level on the Rhine recently, which is beneath seasonal averages again. Indeed, data for the measured water level at Kaub showed it down to 1.27m yesterday evening, albeit that’s still well above the lows around 30cm from last August that led to major disruption. Our colleagues in the German economics team have argued that if we get to the lows of last year, that could impair the economic recovery, which they’re already expecting to be very modest anyway (link here)

Finally on the data side, there wasn’t much of note, but the main release was the NAHB’s housing market index from the US. That rose for a 6th consecutive month in June to 55 (vs. 51 expected), which is steadily reversing a run of 12 consecutive declines over the entirety of 2022.

To the day ahead now, and data releases include US housing starts and building permits for May, along with German PPI for May. From central banks, we’ll hear from the Fed’s Bullard, Williams and Barr, as well as ECB Vice President de Guindos, and the ECB’s Rehn, Muller, Vujcic and Simkus.