At face value and without any other context, cybersecurity specialist CrowdStrike (NASDAQ:CRWD) might seem to be a riskier-than-average investment idea. Mainly, this concern centers on CrowdStrike’s historical challenge to generate annual net income. Nevertheless, with the rise of threats against the digital ecosystem, there’s little reason to doubt the enterprise. Therefore, I am bullish on CRWD stock.

Workplace Pivot Should Bolster CRWD Stock

Easily, one of the most profound pivots that the pandemic sparked years ago was the normalization of a remote workplace. With the white-collar professional landscape becoming effectively decentralized, workers can essentially operate from anywhere. At the same time, that only means that nefarious actors can comprise corporate security from anywhere as well.

Basically, a decentralized workforce increases the scope of vulnerability. Now, hackers no longer need to target a centralized corporate headquarters. Instead, through “investigational” endeavors – such as scouring social media for information – these bad actors can target corporate employees. Generally speaking, individual households utilize far less rigorous cybersecurity protocols than major organizations.

Obviously, companies that will continue to operate remotely or via a hybrid schedule must adapt to new realities. Cynically, this framework should only help CRWD stock. For example, CrowdStrike’s Zero Trust solution should prevent breaches in real time on any identity, endpoint, or workload. That’s going to give peace of mind to potentially vulnerable enterprises while also boosting CrowdStrike’s top line.

Even without the workplace paradigm shift, CRWD stock represents a tremendously relevant idea. One might even argue that it’s permanently relevant. In the information age, there may be three certainties in life: death, taxes, and cyberattacks.

According to Statista, as of 2023, the average cost of a cyber attack in the U.S. came out to $9.48 million. That’s just an average, which means certain enterprises can suffer substantial losses. Also, lesser-capitalized companies may very well go under.

Like auto insurance, cybersecurity isn’t something to be cheap about. And that concept favors CRWD stock.

Technical and Options Analysis Make the Case for CrowdStrike

For investors on the fence regarding CRWD stock, the convergence of technical and options market factors may continue to lift shares. Yes, buying into a security that has already gained 56.9% since the start of the year presents bag-holding risk. However, because of the fundamental relevance, the winds may favor the optimists.

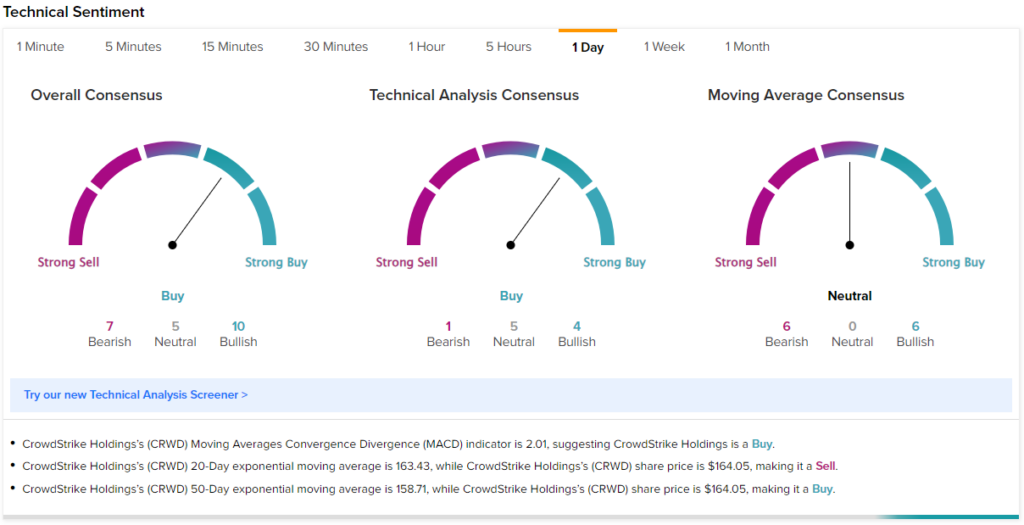

Specifically, TipRanks’ technical analysis indicator suggests that CRWD stock represents an overall Buy. That stems from chart patterns that appear optimistic.

Now, the options data requires a bit of analysis and speculation. On January 25 of this year, a major trader (or traders) bought 1,900 contracts of the Jan 19 ’24 185.00 put. At the time of the transaction, open interest sat at 388 contracts. Today, this stat increased to 425, which means traders mitigated most but not all the exposure related to this put.

Should CRWD stock continue to swing upward – and by most indications, that’s the forecasted trajectory – the still open bearish positions could be vulnerable to expire worthless. Subsequently, possible mitigating actions (like buying calls) can provide an uplift to CRWD.

A Risky but Also Sensible Speculation

For full disclosure, CRWD stock still presents significant risks to investors currently contemplating exposure. For example, CRWD trades at a forward earnings multiple of 64.9x, which is elevated compared to the sector median forward multiple of 21.4x. Still, the robust expansion of the top line makes CrowdStrike appealing.

For instance, in the quarter ended July 2023, CrowdStrike posted revenue of $731.63 million. This tally beat the year-ago quarter’s result of $535.15 million by 36.7%. Significantly, net income landed at $8.47 million, an obviously much better result than the net loss of $49.28 million printed one year earlier.

A couple more quarters like this, and CrowdStrike can start achieving more consistent profitability. And that’s a reasonably realistic target, given the expanded cyber threat profile.

Is CRWD Stock a Buy, According to Analysts?

Turning to Wall Street, CRWD stock has a Strong Buy consensus rating based on 30 Buys, three Holds, and zero Sell ratings. The average CRWD stock price target is $191.94, implying 17% upside potential.

The Takeaway: CRWD Stock is About Following the Math

When it comes down to it, wagering on CRWD stock centers on following the math. True, CrowdStrike hasn’t enjoyed the most sterling financial performances in the past. However, given the ongoing expansion of the cyber threat profile, investors will likely consider betting on the company. Plus, analysts are highly bullish on the company, and the technicals suggest upside ahead, according to TipRanks.