Introduction to NVIDIA Corp (NVDA, Financial)

NVIDIA Corp (NVDA) is a leading player in the Semiconductors industry, renowned for its innovative designs of discrete graphics processing units (GPUs). These GPUs enhance the computing experience across various platforms. NVIDIA's chips find extensive use in diverse end markets, including PC gaming and data centers. In recent years, the company has expanded its focus from traditional PC graphics applications such as gaming to more complex and lucrative opportunities. These include artificial intelligence and autonomous driving, which leverage the high-performance capabilities of the firm's products.

Stock Performance Analysis

As of August 9, 2023, NVIDIA Corp's stock price stands at $425.54. The company's stock has seen a slight dip today, with a price change of -4.72%. However, the past three months have been quite favorable for NVIDIA, with the stock price witnessing a substantial gain of 49.18%. This impressive performance underscores the company's robust position in the market and its potential for future growth.

Business Description and Revenue Analysis

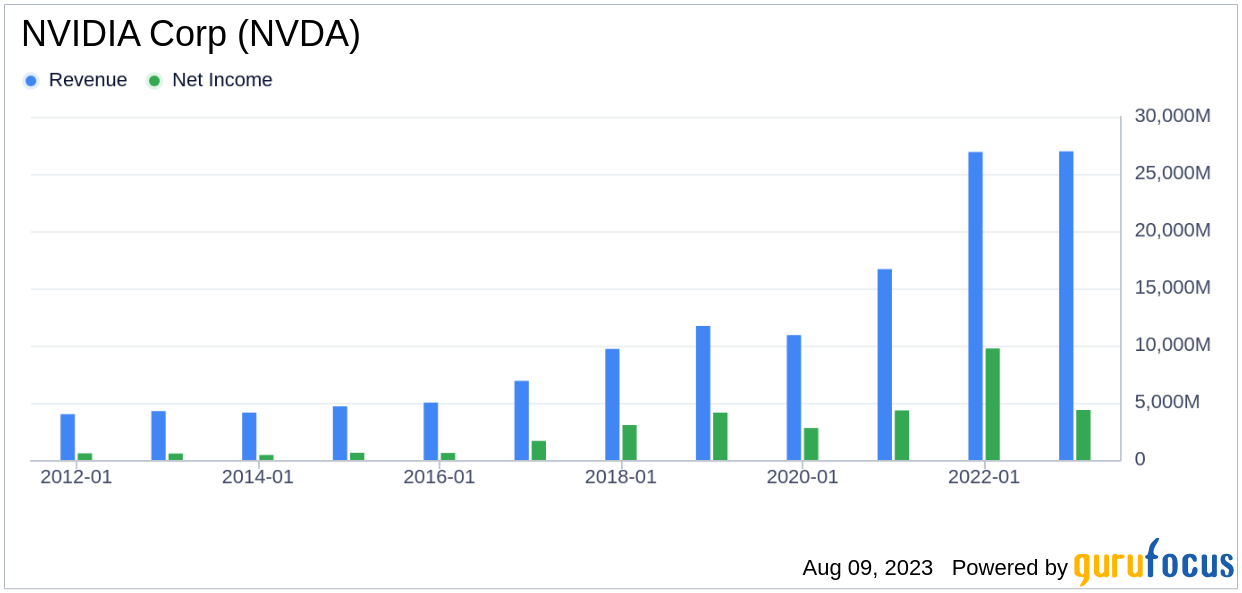

NVIDIA's business model is centered around the design and development of GPUs that enhance computing platforms. The company has successfully broadened its focus areas to include artificial intelligence and autonomous driving, leveraging the high-performance capabilities of its products. NVIDIA's Revenue Per Share for the trailing twelve months (TTM) ended in April 2023 stands at $10.37. The company has also demonstrated a strong 3-Year Revenue Growth Rate of 34.50%, indicating a healthy revenue stream and potential for future growth.

Earnings and Dividend Growth Analysis

NVIDIA's financial performance is further highlighted by its Earnings per Share (EPS) and dividend growth rate. The company's Earnings per Share (Diluted) for the trailing twelve months (TTM) ended in April 2023 is $1.92. The 3-Year EPS without NRI Growth Rate stands at 15.50, indicating a steady increase in earnings. Furthermore, the company's 5-Year Dividend Growth Rate is 2.00, demonstrating a commitment to returning value to shareholders.

Major Stockholders

NVIDIA Corp's stock is held by several major stockholders. Ken Fisher (Trades, Portfolio) holds the largest share with 8,609,799 shares, accounting for 0.35% of the total shares. Ron Baron (Trades, Portfolio) and David Tepper (Trades, Portfolio) follow with 540,614 and 150,000 shares, respectively. Other notable stockholders include Dodge & Cox, Jefferies Group (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Tiger Management (Trades, Portfolio), and Private Capital (Trades, Portfolio).

Competitive Landscape

NVIDIA operates in a competitive landscape with several key players in the Semiconductors industry. Broadcom Inc (AVGO, Financial) with a market cap of $351.08 billion, Advanced Micro Devices Inc (AMD, Financial) with a market cap of $178.48 billion, and Texas Instruments Inc (TXN, Financial) with a market cap of $151.88 billion are some of the main competitors. Despite the competition, NVIDIA's market cap of $1.05 trillion demonstrates its dominant position in the industry.

Conclusion

In conclusion, NVIDIA Corp has demonstrated robust performance in the stock market, backed by its innovative business model and strong financial performance. Despite a slight dip in the stock price today, the company's substantial gain over the past three months and its dominant position in the market make it a compelling consideration for value investors. With a strong revenue stream, steady earnings growth, and a commitment to returning value to shareholders, NVIDIA Corp continues to be a strong player in the Semiconductors industry.