Director of gold and silver business ‘danger to creditors’

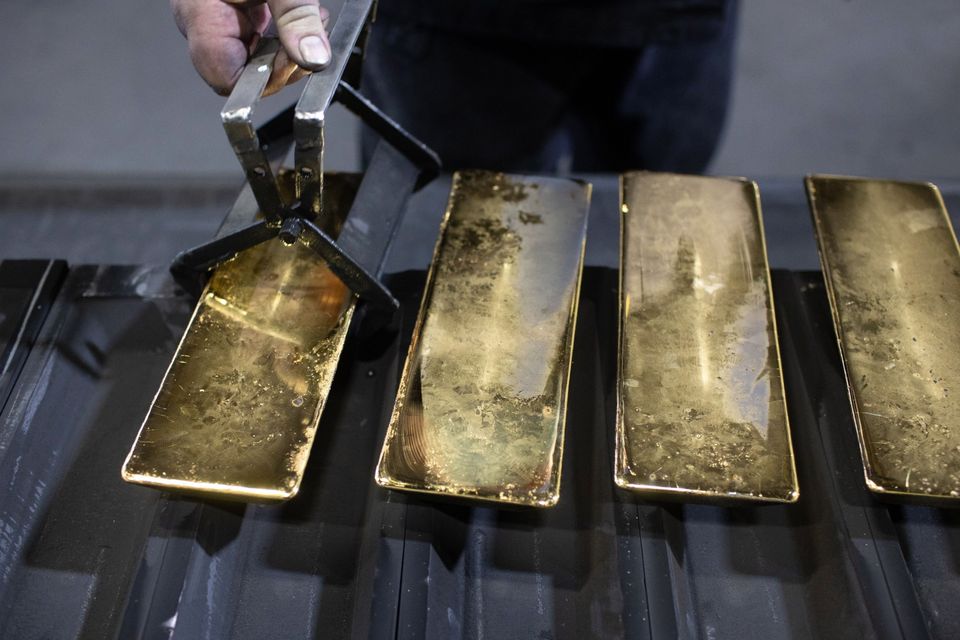

Gold ingots. Photo: Andrey Rudakov/Bloomberg

The shareholder and director of a gold and silver investment company has been disqualified from holding a directorship for seven years after a judge found he presents a danger to creditors.

The High Court heard a liquidator believes the Irish Gold and Silver Bullion Limited defrauded its customers and operated as a “Ponzi scheme”.

In a ruling, Mr Justice Brian O’Moore said Nicholas Wickham was not honest to investors and his behaviour makes it clear he presents a danger to creditors.

He was not honest with investors in the company and his business model involved “repeated misrepresentation” to customers about how their funds were used, the judge said.

He gave a “headline” sanction of 14 years. This was halved based on mitigating factors such as Mr Wickham’s acceptance of a disqualification order and his £310,000 payment to the liquidator in settlement of proceedings.

The court also noted Mr Wickham (61) reversed his original policy of not cooperating with the liquidator.

The disqualification order, made under section 838 of the 2014 Companies Act, came in response to an application by Miles Kirby, the liquidator of the firm, which has an address at The Crescent, Monkstown, in south Co Dublin.

Mr Kirby, as liquidator, secured court orders in July 2022 to freeze assets of Mr Wickham and a firm he owns and controls called Hamden Development Homes UK Ltd.

Mr Kirby’s counsel, Arthur Cunningham, later informed the court in May that Mr Wickham had begun to cooperate with the liquidator. The proceedings, seeking various orders including judgment of €1m against Mr Wickham and Hamden, had settled, he said. All previous court orders were lifted.

Mr Justice O’Moore said in his judgment that the liquidator’s investigations found Mr Wickham pooled customer funds, which should have been used to purchase precious metals as investments, with company money. This enabled Mr Wickham to operate what Mr Kirby described as a Ponzi scheme over several years.

By the time Mr Kirby was appointed there was no stock of metal and the company’s bank account contained €3,900. The firm’s deficit was €1m, said the judge.

Mr Justice O’Moore said his conduct puts him into the category of “particularly serious cases” warranting consideration of a disqualification period exceeding 10 years.

Join the Irish Independent WhatsApp channel

Stay up to date with all the latest news