Categories Analysis, Industrials

United Airlines (UAL) will report Q2 2023 earnings next week, here’s what to expect

United has guided for adjusted EPS of $3.50-4.00 for Q2 2023

Shares of United Airlines Holdings Inc. (NASDAQ: UAL) stayed red on Wednesday. The stock has gained 47% year-to-date and 34% over the past three months. The airline company is slated to report its second quarter 2023 earnings results on Wednesday, July 19, after market close. Here’s a look at what to expect from the earnings report:

Revenue

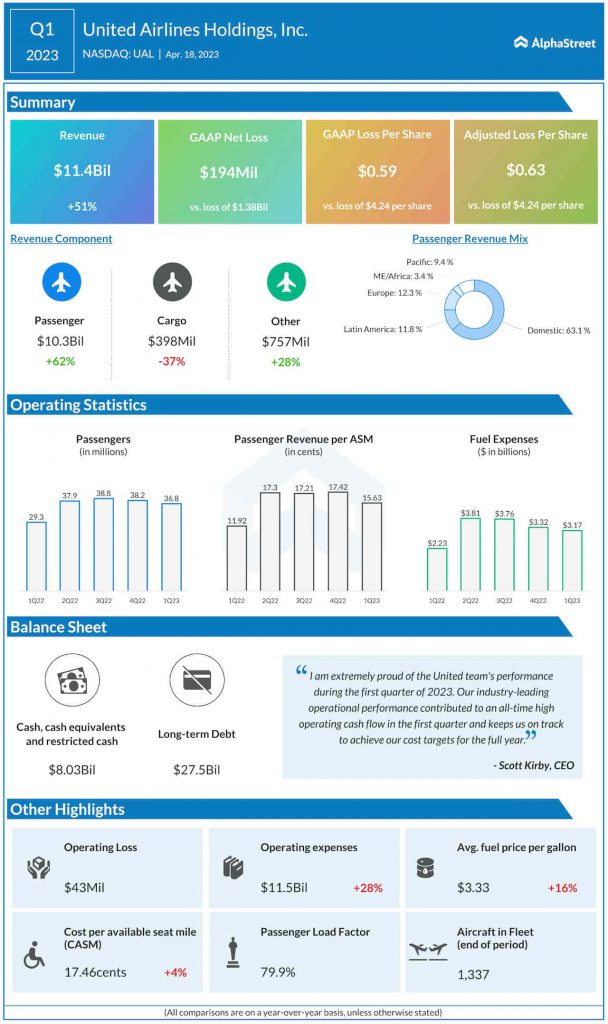

United expects its second-quarter 2023 revenue to be 14-16% higher than the same period a year ago. Analysts are projecting revenues of $13.9 billion, which represents a year-over-year growth of around 15%. In Q1 2023, operating revenue increased 51% YoY to $11.4 billion.

Earnings

United has guided for adjusted EPS of $3.50-4.00 for Q2 2023. Analysts are projecting EPS of $4.03, which compares to EPS of $1.43 reported in the year-ago quarter. In Q1, the company reported an adjusted loss of $0.63.

Points to note

United is seeing strong demand for air travel with particular strength in leisure travel. Business travel is also gaining momentum, especially in global long-haul markets. International demand seems to be gaining traction over domestic. The trends for second-quarter revenue and bookings appear to be strong.

In Q1 2023, passenger revenues were up 62% YoY while cargo revenue was down 37%. Total revenue per available seat mile (TRASM) was up 22.5% while passenger revenue per available seat mile (PRASM) was up 31.1%. Passenger load factor was 79.9%.

In Q1, capacity was up 23.4% YoY. In Q2, capacity is expected to be up approx. 18.5%. In Q1, CASM-ex was down 0.1% versus the year-ago period. For Q2, CASM-ex is expected to be flat to up 2%.

Most Popular

INTU Earnings: Intuit Q3 2024 revenue and adj. profit top expectations

Intuit Inc. (NASDAQ: INTU) Thursday reported an increase in adjusted earnings and revenues for the third quarter of 2024. The results also exceeded analysts' estimates. At $6.74 billion, the Mountain

After blowout quarter, Nvidia (NVDA) looks set to continue riding the AI wave

Shares of NVIDIA Corporation (NASDAQ: NVDA) rallied this week after the semiconductor giant reported robust first-quarter numbers. Being a first mover in artificial intelligence chips, the company is spearheading the

Target Corp. (TGT): A brief look at the retailer’s performance in Q1 2024

Shares of Target Corporation (NYSE: TGT) rose over 1% on Thursday. The stock has dropped over 11% in the past one month. The company delivered mixed results for the first