maumapho/E+ via Getty Images

Summary

Please note that this article was submitted for publication the night before the Q1 earnings call. The article is based on our opinions prior to seeing the results. Prior to 2022, tower REITs had experienced an exceptional run. Investors loved the sector due to towers' significant growth potential and mission-critical nature, resulting in premium valuations. However, recent factors, including decreased leasing activity in the US, churn from Sprint, and higher rates, have negatively impacted their recent performance. Additionally, a shift in the Company's dividend policy has led to a technical sell-off in American Tower's (NYSE:AMT) stock driven by dividend funds. Despite these challenges, we have a positive outlook on the industry's fundamentals and AMT's current valuation as an attractive entry point. We initiate at Buy.

Tower REIT Overview

Tower REITs lease antenna space on towers to major wireless communication providers (e.g., AT&T, Verizon, T-Mobile/Sprint, Dish Wireless). They have become highly favored due to their predictability of revenue and significant long-term cash flow growth potential. Tower leases generally have 3% annual rent escalators, providing inflation protection and the ability to add multiple incremental tenants to the same tower, providing significant cash flow growth due to operating leverage.

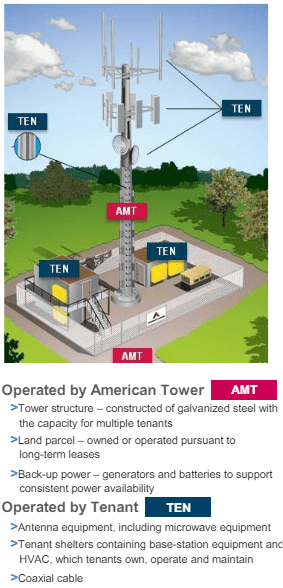

Towers Business Model (AMT)

Demand for towers is driven by a few key macro trends: population growth, new technologies, and data proliferation. Population growth, along with increasing smartphone penetration, increases tower utilization rates and drives the development of new tower sites to support call quality and upload/download speeds. Each new evolution of mobile network technology (e.g., 4G, 5G, and, eventually, 6G) results in higher-quality signals. However, these incrementally higher-quality signals can only travel short distances, necessitating a denser network (i.e., more towers) to support service levels. Lastly, data proliferation, driven by new data-heavy applications (e.g., streaming, social media, e-commerce, AI, crypto, video conferencing, etc.), increases tower utilization rates, driving the demand for more towers to increase network capacity. Tower networks are critical infrastructure for telco tenants, who cannot operate their businesses without these sites.

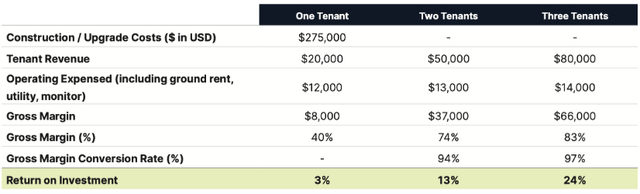

Multiple competing telcos often host equipment on the same towers, leveraging the tower REIT's investment. Tower economics are such that single-tenanted sites are rather unattractive investments. This was the primary reason telcos exited this part of their business, selling their towers to specialized REITs. Moving from a single-tenant to two or three tenants per tower generates significantly more attractive returns, as there are minimal incremental operating or capital costs required to do so.

Tower Economics (AMT)

In the US, towers can generally be built for ~$275k. The initial (or "anchor") tenant generally gets a below-market rent and is used to de-risk the development. Single-tenant towers generate gross margins of ~40% and an ROI of ~3%. Adding a second tenant drives 34pp of margin expansion and gets ROI to ~13%. A third tenant drives an incremental 9pp of margin expansion and drives ROI to ~24%. Multi-tenanted towers sell for ~30x-40x tower cash flow ("TCF"), creating significant value for the developer/owner.

TCF multiples are incredibly high because of the long-term cash flow growth potential. First, leases contain 3% annual rent escalators that provide built-in cash flow growth. Second, tenants pay additional rent when they upgrade their equipment situated on the tower (e.g., 4G to 5G). Lastly, adding new tenants to the tower drives cash flow growth, as discussed previously. The ability to grow cash flows by >100% justifies the premium multiples.

While the tenant's lack of exclusivity may seem unfavorable, this is actually a mutually beneficial business model. The tenants' savings on the capital costs of the tower network far outweigh any potential gain from exclusivity.

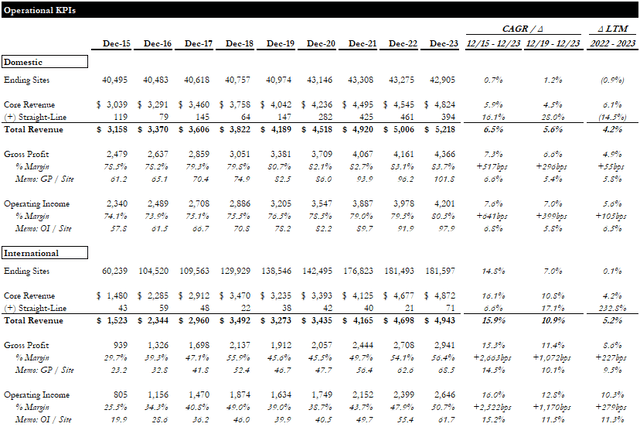

The favorable dynamics for tower REITs discussed above are evident in AMT's long-term financial performance. From 2015 to 2023, AMT's domestic tower portfolio grew at a ~1% CAGR, while revenue, gross profit, and operating income ("OI") grew at ~6-8% CAGRs. This is explained by strong GM and OI margin expansion and rapid earnings per tower growth based on the abovementioned factors. The same dynamic can be seen in the international segment, with much higher growth rates and greater margin expansion.

Operational KPI Evolution (Empyrean; AMT)

While the sector has been under some pressure recently due to higher rates weighing on tower multiples, Sprint churn, and a temporary US leasing slowdown, we believe that the sector's growth drivers and economics remain highly favorable.

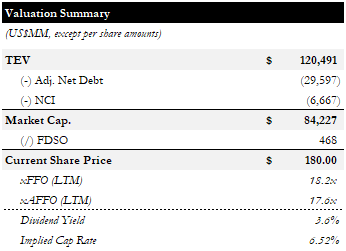

Valuation

AMT trades for ~18x LTM FFO/AFFO and a ~6.5% implied cap rate. After announcing its intention to hold the dividend "relatively flat" for 2024 and split it evenly across all 4 quarters, the current yield sits at ~3.6%. This was a material event for the stock. The dividend policy for the year implies a relatively flat change from the prior year but a sequential decrease from $1.70 per share in Q4 2023 to $1.62 per share in Q1 2024. Many dividend funds have rules/guidelines about owning stocks that reduce dividends, even for technical reasons such as this. We believe this has explained some of the underperformance over the past month and helped create an attractive entry point.

Valuation Summary (Empyrean)

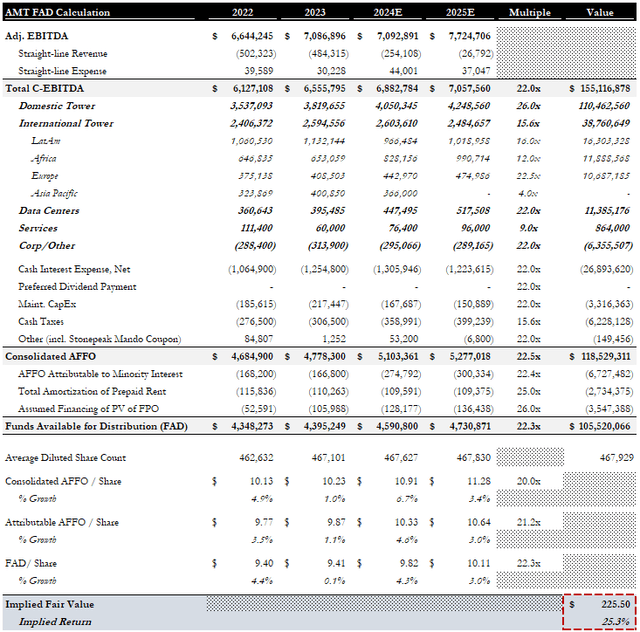

As a large, globally diversified company with operations that have different risk/return profiles, we prefer to value AMT using a sum-of-the-parts ("SOTP") analysis, applying multiples to the operations of each segment. We apply multiples to funds available for distribution ("FAD"), which applies adjustments to reported consolidated AFFO.

Because we do not have sufficiently granular disclosures to calculate FAD for each segment, we use cash EBITDA ("C-EBITDA") as a proxy metric. We apply different multiples to each segment based on its particular risk/return profile and end up with a blended multiple of ~22x.

AMT SOTP Valuation (Empyrean)

We apply a 26x multiple to the US macro tower segment, based on a DCF. A relatively more stable interest rate environment should drive multiple expansion and allow investors to focus on the fundamentals of this non-cyclical, growing, cash-yielding business.

We apply a 16x multiple to the Latin America segment, a premium to the public LatAm operator Opsimex which has a lower growth rate.

We apply a 22.5x multiple to the Europe segment, a 3.5x discount to our US multiple given the FX exposure and different economics between countries and assets (n.b., significant rooftop assets), but we still expect strong, stable growth with low churn from anchor tenant Telefonica and a strong leasing environment in Germany, supported by the new entrant 1&1 Drillisch.

We apply a 12x multiple to the Africa segment, a premium to African peers IHS and Helios, which we believe have inferior economics and lease terms.

We do not value the APAD (n.b., India) segment; instead, we account for the $2.5Bn cash proceeds from the sale of this business, which is assumed to be received by the end of 2024.

We apply a 22x multiple to the US data centers ("DC") segment, reflecting their attractiveness across cycles given their long-term, non-cyclical, recurring, and growing cash flows. Additionally, AI development will be a strong demand driver, extending the long-term growth runway. Nevertheless, DCs do not have the same high quality economics as towers do, having lower barriers to entry/pricing power, and higher capex requirements.

We apply a 9x multiple to the services business, in-line with peers Dycom and MasTec.

After arriving at total C-EBITDA, we adjust segment values to reflect corporate-level cash interest, preferred dividends, maintenance capex, and taxes at blended multiples.

We apply a blended multiple of ~22x to cash interest and maintenance capex, as these can be attributed across the entire company. We apply only the international blended multiple of ~16x to cash taxes, as AMT's REIT status shields the qualified REIT subsidiary from U.S. federal tax.

We get to our 2025 FAD estimate by removing AFFO attributable to minority interest, non-cash amortization of prepaid rent, and the impact of financing the present value of final purchase options.

Our resulting price target of $225 implies ~25% upside at the ~22x blended FAD multiple (n.b., implied ~7.3% discount rate).

Conclusion

Tower REITs have been some of the best performers in the REIT universe in recent years. Their unusually high growth profile and essential nature have driven premium multiples. Narratives relating to the recent slowdown in US leasing activity, Sprint churn, and higher rates have pressured performance in recent months. The recent change in dividend policy also appears to have caused a technical sell-off in AMT's stock. We believe the fundamentals of the tower leasing space remain highly attractive and see AMT's current valuation as a rare opportunity to get such an attractive business at a good price. We initiate at Buy.