Ray Dalio’s Bridgewater Associates dumped the shares of large U.S. banks in Q1, per the latest 13F filing. Dalio exited positions in JPMorgan Chase & Co. (NYSE:JPM), Wells Fargo (NYSE:WFC), Bank of America (NYSE:BAC), and Goldman Sachs (NYSE:GS). On the other hand, the ace investor placed bets on Shopify (NYSE:SHOP)(TSE:SHOP) and Home Depot (NYSE:HD).

The market sentiment on bank stocks remains weak following the shocking collapse of three regional banks and the Credit Suisse saga. Further, credit tightening, the decline in deposits, and an expected slowdown in loan growth due to macro weakness could limit the upside in bank stocks.

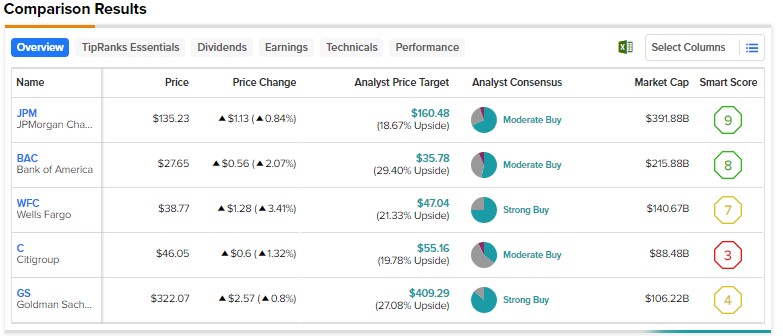

TipRanks’ Stock Comparison tool shows that Wall Street analysts are cautiously optimistic about top banks. Further, only Goldman Sachs sports a Strong Buy consensus rating. However, Goldman’s Smart Score of four indicates a Neutral outlook.

While bank stocks don’t appear to be the best bets based on the combination of analysts’ consensus ratings and Smart Score, let’s check what’s on the horizon for the stocks Dalio went long in Q1.

What’s the Prediction for Shopify Stock?

Shopify stock has gained over 76% year-to-date, reflecting its ability to deliver solid growth despite tough year-over-year comparisons and weak e-commerce trends. Further, the company’s decision to sell its logistics business and make job cuts will ease pressure on margins. Shopify continues to drive merchants to its platform and is benefitting from growth in Payments.

While the company is taking initiatives to deliver sustainable growth, analysts maintain a cautiously optimistic outlook due to the weakness in consumer spending and soft e-commerce trends. Further, insiders also reduced their exposure to SHOP stock.

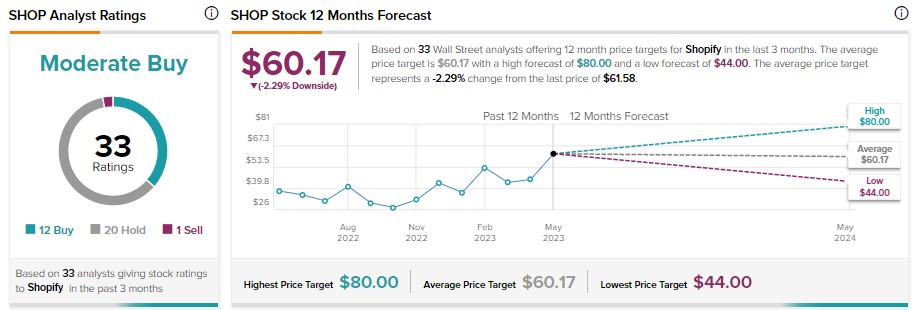

Shopify stock has received 12 Buy, 20 Hold, and one Sell recommendations for a Moderate Buy consensus rating. Given the recent appreciation in its price, analysts’ average price target of $60.17 implies 2.29% downside potential.

Is Home Depot a Buy, Sell, or Hold?

Home Depot will announce its first quarter financial results today. The moderation in demand is likely to weigh on Home Depot’s financials in the short term. Thus, analysts remain cautiously optimistic about HD stock.

Home Depot has a Moderate Buy consensus rating based on 14 Buy and nine Hold recommendations. At the same time, analysts have an average price target of $333.42 ahead of the Q1 print, implying 15.55% upside potential.

Bottom Line

Besides for the shares mentioned above, Dalio bought and sold several other stocks. Learn more about Bridgewater Associates’ holdings here. Also, retail investors can leverage TipRanks’ Experts Center tool to identify stocks with the potential to outperform the broader market.

Find out which stock the biggest hedge fund managers are buying right now.