Salesforce (NYSE:CRM) seems to be doubling down to gain a better position in the AI race. That much was clear after the company’s latest AI day, and though AI chip stocks have continued to hog most of the momentum in the AI universe, it may not take long before that AI wave hits the software scene. If it does, Salesforce could be one of the bigger beneficiaries, given its AI prowess and its ability to monetize its enterprise solutions.

Though it’s quite a stretch to compare Salesforce’s AI upside potential to the likes of a pre-ChatGPT-era Nvidia (NASDAQ:NVDA), I believe that many investors and analysts may be discounting the company’s potential to take the AI ball and run with it all the way to the endzone. Given this, I’m staying bullish on CRM stock, even as rates on the 10-Year Treasury Note reach 4.3%.

Over the past few weeks and months, Salesforce stock has been steadily trending higher. Indeed, investors still seem upbeat on Salesforce stock after its recent Q2 earnings beat and promising growth drivers highlighted in the company’s latest AI day.

For now, enthusiasm seems to be enough to offset rate concerns that have been troubling some tech-focused investors. As the company moves from cost-cutting and driving efficiencies to “flooring it” on the front of AI innovations, CRM stock’s all-time highs (of over $300 per share) may be within striking distance.

AI Could Help Power Future Quarters

Salesforce’s latest round of numbers were quite impressive (earnings per share of $2.12 vs. $1.90 consensus estimate). As the company continues to invest heavily in generative artificial intelligence (AI), we shouldn’t be surprised if Marc Benioff’s empire can one-up itself in the near future. With Salesforce’s annual Dreamforce event coming up tomorrow, investors should expect to learn even more about what the company has to offer on the front of AI.

Though there’s still quite a bit of AI-related upside priced in already, I’d pay more attention to commentary on how generative AI technologies can help bolster earnings growth. The company already hiked prices by 9% for the first time in seven years. Now, it needs to show the world that such hikes aren’t just a response to inflation.

The company’s recent AI day shone a bright light on some pretty intriguing innovations. As the company continues doubling down on AI innovations ($20 billion to go into AI-related R&D), I believe the company will have the means to justify price hikes again at some point in the near future, especially if clients can’t get enough of Salesforce’s AI Cloud, which was launched in June.

Is CRM Stock a Buy, According to Analysts?

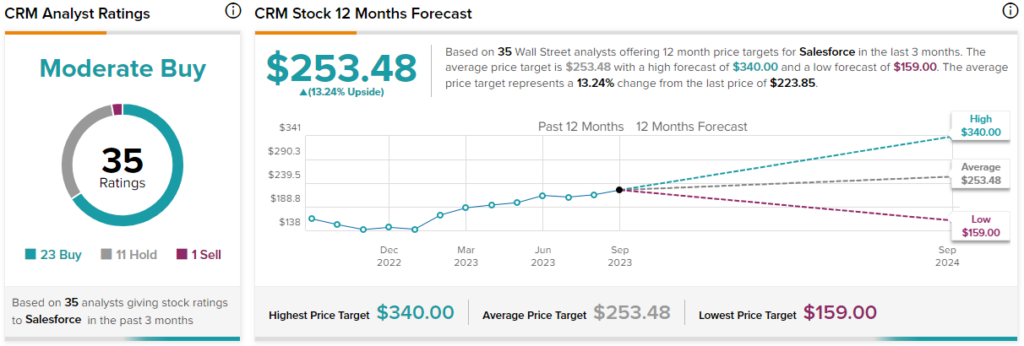

On TipRanks, CRM stock comes in as a Moderate Buy. Out of 35 analyst ratings, there are 23 Buys, 11 Holds, and one Sell recommendation. The average Salesforce stock price target is $253.48, implying upside potential of 13.2%.

Goldman Sachs analyst Kash Rangan seems to be pounding the table on Salesforce stock with his Street-high price target of $340.00, which implies more than 51% upside from current prices. As a five-star analyst, according to TipRanks, Mr. Rangan has a pretty good track record. On a one-year time frame, his success rate stands at 60%, while his average return per rating is 8.9%.

Why’s Mr. Rangan so bullish? He’s a fan of the firm’s move into profitability and its ability to innovate organically and inorganically through acquisitions. One organic innovation Mr. Rangan highlighted was its real-time customer data platform Genie.

As Salesforce tilts toward AI innovation, I think Mr. Rangan is right in that many analysts may need to re-rate CRM stock higher.

The Bottom Line on Salesforce Stock

Salesforce isn’t a newcomer to the AI race. For those paying attention to the firm, Salesforce has been a big player in AI for quite some time with its Einstein AI technology.

Post-ChatGPT, Salesforce seems to have doubled down. As a result, the firm stands out as one of the more impressive plays in AI software today. The company’s latest quarter was great, with continued margin improvement (non-GAAP operating margins surged to 31.6%, up from last year’s 19.9%), but future quarters have the potential to be magnificent if AI tech manages to hit the spot.