- Gold Price eases from the highest levels in two months on failure to cross short-term key resistance confluence.

- Mixed sentiment, promising US data allow US Dollar to consolidate recent losses around multi-month low.

- Headlines from China, Fed concerns weigh on Treasury bond yields and XAU/USD price.

- Risk catalysts eyed for clear directions amid light calendar.

Gold Price (XAU/USD) remains on the back foot around the intraday low as it reverses from the highest levels in eight weeks amid the US Dollar’s sustained recovery from a 15-month low. Also exerting downside pressure on the XAU/USD price could be the risk headlines from China. It’s worth noting, however, that the downbeat US Treasury bond yields fail to inspire the Gold Price upside as markets await more clues to defend the previous day’s risk-on mood.

That said, the sentiment improved the previous day as the US banks expect more profits from the higher rates while the growing concerns about the Federal Reserve’s (Fed) policy pivot after July’s 0.25% rate increase also favored the mood and propelled the XAU/USD price. However, the upbeat details of the US Retail Sales and expectations that the Fed will keep the rates higher for longer, if not announce many rate lifts, exert downside pressure on the Gold Price of late.

Elsewhere, China Industry Ministry recently conveyed fears of insufficient demand and declining revenues and justifies the downbeat Gross Domestic Product (GDP) data for the second quarter (Q2) that suggested fears of easing economic recovery in the world’s biggest industrial player. Considering China’s status as one of the biggest oil users, downbeat economic concerns about the dragon nation weigh on the commodity price

Looking ahead, the risk catalysts can entertain the XAU/USD traders amid a light calendar and cautious mood ahead of the next week’s Federal Open Market Committee (FOMC) monetary policy meeting.

Also read: Gold Price Forecast: XAU/USD retreat from two-month highs could test key 100 DMA support

Gold Price: Key levels to watch

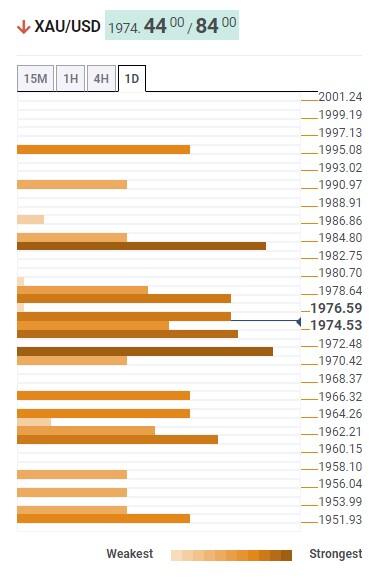

As per our Technical Confluence indicator, the Gold Price edges lower past the $1,985 resistance confluence comprising the previous daily and monthly high.

Also challenging the XAU/USD bulls is the Pivot Point one-week R1, around $1,998, quickly followed by the $2,000 psychological manget.

In a case where the Gold Price remains firmer past $2,000, the odds of witnessing a run-up toward April’s peak of around $2,050 can’t be ruled out.

Meanwhile, Pivot Point one-month R1 highlights $1,970 as immediate support for the bears to watch for confirmation.

Following that, the 5-day SMA, Pivot Point one-month S1 and the middle band of the Bollinger on four-hour chart, around $1,961, can lure the Gold sellers.

It’s worth observing that Fibonacci 23.6% on one-week and one-day, around $1,950 is the last defense of the Gold buyers, a break of which will give control to the XAU/USD bears.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.