The ongoing U.S.–China trade tensions are significantly affecting American corporations. In a recent development, investment and asset management company BlackRock (NYSE:BLK) and finance company MSCI (NYSE:MSCI) are under investigation by a congressional committee. Both companies are being blamed for promoting investments in Chinese companies that are blacklisted by the U.S. for human rights abuses and bolstering Chinese military advancements.

While BLK has denied any wrongdoing, MSCI is “reviewing the inquiry,” Reuters reported.

The U.S.-China trade war has already been taking a toll on chip companies in the U.S. Further, the recent development indicates that additional sectors and corporations could bear the brunt as the trade war escalates.

Against this backdrop, let’s understand what the Street recommends for BLK and MSCI stocks.

Is BlackRock a Buy, Sell, or Hold?

BlackRock stock closed 0.9% lower on August 1. Moreover, the stock is down about 0.4% after-hours. Nonetheless, BLK stock sports a Strong Buy consensus rating based on nine Buy and one Hold recommendations. Further, analysts’ average price target of $817.50 implies 11.64% upside potential.

Just when the analysts are bullish, the insider confidence signal is “Negative” for BLK stock. Its Chairman and CEO, Laurence Fink, recently sold BLK stock worth $15 million. Meanwhile, in the last six months, the stock witnessed 11 informative sell transactions from several insiders, including its senior Managing Directors. Further, insiders sold BLK shares worth $16.5 million in the last three months.

Note that TipRanks offers daily insider transactions as well as a list of the top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Also, it is important to highlight here that insiders selling stocks is not always a bad sign. However, informative trades show insiders’ sentiment and possess a higher predictive ability. Thus, tracking these trades could help investors make sound investment decisions.

What is the Price Target for MSCI Share?

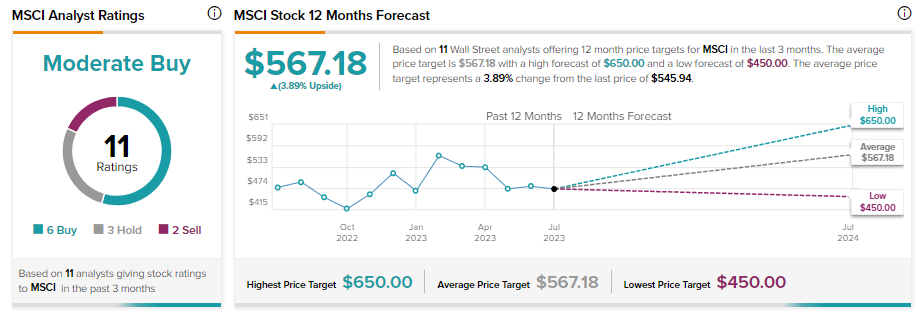

MSCI stock has six Buy, three Hold, and two Sell recommendations for a Moderate Buy consensus rating. Further, analysts’ average price target of $567.18 implies 3.89% upside potential.