Shares of Netflix (NASDAQ: NFLX) gained in morning trading at the time of writing after top-rated JP Morgan analyst Doug Anmuth stated that he believes that the stock could soar higher. NFLX has already surged by more than 35% year-to-date. Anmuth reiterated a Buy rating on the stock and raised the price target to $470 from $380. The analyst’s price target implies an upside potential of 14.8% at current levels.

Anmuth estimates that the streaming giant‘s crackdown on password sharing could generate around $6 billion in additional revenues over the next year and in 2025. Netflix had stated earlier that by its estimates, 100 million households are using the streaming service without paying for it. The company has stated that households would have to pay $7.99 per month to share their passwords.

According to the analyst, the company could monetize 14 million of these non-paying households by the end of this year through its crackdown. Anmuth has projected that the monetization of members could rise to 26 million in 2024 and to 33 million by the end of 2025. As a result, the company could generate revenues of $2.4 billion in 2024 and $3.5 billion in 2025.

Anmuth added that Netflix’s newly-introduced $7 per month, ad-supported tier could be another revenue growth driver for the company. The analyst commented, “The recent launch of Netflix’s ad-supported tier, as well as the broader paid sharing launch, should further help re-accelerate subscriber and revenue growth while driving high-margin incremental revenue.”

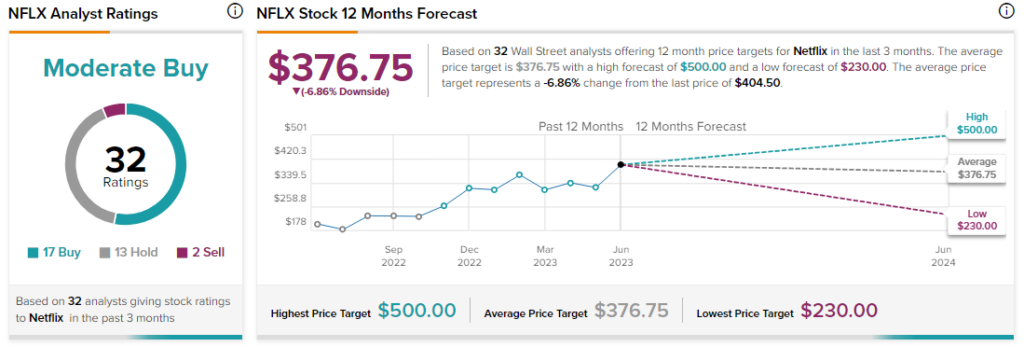

Analysts are cautiously optimistic about NFLX stock with a Moderate Buy consensus rating based on 17 Buys, 13 Holds, and two Sells.