shaunl

Public Service Enterprise Group Incorporated (NYSE:PEG) is the largest regulated electric and natural gas utility in the highly-populated state of New Jersey. The utility sector is generally a good place to be right now, as concerns surrounding the near-term future of the American economy persist, with things such as the political fight over the debt ceiling, persistently high inflation, and deteriorating measures of economic performance hanging over the economy.

The reason for the appeal of utilities like Public Service Enterprise Group is because of the characteristics that have long made them favorites of retirees and other conservative investors. These characteristics include inherent stability in any economic climate and generally higher yields than anything else in the market. Indeed, Public Service Enterprise Group yields 3.75% at the current stock price, which is substantially higher than the market as a whole. Unfortunately, the stock looks to be significantly overvalued today, which will handicap its forward returns.

About Public Service Enterprise Group

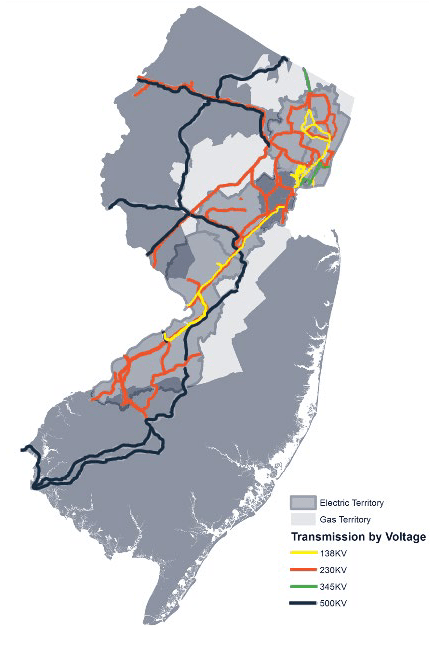

As mentioned in the introduction, Public Service Enterprise Group is the largest regulated electric and natural gas utility in the highly populated state of New Jersey. The company's service territory includes most of the state:

Public Service Enterprise Group

We can see that its electric service territory is much larger than its natural gas territory, so we can probably assume that its electric utility service has substantially more customers. This is not really the case though, as the company has 2.4 electric utility customers and 1.9 million gas utility customers. These counts are not mutually exclusive and the company does have some customers receiving both services from it. There will no doubt be some readers that wish the company's weighting was much more in favor of electricity, due to the widespread perception that natural gas is an obsolete fuel that will soon fall into disuse. I have discussed in various previous articles that this is highly unlikely to occur in the near-term, due mostly to the unreliability of renewable energy sources and the fact that natural gas is much more efficient than electricity as a heat source.

For my part, I can appreciate the fact that Public Service Enterprise Group's business is reasonably balanced between electricity and natural gas. This is because each of these businesses has a degree of seasonality to it. As I have pointed out in numerous previous articles, natural gas is much more heavily consumed during the winter than at other times of the year. This is the reason that most pure-play natural gas utilities enjoy substantially higher revenues during the September to March period than they do during other times of the year. Electricity, meanwhile, has year-round consumption, but consumption is higher during the summer as people run air conditioners in order to keep their homes and businesses cool. Air conditioners require a lot of electricity to operate, which causes electric bills and electric utility revenue to spike during the summer months. The fact that Public Service Enterprise Group has both of these businesses in reasonably balanced proportions should help the company avoid some of the seasonal fluctuations in cash flow that it would see with a much less balanced electric and natural gas portfolio.

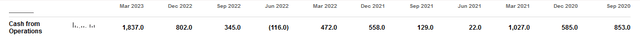

With that said, Public Service Enterprise Group does occasionally see a significant increase in its operating cash flow during the winter months. We can see this here:

As we can see, the company saw pretty large quarterly increases in its operating cash flow during both the first quarter of 2023 and the first quarter of 2021. Otherwise, though, the company's operating cash flow lacks any real discernable pattern, but in most cases, the second and third quarters are its weakest. The fact that the company is purchasing natural gas to put in storage for the winter months may account for some of this.

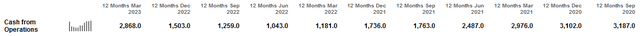

We can see much more stability in the company's financial performance when we look at its cash flows on a rolling twelve-month basis. Here are its operating cash flows over each of the past eleven such periods:

This is still more volatility than we usually see with a regulated utility, but it is much more stable from period to period than the company's quarterly numbers exhibited.

The biggest reason for this overall stability is that Public Service Enterprise Group provides a product that most people consider to be a necessity for modern life. After all, how many people do not have electricity or heating in their homes and businesses? As such, they will typically prioritize paying their utility bills ahead of other discretionary expenses when money gets tight. This is something that could be especially important should a recession hit in the near future, which many analysts and economists are predicting based on weakening economic indicators. Indeed, the market itself is predicting a recession in the second half of the year that will cause the Federal Reserve to cut rates. That is the reason for the current market strength.

I personally doubt that the Federal Reserve will actually cut rates even if a recession hits though, since that would easily result in stagflation. Due to this overall uncertainty, it would be a good idea to include a recession-resistant company like Public Service Enterprise Group in your portfolio, since it will keep performing regardless of what happens in the economy. After all, nobody wants to have their electricity or natural gas shut off, especially since a recession usually results in people spending more time and home and going out less often.

Growth Prospects

As investors, we are naturally interested in much more than mere stability. After all, we like a company in which we are invested to grow and prosper over time. Fortunately, Public Service Enterprise Group is positioned to deliver some growth to its investors.

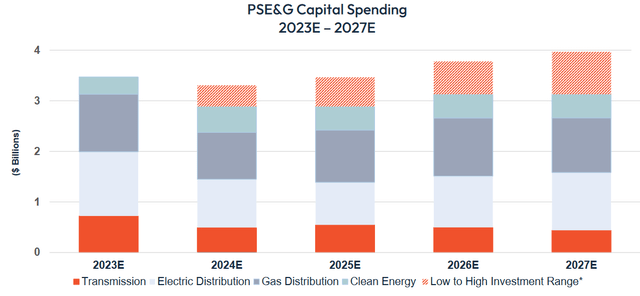

The primary way through which the company will accomplish its growth is by increasing its rate base. The rate base is the value of the company's assets upon which its regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the rate base will increase the amount that the company can charge its customers in order to earn that specified rate of return. The usual way through which a company will grow its rate base is by upgrading, modernizing, or possibly even expanding its utility-grade infrastructure. Public Service Enterprise Group is planning to do exactly this, and has budgeted $15.5 billion to $18 billion over the 2023 to 2027 period for that task:

Public Service Enterprise Group

That is, admittedly, a pretty wide range that the company has budgeted. It may be attempting to give itself some leeway in case some of its growth projects go over budget, but that is not something that we like to see with a private company. There is also the possibility that the company is preparing for the possibility that New Jersey's government will accelerate or alter its carbon-reduction goals, which will force the company to spend significant sums to comply with them. This is also not something that we would like, but regime risk is a risk that we are always exposed to as investors. The company may also just be allowing itself some budgetary flexibility in case it wishes to add a few new projects during the horizon, which is understandable and acceptable.

The company has stated that this capital spending program will grow its rate base at a 6% to 7.5% compound annual growth rate over the period. That should allow it to grow its earnings per share at a 5% to 7% compound annual growth rate over the period. The reason why earnings growth is lower than the rate base growth is because of the costs that the company will incur in financing its growth program. When we combine this projected earnings per share growth with the current 3.75% dividend yield, Public Service Enterprise Group should be able to deliver a 9% to 11% total average annual return. That is in line with most of its peers and is a pretty reasonable total return for a utility.

Financial Considerations

It is always important to review the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is normally accomplished by issuing new debt and using the proceeds to repay the existing debt. This can cause a company's interest expenses to go up following the rollover in certain market conditions. That is something that is especially important today as interest rates are currently at the highest levels that we have seen in more than fifteen years. In addition to this risk, a company needs to make regular payments on its debt if it is to remain solvent. As such, an event that causes a company's cash flow to decline could push it into financial distress if it has too much debt. Although utilities like Public Service Enterprise Group tend to have remarkably stable revenues and cash flows over time, bankruptcies have occurred in the sector so this is still a risk that we should not ignore.

One metric that we can use to evaluate a company's debt level is its net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company's equity can cover its debt obligations in the event of bankruptcy or liquidation, which is arguably more important.

As of March 31, 2023, Public Service Enterprise Group had a net debt of $19.179 billion compared to $14.726 billion in shareholders' equity. This gives the company a net debt-to-equity ratio of 1.30 today. Here is how that compares to some of the company's peers:

| Company | Net Debt-to-Equity |

| Public Service Enterprise Group | 1.30 |

| Eversource Energy (ES) | 1.49 |

| Entergy Corporation (ETR) | 1.91 |

| CMS Energy (CMS) | 1.82 |

| FirstEnergy Corporation (FE) | 2.10 |

These are the same peers that were used the last time that we discussed Public Service Enterprise Group to allow for a more meaningful comparison. As we can clearly see, Public Service Enterprise Group has substantially decreased its leverage over the past quarter and is now much less reliant on debt to fund its operations than any of its peers. This is a positive sign that clearly indicates that the company is not overly reliant on debt to fund its operations. As such, investors should not have to worry too much about Public Service Enterprise Group's debt load.

Dividend Analysis

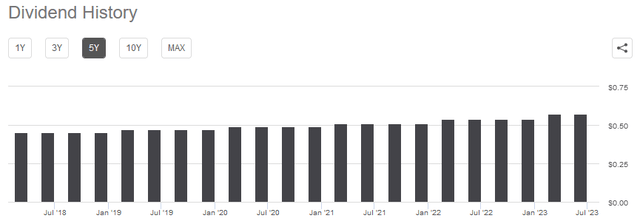

One of the biggest reasons why investors purchase shares of utility companies like Public Service Enterprise Group is that they typically have higher yields than most other things in the market. Public Service Enterprise Group, for its part, is no exception to this as its 3.75% current yield is substantially above the 1.57% current yield of the S&P 500 Index (SP500). It is also above the 2.57% yield of the U.S. Utilities Index (IDU), which is also appealing. As is the case with many utilities, Public Service Enterprise Group has a long history of raising its dividend on an annual basis:

This is particularly attractive in inflationary environments, such as the one that we are in today. This is because inflation is constantly reducing the number of goods and services that can be purchased with the dividend that the company pays out. This can make it feel as though an investor is getting poorer and poorer with the passage of time. The fact that Public Service Enterprise Group increases its dividend every year helps to offset this effect and maintains the purchasing power of the dividend over the long term.

However, it is still important that we analyze the company's ability to maintain its dividend. After all, we do not want to be the victims of a dividend cut that will reduce our incomes and almost certainly cause the company's stock price to decline.

The usual way that we judge a company's ability to maintain its dividend is by looking at its free cash flow. Free cash flow is the amount of cash that was generated by a company's ordinary operations and is left over after it pays all of its bills and makes all necessary capital expenditures. This is therefore the amount that can be used for purposes such as repaying debt, buying back stock, or paying a dividend. Over the twelve-month period that ended on March 31, 2023, Public Service Enterprise Group had a negative levered free cash flow of $426.0 million. That is obviously not enough to pay any dividends, but the company still paid out $1.092 billion during the period. This may be concerning at first glance as the company is clearly failing to cover its dividend out of free cash flow.

However, it is not uncommon for a utility to finance its capital expenditures through the issuance of debt and equity. The company will then use its operating cash flow to cover the dividend. This is because the high costs of constructing and maintaining a utility-grade infrastructure network over a wide geographic area would otherwise make it impossible for a utility to ever pay a dividend to its shareholders, and nobody would purchase the stock of these companies in such a scenario. In the trailing twelve-month period that ended on March 31, 2023, Public Service Enterprise Group had an operating cash flow of $2.868 billion. That was easily enough to cover the $1.092 billion in dividends with a significant amount of money left over for other purposes. Overall, Public Service Enterprise Group should be able to sustain its dividend at the current price.

Valuation

It is always critical that we do not overpay for any assets in our portfolios. This is because overpaying for an asset is a surefire way to earn a suboptimal return on that asset. In the case of a utility like Public Service Enterprise Group, we can value it by looking at the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company's forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa. However, there are very few stocks that have such an attractive valuation in today's hot market.

That is especially true in the utility sector, which tends to be fairly low-growth. As such, the best way to use this ratio is to compare Public Service Enterprise Group to its peers and determine which stock has the most attractive relative valuation.

According to Zacks Investment Research, Public Service Enterprise Group will grow its earnings per share at a 4.33% rate over the next three to five years. This seems a bit low based on the company's rate base growth, which we discussed earlier in the article. Nevertheless, this earnings growth gives the stock a price-to-earnings growth ratio of 4.08 at the current price. Here is how that compares to some of the company's peers:

| Company | PEG Ratio |

| Public Service Enterprise Group | 4.08 |

| Eversource Energy | 2.60 |

| Entergy Corporation | 2.61 |

| CMS Energy | 2.49 |

| FirstEnergy Corporation | 2.34 |

As we can clearly see, Public Service Enterprise Group looks incredibly expensive relative to its peers. However, this is using Zacks' estimate of its forward earnings per share growth rate. The company itself is projecting a 5% to 7% earnings per share growth, which would make its price-to-earnings growth ratio 2.52 in the best-case scenario. That is certainly much more in line with its peer group. However, the middle of that range gives it a 2.94 ratio, which looks expensive and is more likely than the best-case 7% growth rate. This stock looks expensive to me and it may be best to wait for it to drop a bit in price before buying in. Fortunately, we may get a near-term catalyst for a stock market drop when the debt ceiling talks conclude and the U.S. Treasury refills its accounts by sucking a lot of money out of the market.

Conclusion

In conclusion, Public Service Enterprise Group is the largest utility in New Jersey and the fact that it supplies both natural gas and electricity to its customers could give it certain advantages. The company should be quite recession-resistant, which is appealing in today's uncertain economy. When we combine this with a fairly high dividend yield and a strong balance sheet, the company appears to have a lot to offer. Unfortunately, Public Service Enterprise Group Incorporated also looks to be a bit expensive today, so it would be a good idea to wait for the price to come down before buying in.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!