According to new economic data released by the US Labor Department, jobless claims fell 26,000 to 239,000 in the week ending June 24, as cooling labor conditions portend job stability.

The four-week moving average for unemployment benefits remained fairly high at 257,500.

Four-Week Moving Average Neutralizes Volatility

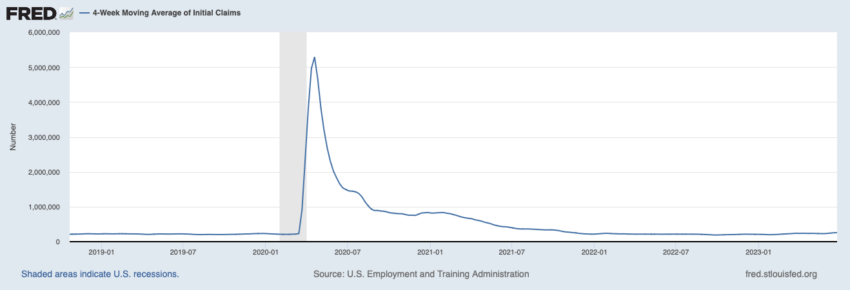

The US Labor Department reports claims weekly to reveal the number of new people applying for unemployment benefits. However, this number can be very volatile. Hence, market participants often see the four-week average as a truer reflection of the US job market.

The moving average for June reflects an uptrend in jobless claims, meaning more people are losing their jobs. June claims rose from 237,500 on June 3 to 247,250 a week later. Last week, the Labor Department reported 256,000 new claims.

Benefit applications reached a record of 30 million during the COVID-19 pandemic between mid-March and the end of April 2020.

At a forum sponsored by the European Central Bank, Federal Reserve Chair Jerome Powell said that if sustained, cooling labor markets caused by rising interest rates could eventually result in fewer job losses. He also advocated tighter bank supervision to limit systemic risks.

Bank Stocks Surge on Stronger Economic Data

Jobless claims alone do not affect US markets unless seen in the context of other economic data.

Adjusted US gross domestic product for Q1 saw the US economy grow 2% instead of contracting amid rising interest rates. This positive data, together with banks passing the Federal Reserve’s recent stress test, saw stocks of JPMorgan, Bank of America, and Wells Fargo rise more than 3% in early US trading Thursday.

Read here about the recent US banking crisis.

After the jobless claims, Bitcoin (BTC) was relatively unchanged, down 0.4% to $30,613 on an hourly basis. Ethereum (ETH) also fell, albeit by 0.2% more than Bitcoin, to $1,859.

Bitcoin’s rally over the last two weeks was driven by optimism surrounding spot ETF filings made by major Wall Street firms. Last week, the asset breached $31,000.

Got something to say about US jobless claims or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.