The recent performance of American Electric Power Co Inc (AEP, Financial) in the stock market has shown a daily loss of 3.45%, and a 3-month decline of 7.5%. Despite these dips, the company boasts an Earnings Per Share (EPS) of 4.35. This raises the question: Is AEP modestly undervalued? To address this query, we will delve into a valuation analysis that aims to provide investors with clarity on whether the stock's current market position reflects its true worth. Continue reading for an in-depth evaluation of American Electric Power Co's intrinsic value and market potential.

Company Introduction

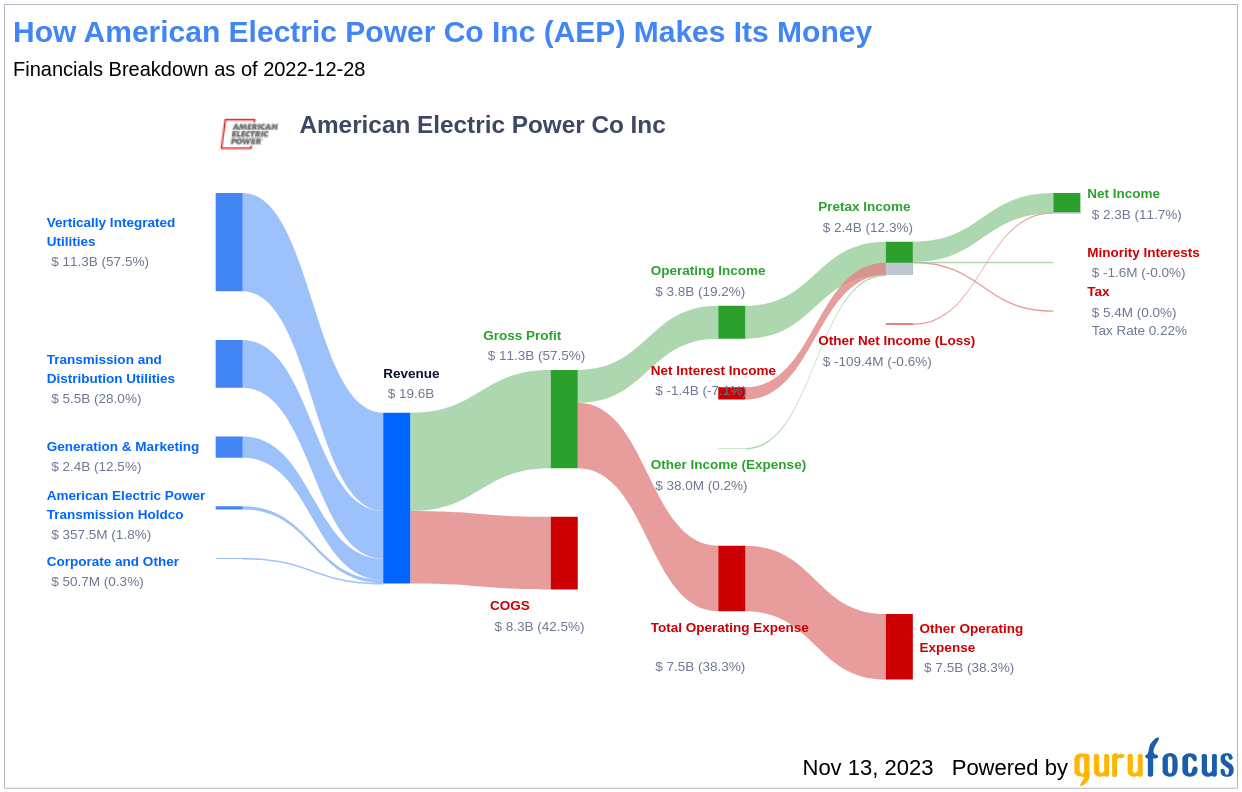

American Electric Power Co Inc (AEP, Financial) is a major player in the regulated utilities sector in the United States, serving over 5 million customers across 11 states. The company's diverse energy mix includes 41% coal, 27% natural gas, 23% renewable energy and hydro, 7% nuclear, and 2% demand response. With a vertically integrated structure, AEP supports its earnings through utilities, transmission and distribution, and generation and marketing operations. When comparing the current stock price of $75.02 to the GF Value of $101.43, a measure of fair value, it becomes evident that a closer examination of the company's valuation is warranted.

Summarizing GF Value

The GF Value is a proprietary metric that calculates the intrinsic value of a stock based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line indicates the fair market value at which AEP should be trading. If the stock price significantly surpasses this line, it may be overvalued, suggesting a potentially lower future return. Conversely, a price well below the GF Value Line could indicate an undervalued stock with a brighter return outlook.

At the current price of $75.02 per share and a market cap of $39.50 billion, American Electric Power Co Inc appears to be modestly undervalued. This assessment suggests that the long-term return on AEP's stock could outpace its business growth, presenting a potentially attractive investment opportunity.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength Analysis

Investing in companies with robust financial strength is crucial to minimize the risk of capital loss. American Electric Power Co's financial strength, with a cash-to-debt ratio of 0.01, is weaker than 96.09% of its peers in the Utilities - Regulated industry. This low ratio suggests that the company's ability to manage its debt is not as strong as many of its competitors. With an overall financial strength rating of 3 out of 10, the financial health of American Electric Power Co warrants careful consideration by potential investors.

Profitability and Growth Prospects

Profitability is a key indicator of a company's financial stability and long-term viability. American Electric Power Co has maintained profitability for the past decade, with an operating margin of 19.33%, ranking it higher than 69.03% of its industry counterparts. This indicates a relatively strong competitive position and efficient operations. Additionally, the company's growth trajectory is also a vital factor in its valuation. American Electric Power Co's average annual revenue growth rate stands at 6.8%, and its 3-year average EBITDA growth rate is 6.6%, reflecting a solid performance in the Utilities - Regulated industry.

ROIC vs. WACC

The comparison between a company's Return on Invested Capital (ROIC) and its Weighted Average Cost of Capital (WACC) offers insight into its value creation efficiency. American Electric Power Co's ROIC of 3.92 is currently lower than its WACC of 6.01, suggesting that the company is not generating adequate returns on its capital investments relative to the cost of financing those investments. This is an important consideration for potential investors assessing the company's profitability and market valuation.

Conclusion

In conclusion, American Electric Power Co Inc (AEP, Financial) appears to be modestly undervalued based on the GF Value assessment. Despite the company's financial condition being less than ideal, its fair profitability and growth rates above industry averages suggest that AEP could offer a worthwhile investment opportunity. For a deeper understanding of American Electric Power Co's financials and potential, prospective investors are encouraged to review its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns with lower risk, explore the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.