Amid global economic challenges, it’s no surprise that the EV sector has fallen on hard times. In particular, China’s automotive giant NIO (NYSE:NIO) has especially struggled for traction due to its home market’s broader woes. Still, with everyone else desperately treading water, the company’s situation may not be as dire as previously thought. Specifically, NIO’s strategic positioning and brand strength make it a compelling contender in the pure-play EV sector. It’s a high-risk, high-reward idea. Therefore, I am pivoting to a bullish outlook for NIO stock.

Starting with the Risks — The EV Sector Still Stinks

Before diving into the optimistic argument for NIO stock, it must be stated that the industry faces many challenges ahead. Essentially, the Chinese EV manufacturer is in a knife fight. It can potentially win, but winning, in this case, doesn’t mean getting out of the conflict without a scratch. It’s going to suffer a laceration or two.

Of course, one of the biggest challenges facing the sector is the EV price war. Started by Tesla (NASDAQ:TSLA) in a bid to disrupt the competition and simultaneously boost sales, the action started a snowball effect. On paper, Tesla should be able to knock out several competitors, but it has come at a great cost. Since the start of the year, TSLA stock has fallen 27%.

Another factor to consider is the rise of the hybrid vehicle. During the EV meltdown, legacy automotive giant Toyota (NYSE:TM) took full advantage of the situation. Its sales of hybrids – which combine the utility of combustion-powered vehicles with the efficiency of EVs – have skyrocketed.

Here, it’s not just about a competitor stealing away prospective customers. Rather, it’s that those customers are unlikely to buy another vehicle for the next three to five years, if not longer. So, you’re still taking a big risk with NIO stock.

Brand Power and Presence Could Boost NIO

Not too long ago, I wrote a bearish article about NIO stock. As it turned out, it was the right call since shares fell from $5.54 to a closing low of $3.80. However, the company has since stormed back, warranting a rethink.

One of the issues that I had with NIO was the threat of commoditization. Compared to the complexity involved with combustion-powered vehicles, EVs are easy to manufacture. Fundamentally, there’s not much that distinguishes one EV from another. Therefore, companies that can provide the lowest-priced models can potentially win out in the end.

However, with the protracted price war and tough economic environment, all EV players find themselves in the same boat. Winning then comes down to standing on the least-damaged side of the vessel. That may well describe NIO stock.

First, NIO enjoys a brand advantage. Prior to the price war erupting, NIO quickly established itself as a premium label. Not only that, but the name is so much easier to remember and sounds universally appealing. A company like XPeng (NYSE:XPEV), on the other hand, is comparatively clunky and foreign sounding.

Second, NIO is converting its brand advantage into a global presence. It has expanded into multiple markets, including several European nations. And that’s where the advantage of a universally appealing, three-letter corporate name may shine through.

It’s true that NIO doesn’t generate net income. That’s long been a challenge for pure-play EV manufacturers not named Tesla. However, by expanding the playing field with a brand that has a legitimate shot at broader adoption, NIO could eventually lay the foundation for profitability.

Finally, as a Chinese company, it’s going to be difficult for a U.S. or Western-based upstart EV enterprise to offer robust competition. Simply put, Chinese labor – while rising in wages – is still vastly cheaper than American or Western labor.

So, should the EV sector continue its war of attrition, Tesla will likely win. However, NIO could sneak in at second place, which would be huge for NIO stock.

NIO Stock Could be Undervalued

Last month, NIO stock soared due to encouraging delivery numbers. For March 2024, the company delivered 11,866 vehicles, representing a 14.3% year-over-year increase. This stat provides credibility for analysts’ Fiscal 2024 revenue target of $9.09 billion.

At the moment, NIO stock trades hands at 1.23x trailing-year revenue. In contrast, the average price-to-sales multiple for the auto manufacturing industry stands at 1.37x. Assuming a share count of 1.72 million, NIO is trading at 1.05x projected 2024 sales.

It’s still a risky idea, and there are broader concerns associated with overall demand. However, NIO may be one of the best houses in the worst block. That just might be enough for speculators to take a shot.

Is NIO Stock a Buy, According to Analysts?

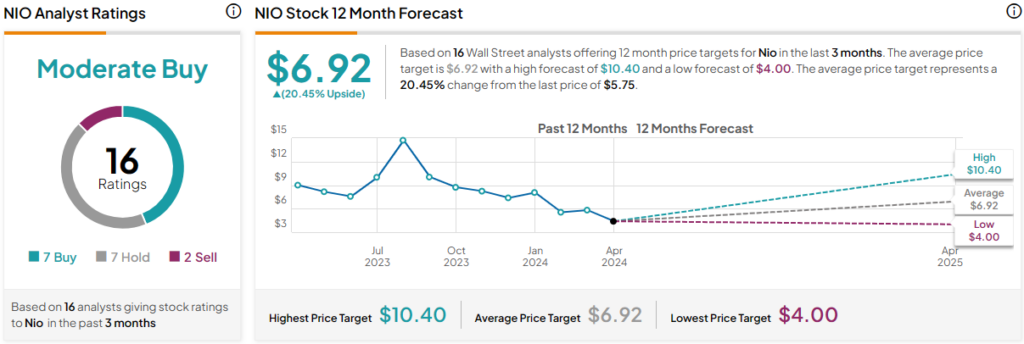

Turning to Wall Street, NIO stock has a Moderate Buy consensus rating based on seven Buys, seven Holds, and two Sell ratings. The average NIO stock price target is $6.92, implying 20.45% upside potential.

The Takeaway: NIO Stock Isn’t the Best, But It’s Far from the Worst

When running away from a literal bear attack, it’s not that the fastest runner wins. Rather, it’s critical that you’re not the slowest person in the pack. Similarly, NIO may not be the top pure-play EV manufacturer, but its strong brand and ability to leverage relatively low-cost Chinese labor give it a competitive edge. In turn, NIO stock could be quite a deal for the risk-tolerant speculator.