MercadoLibre stock (NASDAQ:MELI) released its Q1 results last week, demonstrating sustained hypergrowth momentum. Latin America’s e-commerce and fintech behemoth continues to grow its revenues and earnings at exceptional rates that far exceed those of its North American peers. The company’s free cash flow has also started to snowball, thanks to economies of scale and softer capital expenditure needs. This supports its seemingly rich valuation and is the reason I remain a very bullish investor on MELI stock.

Kicking Off FY2024 on a High Note

MercadoLibre kicked off FY2024 on a high note, posting impressive revenue and earnings growth. This surge was fueled by sustained momentum in the company’s e-commerce and fintech divisions, which continue to benefit from the Latin American market’s growing adoption within these industries.

More specifically, net revenues increased by 36% (or 94% on a constant-currency basis). This is an almost unbelievable growth rate. It massively exceeds the growth rates of MercadoLibre’s North American e-commerce and fintech peers and builds upon over two decades of remarkable growth. In fact, the lack of a noteworthy slowdown impresses me every single time. Let’s take a deeper look at the two business segments — E-Commerce and Fintech — that drove this consolidated result.

The E-Commerce Business Keeps Thriving

MercadoLibre’s E-Commerce business continued to thrive, riding the wave of growing online shopping adoption across Latin American markets. Its gross merchandise volume (GMV) surged by 20%, or 79% on a constant-currency basis, to $11.4 billion.

The significant increase in GMV was powered by strong performance, primarily in Brazil and Mexico—the company’s largest markets. Both countries achieved FX-neutral GMV growth year-over-year, continuing the strong momentum shown in Q4. See the image below.

MercadoLibre sold 385 million items in Q1, 25% more (76 million items) than last year. Notably, in Brazil, the company sold 32% more items year-over-year, scoring the fastest growth pace since Q4 of 2021, when e-commerce skyrocketed following the pandemic-induced work-from-home economy. This was true for Chile, too, which also posted its fastest growth rate since Q4 of 2021.

The Fintech Business Is Accelerating

While MercadoLibre is commonly dubbed the “Amazon (NASDAQ:AMZN) of Latin America” due to its primary E-Commerce business, it’s worth noting that the company has a flourishing Fintech arm, an aspect often overlooked by many investors. Impressively, MercadoLibre’s Fintech arm is showing strong signs of acceleration.

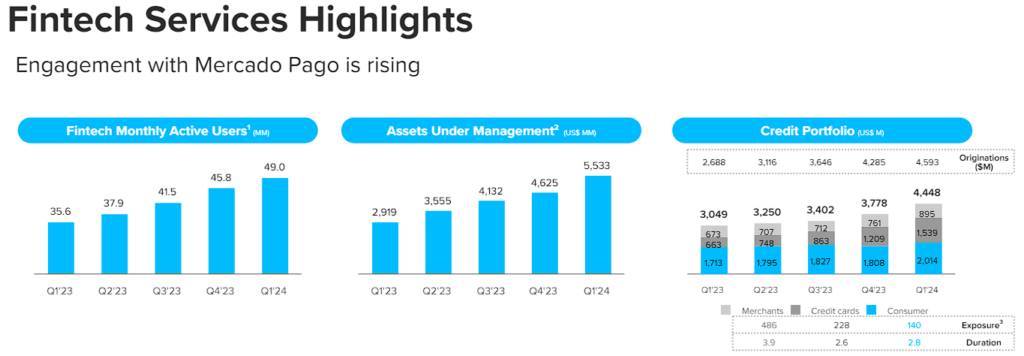

In particular, its Fintech monthly active users growth accelerated to 38% year-over-year. The company saw strong growth across all countries, with Brazil, again, growing ahead of the average (see its growth trend below). Assertive momentum was also seen in Argentina, backed by the value proposition Mercado Pago offers Argentinians in a highly inflationary environment.

Furthermore, with financial literacy among the Latin American populace continuing to rise, there has been a notable uptick in their inclination toward investment. This is evident in MercadoLibre’s notable surge in its assets under management. Impressively, AUM growth accelerated to 90% year-over-year, reaching $5.53 billion, while AUM in Brazil and Mexico more than doubled during this period.

Finally, the company’s credit portfolio expanded by 46% compared to last year. This is despite the credit portfolio in Argentina falling by 43% during this period due to the devaluation of the Argentine Peso. The credit card portfolio also displayed vigorous growth, up 132% year-over-year, with strong contributions both from Brazil and Mexico.

Free Cash Flow Surges, Justifies Its Valuation

MercadoLibre’s operating cash flow has soared due to its thriving results across both business segments. Meanwhile, as the company matures over time, its CapEx as a percentage of revenues is gradually declining, coming in at just 3.4% in Q1. Consequently, MercadoLibre’s free cash flow continues to skyrocket quarter after quarter—a trend that I believe justifies the stock’s seemingly rich valuation.

Following MercadoLibre’s Q1 results, the company’s trailing-12-months (TTM) free cash flow reached a record $5.23 billion. It’s also 44% higher than last year’s equivalent period free cash flow, charting a phenomenal growth trajectory. At just 15.8 times its LTM free cash flow, combined with such steep growth rates (including acceleration in some sub-divisions), MELI stock continues to appear attractively priced, in my view.

Is MELI Stock a Buy, According to Analysts?

Regarding Wall Street’s sentiment on the stock, MercadoLibre has gathered a Strong Buy consensus rating based on 11 Buys and one Hold assigned in the past three months. At $1,884.09, the average MercadoLibre stock forecast implies 13.9% upside potential.

If you’re unsure which analyst you should follow if you want to buy and sell MELI stock, the most profitable analyst covering the stock (on a one-year timeframe) is Deepak Mathivanan from Wolfe Research, with an average return of 48.61% per rating and an 86% success rate. Click on the image below to learn more.

The Takeaway

To sum my thoughts up, MercadoLibre’s Q1 performance sets a promising tone for FY2024. Undoubtedly, the company showcases remarkable growth across both its E-Commerce and Fintech divisions, underlining its continued dominance in the region.

With solid growth in GMV and accelerating metrics in Fintech services, soaring free cash flow, and overall momentum, the stock’s valuation finds justification. For this reason, I remain heavily invested and rather bullish on MELI stock, anticipating further value creation in the coming quarters.