Philip Morris (NYSE:PM) shares are trending marginally lower today after the tobacco and smoke-free products major delivered a mixed third-quarter performance. Despite a nearly 14% jump, its revenue of $9.14 billion fell short of expectations by $80 million. However, the firm’s EPS of $1.67 comfortably beat estimates by $0.06.

While combustible product sales remained resilient, IQOS and ZYN delivered robust growth. Importantly, net revenue from smoke-free products surged by 35.6% over the prior year to $3.3 billion, indicating that the company’s focus on a smoke-free future is paying off. Further, the total number of IQOS users rose to 27.4 million, and the shipment volume of ZYN nicotine pouches rose by 65.7% to 105.4 million cans in the U.S.

Buoyed by this performance, PM raised its adjusted EPS expectations for the full year to a range of $6.58 to $6.61. In addition, net revenue is anticipated to rise by nearly 8% on an organic basis.

Is PM a Good Stock to Buy?

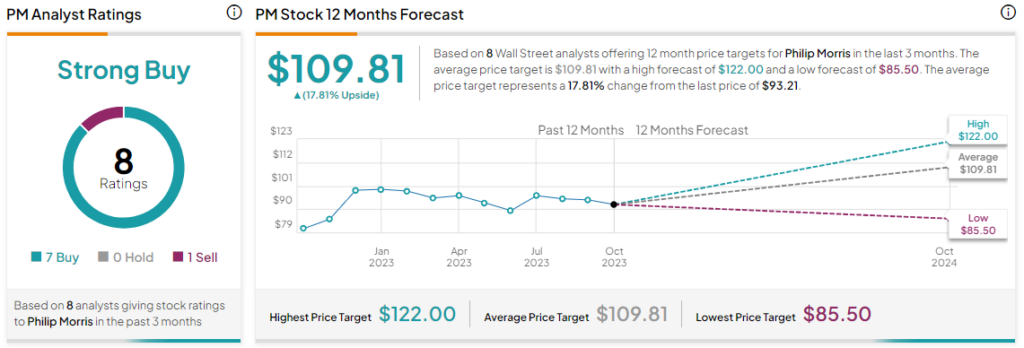

Overall, the Street has a Strong Buy consensus rating on Philip Morris. The average PM price target of $109.81 implies a nearly 18% potential upside. That’s on top of a nearly 8% gain in the share price over the past year.

Read full Disclosure