Cash Crunch Strikes Vornado? Considers Selling Manhattan's Farley Building Amid CRE Turmoil

In April, Vornado Realty Trust, an office, retail, and residential building owner, suspended its dividend and authorized a stock buyback while shares plunged to levels not seen since 1996. The billionaire head of Vornado in May warned the company was "going to take a breath" in the redevelopment around Manhattan's Penn Station amid CRE turmoil. Now reports suggest Vornado is exploring options to sell a massive office building to raise cash.

Bloomberg spoke with people familiar with Vornado's move to "explore options" for the Farley Building, an iconic civic building that features 740,000 square feet of office and 120,000 square feet of retail. Sources said Vornado could sell the building or mortgage the asset to "shore up liquidity during a commercial-property downturn."

They said the billionaire head of Vornado, Steven Roth, has contacted Newmark Group Inc.'s co-heads of US capital markets, Adam Spies and Douglas Harmon, to review the best strategic options. They added discussions are still ongoing.

What's alarming is that Roth said the Farley Building is "arguably one of the best buildings of its type and kind in the city." He then noted: The Farley Building "could be an important source of liquidity."

This leaves us to believe that Vornado might be experiencing liquidity issues after it has been battered by high borrowing costs and falling office tower prices.

"The Manhattan-based company has been active in selling assets in a bid to boost liquidity. Earlier this year, the firm announced deals to offload four retail properties in Manhattan and the Armory Show," Bloomberg said.

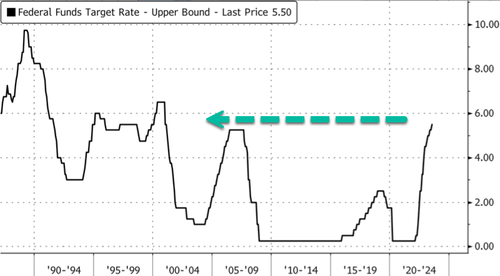

CRE pains come as the Federal Reserve has aggressively hiked interest rates to 22-year highs.

Vornado shares crashed below GFC levels.

And the overall office REIT space is at GFC crash levels.

Remember last month, Starwood Capital Group's Barry Sternlicht warned CRE is in a "Category 5 hurricane." And John Fish, who heads construction firm Suffolk, chair of the Real Estate Roundtable think tank, and former chairman of the board of the Federal Reserve Bank of Boston, warned in a recent What Goes Up podcast: "Nobody understands where the bottom is" for CRE markets.