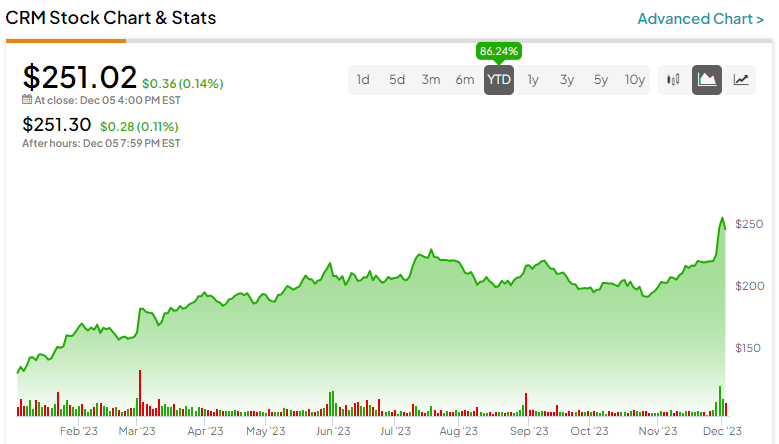

Following a rough stretch throughout last year due to monetary policy and economic concerns, the broader cloud-computing software industry faced viability concerns. However, the latest earnings results from Salesforce (NYSE:CRM) – which specializes in customer relationship management (CRM) software and applications – suggest that a sector pivot may be materializing. Out of respect for the convincing print, I am bullish on CRM stock.

CRM Stock Pops Higher on Better-Than-Expected Q3 Results

Despite progress on multiple fronts, concerns about an economic slowdown or even a recession have not fully faded. With headwinds impacting China and a weak macro environment in Europe, it’s only natural to have some hesitation in equities. However, Salesforce’s latest earnings report powered through these obstacles, suggesting the existence of an air pocket in cloud computing. Thus, CRM stock warrants further investigation.

For starters, Salesforce posted earnings per share of $2.11 during the third quarter of Fiscal Year 2024. This figure beat the consensus estimate, which called for EPS of $2.06. On the top line, the software specialist’s sales jumped 11.2% on a year-over-year basis to $8.72 billion, in line with analysts’ expectations.

Notably, management revealed that growth in the quarter stemmed mostly from order volume rather than inflation. That’s a significant point because it reflects that Salesforce’s enterprise-level clients are willing to pay for the underlying product plus the inflation “premium.” Stated differently, these clients refused the opportunity to list inflation as an excuse to stop working with Salesforce. In this ecosystem, that’s a huge win for CRM stock.

Even better, the software firm stated that it witnessed a notable demand surge during the recently concluded Cyber Week. Again, companies prefer to do business with Salesforce. Fundamentally, this dynamic may indicate that CRM stock will benefit from pricing power.

Looking ahead, management expected Q4 2024 revenue to land between $9.18 billion and $9.23 billion. For the full year, the company anticipates sales to total between $34.75 billion and $34.8 billion.

Economic Woes May Surprisingly Help Salesforce

From late 2021 through early 2022, the economy suffered a harsh reality check. Though easy money arguably helped keep the U.S. machinery running during the worst of the COVID-19 crisis, the bill had to be picked up. Subsequently, the spike in inflation followed by high interest rates panicked investors out of CRM stock and its ilk. Having time to digest the news, a pivot may be in order.

Mainly, an understanding may exist that economic woes may help Salesforce, thus bolstering its market value. To be sure, no one wants to endure a broad slowdown, let alone a recession. However, financial pressures force entities into survival mode. For Salesforce, that meant layoffs.

Still, late last year, I was skeptical about the company’s workforce-cutting directive. Long story short, CRM stock doesn’t represent an investment in making widgets. The underlying CRM business is a complex endeavor requiring significant expertise. However, as the latest Q3 print revealed, Salesforce executed its cuts while simultaneously delivering in-demand products.

Most importantly, the underlying CRM business is essential for companies building relationships with their customers and developing marketing initiatives to expand their footprint. True, economic woes hurt on many levels. However, this desperation fuels the best enterprises to do what’s necessary for customer retention.

Indeed, consultancy firm Grand View Research pointed out that the global CRM market size reached a valuation of $58.82 billion last year. Experts project that the sector will expand at a compound annual growth rate (CAGR) of 13.9% from 2023 to 2030. At the forecast culmination, sector revenue should hit $163.16 billion.

In other words, CRM will likely be vital to foster a recovery across multiple industries.

Pricing Power May Trump Valuation Concerns

Although CRM stock represents one of the top securities mentioned on Wall Street, that also comes at a cost. Currently, shares trade at 98.86x trailing-year earnings. That’s well above the software application sector’s average multiple of 45.8x.

However, the deciding factor for CRM stock may come down to pricing power. In the latest Q3 report, Salesforce’s gross profit margin hit 75.29%. That’s conspicuously above the year-ago quarter’s gross margin of 73.36%. It’s also an encouraging sign that no matter what’s going on with the economy (within reason), enterprises remain committed to Salesforce.

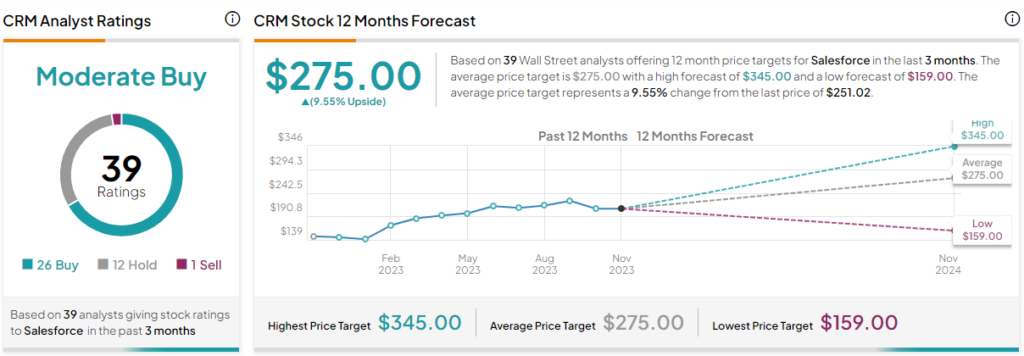

Is CRM Stock a Buy, According to Analysts?

Turning to Wall Street, CRM stock has a Moderate Buy consensus rating based on 25 Buys, 12 Holds, and one Sell rating. The average CRM stock price target is $273.00, implying 9.55% upside potential.

The Takeaway: CRM Stock is on a Credible Comeback Rally

Unsurprisingly, Salesforce’s robust Q3 earnings print emboldened sentiment in CRM stock. However, it’s not just about the financial performance. Rather, enterprises may be realizing the importance of the business to stay competitive, representing a pivot in thinking from last year. And with clients willingly paying for Salesforce despite inflationary pressures, the stock is well worth keeping on your radar.