Jeremy Poland

There has been a lot of news about the Guyana partnership that Hess Corporation (NYSE:HES) is involved in. Much of it has been flat-out scary. But scary news sells, and a lot of news organizations need sales. The fact is that Guyana likely has the upper hand in this dispute. As previous articles have noted and referenced, Guyana has Brazil as an ally. Brazil is already at the border. The United States has a presence, and now Great Britain has delivered a warship. Against this, Venezuela has deployed a whole 5,000 soldiers. This will not be a contest, as Venezuela has no friends and the government is unpopular with its own people. Instead, it is far more likely that any drop in the price of Hess common stock is likely a reason to invest in Chevron Corporation (CVX) stock at a discount.

This is before the fact that, from all accounts, Venezuela is broke. Therefore, all of this posturing is likely to try and bolster a very unpopular figure ahead of the elections that are due. Most tyrants need money to make their rule work. But Maduro has completely destroyed the source of income that Venezuela enjoyed for a very long time. There is no indication that he would run the Guyana oil discoveries any better than he has in his own country. That is still another reason for all these countries to line up behind Guyana.

It is actually very possible that the Maduro government is on the verge of collapse. Therefore, all this posturing could be the last gasp attempt to hang onto power before chaos ensues. Everything points to a situation that favors investors and not Venezuela.

It has only been a couple of weeks since both sides decided not to use force in a border dispute. Exxon Mobil (XOM) had long had a position that it will take some years for this to settle. Before they invested $1, investors can bet that this whole situation was thoroughly reviewed.

Chevron Conflict Of Interest

There has been a whole lot of discussion about the fact that Chevron is importing about 100,000 BOD from Venezuela. This is a cost recovery situation for Chevron and a chance to repay a debt for Venezuela. As such, Venezuela has a debt reduction but no cash income for the government. Therefore, in terms of financing a potential war, this is not the source, as the government has no more cash after the deal than before it.

Chevron is recovering a debt. However, investors can bet that debt was long ago considered a poor-quality debt (to say the least). No matter the accounting, the chances of getting it back were probably looked at as slim to none prior to the deal. Therefore, it is very likely that should the deal grind to a halt due to Venezuela's actions, Chevron would likely call it "found money" and also call it a day while waiting for another opportunity to repay that debt (if it ever happens).

Any other way of looking at the situation would be far more speculative. Investors can "bet" that Chevron management is taking this deal one day at a time.

Guyana Partnership

The Guyana Partnership is proceeding as if nothing is happening. The latest FPSO began production.

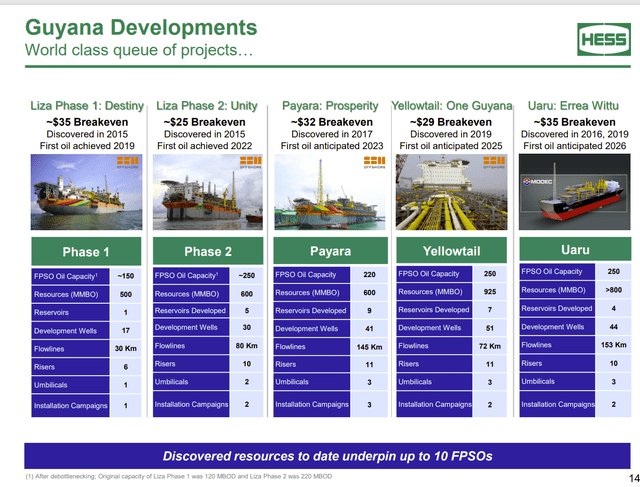

Hess Corporation Presentation Of FPSO Projects And Their Status (Hess Corporation Corporate Presentation September 2023)

The third project, Payara, has now begun production. Every single company that is involved (or will be involved) in the Guyana Partnership has other partnerships that bid on still more leases. There is still a lot of room for upside potential as more exploration is done and more development is completed to result in production as indicated.

The big advantage of offshore is that this business is harder for a country like Venezuela to gain control of that business. It is going to be very easy to escrow the earnings. One of the things that works against a war is that Venezuela has no way of gaining control of the "money." For a government as broke as Venezuela is reported to be, there is no advantage of spending money on a war when there is nothing to be gained. The only thing that would happen is the government would become more isolated (if that is even possible).

Should the impossible happen, it is very likely that Maduro has learned from his own mistakes and would allow the reasonable operation of this offshore business at a fair profit to the partners that are there.

Suriname

The other consideration is that Hess has interests in Suriname. Those interests happen to lie near where both Total (TTE) has announced a discovery and now another Exxon Mobil partnership has likewise announced a discovery. Suriname is now getting to the point where cash flow in the future is becoming more likely very quickly.

Clearly, with three FPSOs operating, the Guyana partnership is currently far more valuable. But it likely will not take long for more discoveries to make the Suriname partnerships significantly important. More importantly, there are no active disputes in Suriname at the current time.

Gulf of Mexico And North Dakota

Hess also has valuable assets in both the Gulf of Mexico and North Dakota. Long-time readers may remember that Hess sold significant amounts of Gulf of Mexico production interests to raise money to fund the Guyana partnership. Hess still has sizable interests in the Gulf of Mexico. Both of these assets have a cash flow valuation for existing businesses, plus decent prospects that have further upside.

Conclusion

The Guyana partnership would have never "gotten off the ground" if the partners thought for one minute that Venezuela had a chance in this situation. There is always a chance that the small chance unfavorable outcome could happen. But right now, that small chance is getting smaller as a lot of big players are lining up on the side of Guyana.

It also should be mentioned that the Chevron deal with Venezuela probably is the first opening in a long time for that country to export oil in this hemisphere. That provides a future possibility of some badly needed cash for the country. This is a country that used to export up to millions of barrels of oil per day. The current is a small amount of the past because the current government and the past one did not know how to run the business. Instead, the governments took the cash and just ran the business one day at a time.

While this sad state of affairs could have been avoided, at this point that is "water over the dam." Investors are probably better off thinking that Hess is a cheap way to invest in Chevron because the deal will likely be complete. The Guyana business is very likely to survive this "saber-rattling" adventure. Once all the bluster is over with, there is a very sound offshore business that will likely grow in value well into the future.

More importantly, Chevron picks up a lot of assets besides Guyana that could, in and of themselves, make the transaction worth the effort. Chevron has a darn good deal in acquiring Hess Corporation. That will not change, despite all the headlines.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.