- Gold Price remains below the key resistance confluence despite the corrective bounce, eyes third weekly loss.

- Indecision about major central banks’ next moves, China woes keep XAU/USD rebond in check.

- Expectations of easing inflation pressure in US allowed Fed to tease policy pivot and favored Gold Price recovery.

- Additional signals of easing US price pressure, FOMC Minutes eyed for clear directions.

Gold Price (XAU/USD) licks its wounds at the lowest level in a month, snapping a four-day downtrend as markets reassess previous fears of higher interest rates and geopolitical concerns about China. Also allowing the XAU/USD to lick its wounds at the multi-day low is the US Dollar’s failure to defend late Thursday’s corrective bounce, as well as dicey US Treasury bond yields.

The Unimpressive US inflation data allowed the Fed policymakers to cheer the victory over price pressure while Reserve Bank of Australia (RBA) Governor Philip Lowe defends the latest pause in the monetary policy by citing fears of higher unemployment. Further, the latest Reuters polls about the Reserve Bank of New Zealand (RBNZ) and the European Central Bank (ECB) were also in favor of marking no interest rate changes in the next monetary policy meetings.

Elsewhere, the Chinese policymakers’ sustained defense of the Yuan also favors the market’s confidence that the Asian leader will overcome the economic fears, which in turn underpinned the latest cautious optimism and Gold Price.

It’s worth noting, that the light calendar and cautious mood ahead of the US PPI, the Michigan Consumer Sentiment Index also tests the Gold buyers ahead of the next week’s Federal Open Market Committee (FOMC) monetary policy meeting minutes.

Also read: Gold Price Forecast: XAU/USD could correct before targeting key 200 DMA support

Gold Price: Key levels to watch

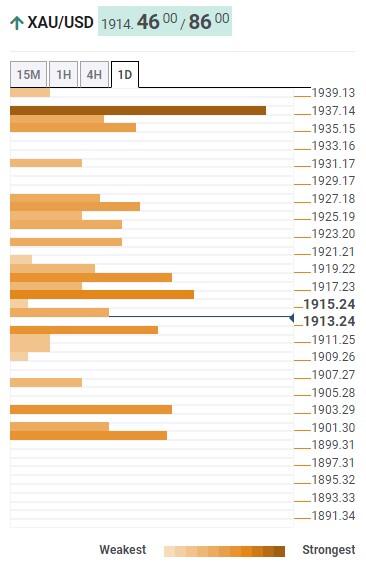

As per our Technical Confluence indicator, the Gold Price remains well below the $1,939 resistance confluence comprising Pivot Point one-day R2, Fibonacci 23.6% on one-week and 10-DMA. The same joins the market’s cautious mood to challenge the XAU/USD rebound ahead of the mid-tier US data and events.

That said, Pivot Point one-month S1 and Fibonacci 23.6% on one-day restrict immediate upside of the Gold Price near $1,918. Following that, the Fibonacci 38.2% level will also limit the XAU/USD recovery near $1,920.

It’s worth noting that the convergence of the previously weekly low and the 5-DMA, close to $1,928, also restricts the Gold Price upside.

On the flip side, the lower band of the Bollinger on one-day, around $1,910, restricts the immediate downside of the XAU/USD.

In a case where the Gold sellers break the $1,910 support, the previous monthly low around $1,905 will test the XAU/USD bears before directing them to the $1,900 support confluence including the 200-SMA, Pivot Point one-day and one-week S2.

It should be observed that the XAU/USD may witness a clear fall towards June’s low of near $1,893 on breaking $1,900 key support.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD recovers toward 1.0850 as risk mood improves

EUR/USD gains traction and rises toward 1.0850 on Friday. The improvement seen in risk mood makes it difficult for the US Dollar (USD) to preserve its strength and helps the pair erase a portion of its weekly losses.

GBP/USD stabilizes above 1.2700 after downbeat UK Retail Sales-led dip

GBP/USD staged a rebound and stabilized above 1.2700 after dropping to a weekly low below 1.2680 in the early European session in response to the disappointing UK Retail Sales data. The USD struggles to find demand on upbeat risk mood and allows the pair to hold its ground.

Gold rebounds to $2,340 area, stays deep in red for the week

Gold fell nearly 4% in the previous two trading days and touched its weakest level in two weeks below $2,330 on Thursday. As US Treasury bond yields stabilize on Friday, XAU/USD stages a correction toward $2,340 but remains on track to post large weekly losses.

Dogecoin inspiration Kabosu dies, leaving legacy of $22.86 billion market cap meme coin behind

Kabosu, the popular Shiba Inu dog that inspired the logo of the largest meme coin by market capitalization, Dogecoin (DOGE), died early on Friday after losing her fight to leukemia and liver disease.

Week ahead – US PCE inflation and Eurozone CPI data enter the spotlight

Dollar traders lock gaze on core PCE index. Eurozone CPIs in focus as June cut looms. Tokyo CPIs may complicate BoJ’s policy plans. Aussie awaits Australian CPIs and Chinese PMIs.