Going against the grain has been a hallmark of Cathie Wood’s investing style. Her singular focus on game changers, innovators, and growth has rewarded her handsomely at times, but when the market has turned against those themes, that game plan has proved less fruitful.

Nevertheless, while the market is regularly subjected to shifts in sentiment, the one thing that hasn’t wavered is Wood’s conviction in her strategy. That has been always the case even if at times some of her predictions might come across as outlandish. For instance, back in September, Wood doubled down on her 2027 $2,000 price target for Tesla (NASDAQ:TSLA) shares. “Our confidence in autonomous has gone up, so you can conclude what you want with that,” Wood, offering a strident tone, said at the time.

Considering the shares have pulled back by ~31% since then and that the figure factors in a more than tenfold gain from current levels, is that a laughable take? Maybe, but it’s worth remembering that when in 2018 Wood predicted TSLA shares would reach $4,000, delivering similar sized gains, the forecast was greeted with derision. Three years later, Wood’s goal was met (when adjusted for the five-for-one split that occurred in 2020).

So, it’s hardly surprising to learn that with Tesla currently getting the bear treatment from all and sundry, Wood has been out shopping for TSLA stock. She bought 503,091 TSLA shares in March through her ARKK, ARKW, and ARKQ funds. Her ARK Invest’s total TSLA holdings now stand at 4.88 million shares, worth $855 million, and accounting for ~6.50% of ARK’s holdings.

So, Wood evidently remains bullish. However, with Tesla about to announce the quarter’s delivery haul, one Street analyst takes an entirely different stance. Wells Fargo’s Colin Langan sees “downside risk to volume as price cuts are having a diminishing impact.”

“We see headwinds from disappointing deliveries & more price cuts, which likely drive negative EPS revisions,” the analyst went on to say. “We expect volumes to be flat in 2024 & down in 2025. In the wake of px cuts are lower lease residuals, disgruntled customers & the possible loss of the luxury brand premium.”

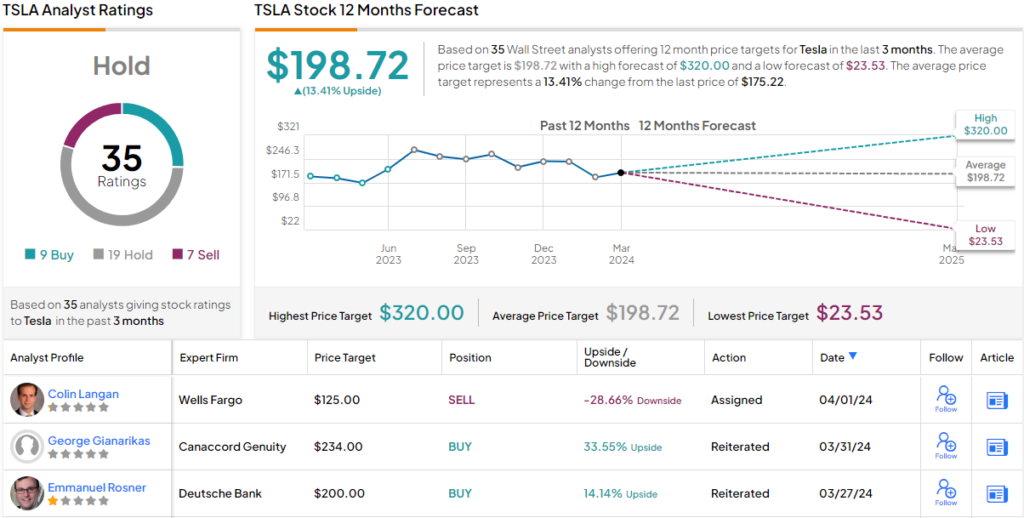

While Wood’s actions cry Buy, Langan tells investors to Sell, and his $125 price target factors in a further decline of 29% from current levels. (To watch Langan’s track record, click here)

Overall, 6 other analysts join Langan in the bear camp with additional Sell ratings, 8 others mirror Wood’s positive stance with Buy ratings, yet with an additional 19 Hold (i.e. Neutral) ratings, the analyst consensus rates the stock a Hold. At $198.72, the average target implies shares will gain ~13% over the next year. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.