PepsiCo stock (NASDAQ:PEP) has underperformed the overall market, recording a 9% decline compared to the S&P 500’s 13% gain in the past year. Despite this, the consumer staples behemoth known for several household brands in the food and beverage space continues to post impressive growth in organic sales and profits. Thus, the stock’s recent dip could present an opportunity for prospective investors, making me bullish on the stock.

Brand Strength Translates to Vigorous Organic Growth

Examining PepsiCo’s recent results, a clean trend emerges: the company is able to consistently achieve robust organic growth, propelled by the robust strength of its brand portfolio. With consumer favorites such as Pepsi, Lays, Tropicana, Quaker, and other renowned names driving reliable demand, PepsiCo commands impressive pricing power. In essence, the company adeptly implements price adjustments, effortlessly expanding its top-line revenue while encountering minimal resistance in consumer demand.

In particular, PepsiCo’s Q3 revenues grew by 6.7% year-over-year to $23.5 billion. The company’s growth was driven by organic growth of 8.8%, somewhat counterbalanced by a 2% foreign exchange headwind. PEP’s organic growth was, in turn, driven mainly by 11% higher effective net pricing, offset by a 2.5% decline in volumes. Evidently, PepsiCo exhibits a remarkable ability to implement notable price hikes on its products while experiencing minimal resistance in consumer demand.

I believe this result is particularly impressive, given that inflation has eased substantially in recent months. Thus, seeing PepsiCo continuing to force double-digit price increases might seem a bit extreme. Yet, it shows that its brands are highly inelastic. It’s noteworthy to recall that these price escalations come on the heels of substantial increases during the high inflation period of 2022. This clearly underscores the affinity of consumers for PepsiCo’s household brands.

In the meantime, management expects strong organic growth to persist through Q4, as it reiterated its full-year organic growth estimate of 10%. Strong confidence can be attributed to some of Pepsico’s emerging markets. The Philippines, Turkey, Mexico, Brazil, and Poland each delivered double-digit organic revenue growth in Q3, while China and Chile each delivered mid-single-digit organic growth during the period.

Strong Profits Sustain Strong Capital Returns

Besides strong organic revenue growth, the company’s recent performance can be characterized by strong profit generation, which has, in turn, allowed the company to deploy notable amounts of cash toward capital returns.

In Q3, PepsiCo’s core (adjusted for one-off items) gross margin expanded by 104 basis points. Therefore, adjusted operating margins rose by 82 basis points. The mixture of growth in revenues and a margin expansion led to core EPS growth of 16%, with share repurchasing also contributing to this result.

As core EPS exceeded prior expectations, management raised its FY2023 forecast, estimating that core EPS will land at $7.54 for the year (up from $7.47 previously). It implies an 11% increase (from 10%) versus 2022’s core EPS of $6.79.

With exceptional profitability, PepsiCo returned roughly $7.7 billion, including dividends of $6.7 billion and share repurchases of $1.0 billion. At its current levels, PepsiCo’s dividend yield stands at 2.93%, while repurchases make for another ~0.5% “buyback yield,” forming a very compelling capital returns combo given that the company is growing its earnings in the double-digits.

PepsiCo’s Valuation is Attractive

The fact that PepsiCo’s earnings are growing vigorously against a lagging share price over the past year has resulted in the stock’s valuation hovering at attractive levels, in my view. Specifically, PepsiCo’s updated core EPS forecast for Fiscal 2023 implies that shares are currently trading at a forward P/E of 22.4.

Despite the recent surge in interest rates, which may have prompted a contraction in the valuation multiples of equities, I maintain the view that PepsiCo continues to present an appealing investment opportunity.

The company is currently growing its earnings in the double-digits, possesses a substantial competitive advantage in a market with formidable entry barriers, and boasts an exceptional track record of capital returns, evidenced by 51 consecutive years of dividend increases. Although its current P/E may carry a modest premium compared to the S&P 500’s forward P/E of 18.7, I believe that it’s totally justified.

Is PEP Stock a Buy, According to Analysts?

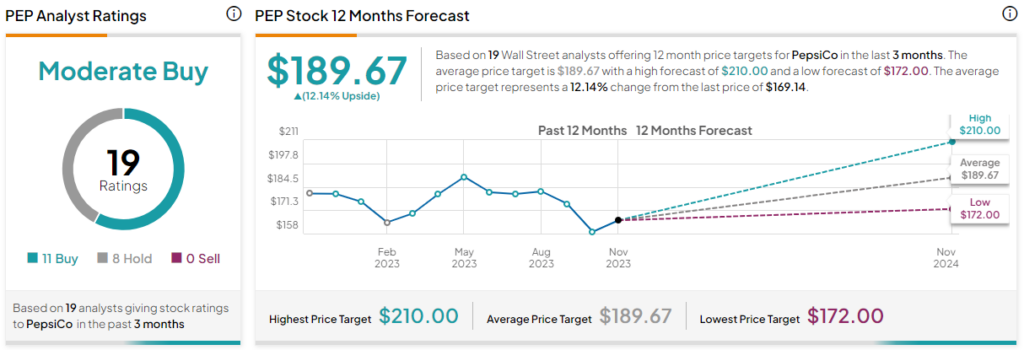

Regarding Wall Street’s view on the stock, PepsiCo has a Moderate Buy consensus rating based on 11 Buys and eight Holds assigned in the past three months. At $189.67, the average PepsiCo price target suggests 12.14% upside potential.

The Takeaway

In summary, while PepsiCo’s stock has recently lagged, its resilient brand strength continues to fuel impressive organic growth and pricing power. In the meantime, strong profits drive significant capital returns. This performance, combined with PepsiCo’s overall qualities and remarkable focus on returning cash to shareholders, makes me believe the stock’s current valuation is attractive.

Accordingly, I believe that PepsiCo’s underperformance against the overall market could present a fruitful opportunity for investors.