It was bad enough for streaming giant Netflix (NASDAQ:NFLX) when Bank of America pulled it from its “US 1” list in order to put Spotify (NASDAQ:SPOT) up in its place. However, insult followed injury as Wedbush did something similar. And that, coupled with the earlier blows and a dubious new trailer reveal, sent Netflix shares down over 2.5% in the closing minutes of Wednesday’s trading.

Wedbush pulled Netflix from its Best Ideas List, basically believing that growth in any serious capacity is off the table for the streaming giant. It had already seen a “year of significant growth,” Wedbush analysts said. However, don’t interpret this as Wedbush turning on Netflix.

Wedbush kept its Outperform rating on Netflix stock and hiked the price target from $615 to $725. It just didn’t think it was a “best idea” anymore. Indeed, Wedbush noted that several of Netflix’s “growth drivers” are already priced in, which will leave Netflix somewhat on the back foot in terms of any future growth.

Not So Good Times

Netflix made another pivot that left some outsiders scratching their heads. They released a trailer for Good Times, the upcoming reboot of the classic 1970s television series. The trailer revealed that the reboot series would be, in fact, animated. Yes, they turned Good Times into a cartoon. This by itself might leave some viewers shaky, but a look at the commentary on the YouTube video of the trailer suggests potential issues. Current estimates from jabrek.net note that the video has 23,710 views, 1,702 likes, and 2,939 dislikes, which isn’t good news for Netflix.

Is Netflix a Buy, Hold, or Sell?

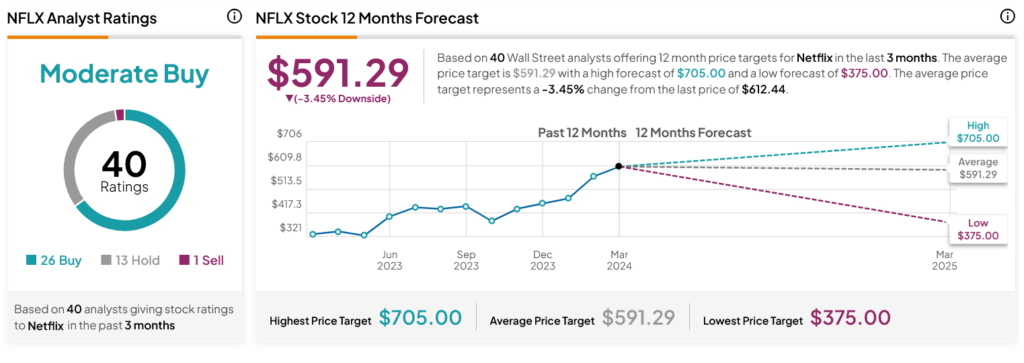

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 26 Buys, 13 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After an 89.16% rally in its share price over the past year, the average NFLX price target of $591.29 per share implies 3.45% downside risk.