US Futures, Global Stocks Rebound Even As Yields Jump

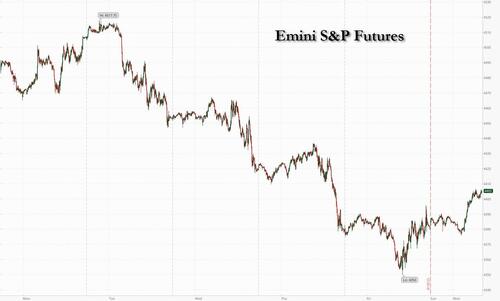

US equity futures and global stocks are solidly higher to start the new week after a bruising August so far for investors, whose attention now turns to the week's Jackson Hole symposium (which last year set off a powerful selloff that sent stocks into a painful bear market). Risk is on despite global bonds broadly weaker, with 10Y TSYs rates rising above the 4.25% level that had acted as strong near-term support. As of 7:45am ET, emini S&P futures were 0.5% higher at 4,405, well above Friday's multi-month lows of 4,350, while Nasdaq futures rose 0.6%. Europe is also solidly in the green, with major markets such as Italy/France/SX5E up more than 1%. Asian stocks were little changed, steadying after six-straight daily losses, even as stocks slumped in Hong Kong and mainland China after Chinese banks made a smaller-than-expected cut to the one-year prime lending rate, confusing markets and traders after last week's unexpected rate cut.

The Bloomberg Dollar Spot Index edged lower, lifting most G10 currencies and helping boost commodities which are seeing all 3 complexes rallying with Ags outperforming. Treasury yields edged higher in quiet trading, with the 10-year rates touching the highest since November 2007. Gold traded near a five-month low just below $1,885, while oil climbed and Bitcoin slid 0.8%. This week’s focus is on Flash PMIs, NVDA earnings, and Jackson Hole. Given low liquidity we may see some outsized moves as technicals/positioning have outsized influence.

In premarket trading, tech megacaps were poised for a relief rally with NVDA earnings this week: NVDA +2% and TSLA +2.8% pre-mkt. Palo Alto Networks Inc. rallied in premarket trading after the cybersecurity company’s billings forecast beat estimates and offset weaker-than-expected fourth-quarter results (peers also rose: CrowdStrike +3.1%, Fortinet +1.6% and SentinelOne +2.9%). Here are some other notable premarket movers:

- Napco Security Technologies fell 34% after the electronic security devices maker said it would have to restate its financial statements for the first three fiscal quarters.

- XPeng’s ADRs gain 6.5% after Bank of America upgraded the Chinese EV maker to buy from neutral on expectation that stronger cost controls and a pact with Volkswagen can enable the company to turn a profit in 2025.

- Kenvue gains 2.01% after Johnson & Johnson said about 23.8% of tendered J&J shares will likely be swapped for Kenvue shares. This so-called preliminary proration rate is closely followed by investors, especially arbitragers who seek to take profit from the split-off event.

- XPeng’s ADRs (XPEV) gain 5.5% after Bank of America upgrades the Chinese EV maker to buy from neutral on expectation that stronger cost controls and a pact with Volkswagen can enable the company to turn a profit in 2025.

The upturn for stocks follows a run of sharp losses, with the S&P 500 down 4.8% this month as investors brace for the potential of interest rates remaining higher for longer. The next clues on the policy outlook will come from this week’s annual gathering of central bankers at Jackson Hole, Wyoming, with Federal Reserve Chairman Jerome Powell due to speak Friday.

Confusion over China’s approach to stemming the nation’s property slump kept the more positive mood in check. Chinese lenders on Monday cut their one-year loan prime rate by 10 basis points and kept the five-year prime loan rates unchanged, even after policymakers called for more lending. Traders had expected a 15-basis-point cut on both rates.

“I do think there is more volatility ahead as the market is not happy with the lack of stimulus in China and especially credit availability for consumers,” said Evgenia Molotova, senior investment manager at Pictet Asset Management. “The narrative in the US is more and more toward a soft-landing. The risk to this is potential inflation resurgence due to strong consumer spending and salary growth.”

When he speaks Friday, Powell is expected to strike “a more balanced tone in Wyoming, hinting at the tightening cycle’s end while underscoring the need to hold rates higher for longer,” according to Anna Wong at Bloomberg Economics. “The Fed have done almost everything they need to do to get inflation down to target and it would surprise me if there was a lot more rate rises to come,” said David Henry, investment manager at Quilter Cheviot.

On the earnings front, the week’s key event is Wednesday’s report from Nvidia, whose blowout revenue forecast last quarter helped ignite this year’s rally in artificial intelligence-linked stocks.

Meanwhile, two of Wall Street’s top strategists are at odds about the outlook for US stocks following as debate rages over whether the economy can avoid a recession. Morgan Stanley’s Michael Wilson — a stalwart equity bear — says sentiment is likely to weaken further if investors are starting to “question the sustainability of the economic resiliency.” But his counterpart at Goldman Sachs Group Inc., David Kostin, says there’s room for investors to further increase exposure if the economy stays on course for a soft landing.

Wilson said stock investors had now become too optimistic about a soft landing, while cooling inflation has crimped Corporate America’s ability to raise prices. Kostin said a recent decline in a Goldman equity sentiment indicator could turn out to be short lived if market conditions continue to improve.

European stocks are on course to snap a four-session losing streak as investors await comments from key central bankers at Jackson Hole later this week. Major markets are higher with Italy/France/SX5E up more than 1%, while the Stoxx 600 is up 0.7% with the energy, health care, consumer products and auto sectors leading gains; higher energy prices buoyed oil producers like TotalEnergies SA and Shell Plc. Italian Banks were among best performers as the gov’t looks to reimburse the windfall tax via a tax credit. Here are the biggest European movers:

- Energy stocks outperform Monday as oil rises for a third day amid signs of market tightening. Natural gas prices also jump as workers serving a key export project in Australia prepare for a strike

- Demant gains as much as 4.5% after being upgraded to overweight from neutral at JPMorgan, with the broker seeing the Danish hearing-aid maker’s strong momentum continuing in 2024

- Indivior rises as much as 3.5% after the drugmaker announced it has reached a settlement in a case alleging the company ran a scheme to extend a monopoly over its addiction treatment Suboxone

- Corbion gains as much as 7.6%, the most in more than seven months, after Berenberg upgrades the Dutch ingredients maker to buy, highlighting its multi-year PE discount to consumer chemicals peers

- Adyen fell as much as 7.8%, extending its decline into a seventh session and hitting its lowest level since April 2020. Citi analyst Pavan Daswani projects further declines after management did little to alleviate investor concerns on competition

Earlier in the session, a key Asian equity gauge was little changed, steadying after six-straight daily losses, as China continued to try and boost its flagging economy and markets. The MSCI Asia Pacific Index swung between a loss of 0.5% and gain of 0.2%. Stocks slumped in Hong Kong and mainland China after Chinese banks made a smaller-than-expected cut to the one-year prime lending rate. Benchmarks climbed in Japan and South Korea.

China’s financial stocks including China Merchants Bank dropped after banks made a smaller-than-expected cut to their benchmark lending rate, a move that is seen to reflect their rising concerns over margin pressure. Orient Overseas plunged after reporting an 80% year-on-year drop in its first-half earnings. Deepening economic concerns over China have coupled with expectations of higher-for-longer rates in the US to dent investor appetite for risk assets like stocks. The MSCI Asian equity measure has fallen nearly 8% so far in August, erasing the previous two months’ gains and paring its gain for the year to a little more than 1%.

- Hang Seng and Shanghai Comp were pressured as China’s recent support efforts, including the PBoC and financial regulators’ meeting with bank executives where they told lenders to boost loans to support the economic recovery, were nullified by a narrower-than-expected cut to the PBoC’s 1-year Loan Prime Rate and the surprise decision to keep the 5-year LPR unchanged which is the reference rate for mortgages.

- Japan's Nikkei 225 was underpinned after Japan announced to raise the minimum hourly wage by the most on record, although the index briefly wobbled in reaction to China’s benchmark rates before returning to session highs.

- ASX 200 was lacklustre with price action contained amid a busy week of earnings and as weakness in financials and defensives offset the gains in energy and tech.

“Sentiment is certainly pretty bad,” Redmond Wong, market strategist for Greater China at Saxo Bank told Bloomberg Television. Highly anticipated big bang stimulus for the Chinese economy is unlikely to arrive, leaving investors “waiting for the mysterious Godot,” he said.

In FX, the Bloomberg Dollar Spot Index is little changed:

- The Japanese yen is the weakest of the G-10 currencies, falling 0.2% versus the greenback.

- The yuan weakened after China’s lenders unexpectedly left a key lending rate that guides mortgages unchanged, a move seen as “puzzling“ after larger cuts by the PBOC last week. Flows are on the low side in the major currencies, with yuan options being active once again, according to three Europe-based traders

- The Aussie fell after Chinese banks made a smaller-than-expected cut to their benchmark lending rate despite the central bank putting pressure on them to boost loans; AUD/USD down as much as 0.2% to 0.6393

In rates, treasuries fell, led by the long end, with US 30-year yields rising 5bps to 4.43%, while two-year yield rose 1bp to 4.95%. US 10-year yields near highs of the day into early US session, trading around 4.30% with bunds lagging by additional 1bp in the sector, gilts outperforming by 3.5bp; long-end-led losses steepen 2s10s, 5s30s spreads by 2bp and 3bp on the day. Gilts are rallying as UK home prices fall that most since summer 2018; high frequency data point to a slowing labor market. Bunds lag slightly while gilts outperform in early London session. Focus this week is on the Jackson Hole economic policy symposium, where Fed Chair Powell is scheduled to speak Friday.

In commodities, crude futures advance, with WTI rising 0.7% to trade near $81.80. European benchmark gas prices soared as much as 18% as traders priced in the possibility of supply disruptions from a potential strike in Australia. Oil rose for a third day as signs the physical market is tightening offset growing demand risks in China and the US. Global benchmark Brent traded above $85 a barrel and is up more than 2% since last Wednesday’s close.

Bitcoin is under modest pressure this morning with newsflow light and the agenda ahead sparse as we look towards the main events at the tail-end of the week. Action which occurs despite modest downside in the USD; though, this hasn't picked up much steam in European hours as the overall risk tone becomes increasingly constructive.

It is a quiet start to the week, with no notable economic news, earnings or Fed speakers scheduled; Fed’s Powell is due to speak at Jackson Hole on Friday at 10:05am, with text release expected

Market Snapshot

- S&P 500 futures up 0.3% to 4,398.00

- MXAP down 0.5% to 156.88

- MXAPJ down 0.7% to 492.65

- Nikkei up 0.4% to 31,565.64

- Topix up 0.2% to 2,241.49

- Hang Seng Index down 1.8% to 17,623.29

- Shanghai Composite down 1.2% to 3,092.98

- Sensex up 0.6% to 65,308.33

- Australia S&P/ASX 200 down 0.5% to 7,115.47

- Kospi up 0.2% to 2,508.80

- STOXX Europe 600 up 0.7% to 451.50

- German 10Y yield little changed at 2.64%

- Euro up 0.1% to $1.0886

- Brent Futures up 0.6% to $85.34/bbl

- Brent Futures up 0.6% to $85.35/bbl

- Gold spot down 0.1% to $1,888.11

- U.S. Dollar Index little changed at 103.37

Top Overnight News

- Chinese banks kept a key interest rate that guides mortgages on hold and made a smaller-than-expected cut to another rate, surprise moves that reflect Beijing’s difficult choice between boosting confidence and safeguarding the banking system’s stability

- The Bank of Japan is purchasing government bonds at a record pace this year, a factor that likely prompted its recent move to allow larger yield movements to reduce the strain on its control of longer-term interest rates

- European natural gas prices jumped as workers serving a key export project in Australia prepare for a strike that could put a significant dent in global supplies in the run-up to winter

- The world’s leading emerging market powers have complained for years about being sidelined by wealthy nations. Now they are mounting their most ambitious challenge yet to the status quo

A more detailed look at global markets courtesy of Newquawk

APAC stocks traded mixed as the disappointment with China’s decision on its Loan Prime Rates overshadowed China’s recent support efforts. ASX 200 was lacklustre with price action contained amid a busy week of earnings and as weakness in financials and defensives offset the gains in energy and tech. Nikkei 225 was underpinned after Japan announced to raise the minimum hourly wage by the most on record, although the index briefly wobbled in reaction to China’s benchmark rates before returning to session highs. Hang Seng and Shanghai Comp were pressured as China’s recent support efforts, including the PBoC and financial regulators’ meeting with bank executives where they told lenders to boost loans to support the economic recovery, were nullified by a narrower-than-expected cut to the PBoC’s 1-year Loan Prime Rate and the surprise decision to keep the 5-year LPR unchanged which is the reference rate for mortgages.

Top Asian News

- PBoC Loan Prime Rate 1Y (Aug) 3.45% vs. Exp. 3.40% (Prev. 3.55%); 5Y (Aug) 4.20% vs. Exp. 4.05% (Prev. 4.20%)

- PBoC and regulators met with bank executives and told lenders to boost loans to support the economic recovery, according to Bloomberg. PBoC said it will better implement prudent monetary policy in a precise and powerful manner, while it will keep credit growth stable and guide smooth credit function, as well as coordinate on resolving local government debt risks and will adjust and optimise credit policies for the property sector, according to Reuters.

- China is to push for the BRICS to become a geopolitical rival to the G7 with leaders from across developing nations to meet this week, according to FT.

- US President Biden is to sign a strategic partnership deal with Vietnam in the latest bid to counter China in the region, according to Politico.

- Singapore PM Lee said during an annual policy address that Singapore is keeping up economically and expects positive growth this year, while he hopes they will avoid a recession and said inflation is coming down but will stay higher than what they are used to. Furthermore, he said there will be financial support for workers who lose jobs and announced a SGD 7bln package for ‘young’ seniors to help with retirement.

- Japan's MOF raises the assumed long-term interest rate to 1.5% in FY24/25 (prev. record low 1.1% in FY23/24), via Kyodo; raises the assumed rate due to rising yields after BoJ policy tweak.

Sentiment has gradually improved since the relatively modest European cash open despite a lack of fundamental developments, Euro Stoxx 50 +1.1%. Sectors are primarily in the green though Real Estate is lagging and resides in the red following updates from Crest Nicholson and the latest Rightmove data. At the other end of the spectrum, Energy outperforms given supply-side risks from Australia and the Gulf of Mexico. Stateside, futures were initially around the unchanged mark but have picked up in tandem with the above action with specifics light as we look towards the Jackson Hole symposium, ES +0.5%.

Top European News

- UK PM Sunak is to spend GBP 100mln of taxpayer money on thousands of high-powered AI chips in an effort to catch up in the race for computing power, according to The Telegraph.

- Italy is reportedly to propose ex-economy minister Franco as their candidate for the ECB executive board in October when Panetta steps down to govern the Bank of Italy, via Reuters citing sources. Contrasts with sources in July that Italy was going to propose Cipollone

- UK Foreign Secretary Cleverly is to visit China at the end of August, via Reuters citing sources.

- Fitch affirmed Netherlands at AAA; Outlook Stable on Friday.

FX

- Dollar drifts in low key start to the week, but DXY holds above 200 DMA within 103.470-270 confines.

- Franc firmer and probing 0.8800 vs Buck as weekly Swiss sight deposits drop, Euro eyes option expiries on either side of 1.0897-70 range and Sterling capped amidst upside in EUR/GBP, with Cable capped between 1.2750-11 bounds and the cross near the top of a 0.8562-34 range.

- Yen undermined by a bounce in US Treasury yields as USD/JPY climbs towards 145.75 from 145.15.

- CNY and CNH were unimpressed with limited PBoC LPR easing, but off lows after major Chinese state banks absorbed offshore Yuan liquidity.

- PBoC set USD/CNY mid-point at 7.1987 vs exp. 7.2893 (prev. 7.2006)

- Turkish Central Bank ended implementation that stipulates a target for conversion from foreign currency deposits to FX-protected deposits and ended securities maintenance and reserve requirement practice based on the Turkish lira share of FX-protected deposits, while it stated that regulations were aimed to increase Turkish lira deposits while decreasing FX-protected deposits.

- China's major state-owned banks were reportedly seen mopping up offshore Yuan liquidity on Monday, via Reuters citing sources.

- Indian Foreign Secretary says BRICS discussing trade in national currencies, and not common currencies.

Fixed Income

- Debt divergent amidst a dearth of data and events.

- Bunds hover near 131.00 after filling the gap within a 131.41-130.97 Eurex range.

- Gilts outperform between 92.20-91.58 parameters after weak UK data and survey releases.

- T-note under par and closer to 101-09 trough than 109-22 peak and curve steeper.

Commodities

- Crude benchmarks are bolstered with multiple supply-side updates in focus, firstly the NHC said the system within the Gulf of Mexico has a high chance of formation.

- WTI October resides around USD 81.10/bbl while its Brent counterpart holds between USD 85.00-85.50/bbl; both of best levels but still firmer on the session.

- Additionally, the complex is perhaps deriving support from Australian LNG (see below), with Dutch TTF surpassing the EUR 40 mark in an initial move, while off best it still posts upside of circa. 6%.

- Unions at Woodside Energy's (WDS AT) North West Shelf offshore gas platforms "unanimously endorsed" giving 7 working days' notice to strike if bargaining claims are not met by Wednesday, according to Reuters.

- The Offshore Alliance, consisting of two key unions, will also finalise a strike vote at Wheatstone and Gorgon LNG ventures (operated by Chevron) by Thursday (August 24th); sources at the two LNG companies, cited by Reuters, believe some form of industrial action is likely in coming weeks.

- Spot gold is little changed and benefitting incrementally from the USD's downside but the overall risk tone keeps the yellow metal ear last week's USD 1886/oz low, while base metals have trimmed from initial best.

Geopolitics

- Ukrainian President Zelensky arrived in the Netherlands for a meeting with Dutch PM Rutte, while it was also reported that Netherlands and Denmark committed to delivering F-16s to Ukraine with the first deliveries due around the new year, according to Reuters.

- Ukraine is nearing a deal with global insurers to cover grain ships, according to FT.

- Russian President Putin met high-ranking military commanders in the southern Russian city of Rostov-on-Don, according to RIA citing a Kremlin statement which did not specify the reason for the meeting.

- Russia conducted a missile strike on Ukraine’s Chernihiv which killed 5 and wounded 37.

- Russian Defence Ministry said anti-aircraft defences prevented an attack on the Belgorod region by two drones and that Russia destroyed a Ukrainian drone in the Moscow region early on Sunday, while Russia briefly halted flights to Moscow’s Vnukovo and Domodedovo airports although all Moscow airports are now operating normally.

- China’s military said it held a joint naval and air combat readiness patrol around Taiwan on Saturday and that this is a serious warning to Taiwan independence separatist forces, while Taiwan’s Defence Ministry said early on Sunday that 25 Chinese air force planes crossed the Taiwan Strait median line during the prior 24 hours, according to Reuters.

- Taiwan’s Presidential Office said China is ignoring their international responsibilities, increasing military threats and undermining regional stability, while it added that transits of Taiwanese leaders should not be an excuse for China to pick quarrels. It was also reported that the US State Department urged China to cease military, diplomatic and economic pressure against Taiwan.

- Russia-China naval drill in the Pacific Ocean has finished, according to Russia’s Defence Ministry cited by Interfax.

- North Korean leader Kim inspected a cruise missile test and navy unit, according to Yonhap.

- South Korean President Yoon said a new chapter of South Korea-US-Japan cooperation opened up after the Camp David summit, while he added the trilateral cooperation will grow stronger as North Korean threats increase and will develop into a strong forum along with AUKUS and the Quad.

- China's Foreign Ministry said after China's dialogue with Iran and Saudi Arabia that both countries have continued to improve relations leading to the formation of a wave of reconciliation in the Middle East, while China appreciates the correct decision made by the Iranian side and will continue to support Middle Eastern countries in exploring the road of development in line with their own national conditions.

- Iran summoned the Swedish and Danish Charges d’affaires over Koran desecration in the two countries, according to IRNA.

US Event Calendar

- Nothing major scheduled

DB's Jim Reid concludes the overnight wrap

For those returning to work after some time away, it’s undoubtedly been a challenging few weeks for global markets after the optimism of the early summer. In aggregate, global bonds have now lost ground for 5 weeks running, and US Treasuries are back in negative YTD territory. At the same time, global equities are now down for 3 weeks running, with last week marking the worst performance for equities since SVB’s collapse in March.

In large part, those moves have been driven by the growing realisation that interest rates are set to remain higher for longer. For instance, as recently as early June, futures were still expecting a rate cut from the Fed by the end of 2023. But they now don’t see a full 25bp cut priced in until the May 2024 meeting. That’s a big shift in just over a couple of months, and alongside the reassessment of the long-term rates outlook, it’s meant that longer-dated government bond yields have hit their highest level in several years.

So far we’ve had a fairly light calendar over the summer, but this week that should change with the Fed’s Jackson Hole Economic Symposium. The overall title this year is “Structural Shifts in the Global Economy”, and Chair Powell’s speech on Friday is simply given the heading “Economic Outlook”. Our US economists don’t expect Powell to send strong signals about the near-term policy path. However, recent years have seen Powell deliver some important longer-term policy messages. In particular, last year saw him deliver a fairly short and direct message on the importance of price stability, which left little doubt as to the Fed’s resolve to return inflation to target.

This year’s conference comes at an interesting moment. On the one hand, nominal and real yields have risen substantially. But some other measures of overall financial conditions are still not particularly tight, and Bloomberg’s index of US financial conditions right now is more accommodative than its historical average. Moreover, the resilient economic data out of the US over recent weeks has helped to bolster the soft-landing case. However, the risk is that with the data coming in so strong, real yields keep pressing higher, which raises the chance that something ends up breaking, as has usually occurred during previous Fed hiking cycles through history.

Apart from Jackson Hole, another important focus this week will be China’s economy. On Sunday, the People’s Bank of China encouraged banks to boost lending to support growth. And this morning, banks have cut the one-year loan prime rate by 10bps to 3.45%. However, Chinese equities have still fallen this morning, since that was smaller than the 15bps cut expected. Furthermore, the 5-year loan prime rate was left unchanged, contrary to the 15bps cut that was expected there too.

Against that background, the Hang Seng (-1.38%) is trading sharply lower this morning, whilst the CSI 300 (-0.52%) and the Shanghai Composite (-0.38%) have also lost ground. However, Japan’s Nikkei (+0.73%) and South Korea’s KOSPI (+0.51%) have both advanced. Meanwhile, US equity futures are pointing slightly higher, with those on the S&P 500 up +0.05%, whilst the 10yr Treasury yield (+2.2bps) is back up again this morning to 4.276%.

Looking forward to the week ahead, there are several other events to look out for. On the data side, the flash PMIs for August are coming out on Wednesday, which will offer an initial indication as to how the major economies have been faring this month. Separately, another important release that day in the US will be the Q1 Quarterly Census of Employment and Wages (QCEW). That provides a benchmark for employment data, so it means we’ll also get some revisions to nonfarm payrolls over previous months. Our US economists have some more details on the release here.

When it comes to earnings, the bulk of this season is over now, so there’s not much left to come out. That said, one remaining highlight will be Nvidia on Wednesday. Readers might recall that their outlook back in late-May was far above expectations thanks to demand for AI processers, and it helped kick off a significant equity rally that continued into June and July. So that’s definitely one to watch out for.

On the rates side, this week’s US Treasury auctions include 20yr Treasuries (Tuesday) and 30yr inflation-protected Treasuries (Wednesday), which will be interesting with yields having risen to multi-year highs. Otherwise from central banks, there are plenty of speakers apart from Fed Chair Powell, including ECB President Lagarde on Friday.

Lastly in the political sphere, there’ll be some more action on the 2024 US Presidential race over the week ahead. In particular, the first Republican primary debate is taking place on Wednesday. But yesterday, former President Trump confirmed that he wouldn’t be doing the debates. President Trump remains the polling frontrunner for the Republican nomination by a substantial margin, and FiveThirtyEight’s average gives him 54.3%, which is well ahead of the next-placed candidate, Florida Governor Ron DeSantis on 14.8%. No other candidate is in double-digits.

Recapping last week now, markets struggled as they grappled with rising risks from the Chinese property sector, as well as strong US data that fanned concerns over persistent inflationary pressures. That triggered a global sell-off across both equities and bonds. For instance, the S&P 500 retreated for a third week in a row, with a -2.11% decline (-0.01% on Friday) that brings its losses for the month to nearly 5%. The NASDAQ similarly declined, slipping -2.59% week-on-week (and -0.20% on Friday). European equities also fell, and the STOXX 600 shed -2.34% (-0.61% on Friday).

With the latest US data speaking to a still-resilient economy, markets priced in interest rates that would remain higher-for longer. Expectations for rate cuts by the Fed in 2024 were pared back, with the anticipated rate for the December 2024 meeting was up by +9.7bps over the week to 4.28%. Off the back of this, US Treasuries sold off, and the 10yr yields was up +10.1bps in weekly terms to 4.255%, hitting their highest level since 2007 on Thursday. However, bonds did manage to recover some of the week’s earlier losses on Friday, with the 10yr yields down -2.2bps on Friday.

Elsewhere, a renewed sell-off in JGBs added to the global pressure on bonds, with the 10yr yield up +5.1bps to 0.63% (-1.1bp Friday). Over in Europe, German bunds did see a rally on Friday, erasing earlier losses, meaning that the 10yr bund yield actually fell -0.3bps week-on-week (and -8.8bps on Friday). Back in the UK, however, gilts significantly underperformed after strong wage growth data on Tuesday. That meant 10yr UK gilt yields rose +14.8bps last week, reaching their highest level since August 2008 before a partial reversal on Friday, when yields fell -7.1bps.

In commodities, oil prices posted a weekly loss after a run of 7 consecutive gains, as China growth concerns dominated. Brent Crude fell back -2.32% (despite a +0.81% rise on Friday) to $84.80/bbl. Lastly, cryptocurrencies were also impacted by the sell-off, with Bitcoin falling –10.78% over the seven days to Sunday, which is its worst weekly performance so far this year.