With a notable daily gain of 4.49% and a three-month gain of 30.86%, United Airlines Holdings Inc (UAL, Financial) presents an intriguing case for investors. The company's Earnings Per Share (EPS) stands at 8.09. Given these figures, one might wonder, is the stock modestly undervalued? This analysis delves into United Airlines Holdings' valuation to provide insights.

Company Overview

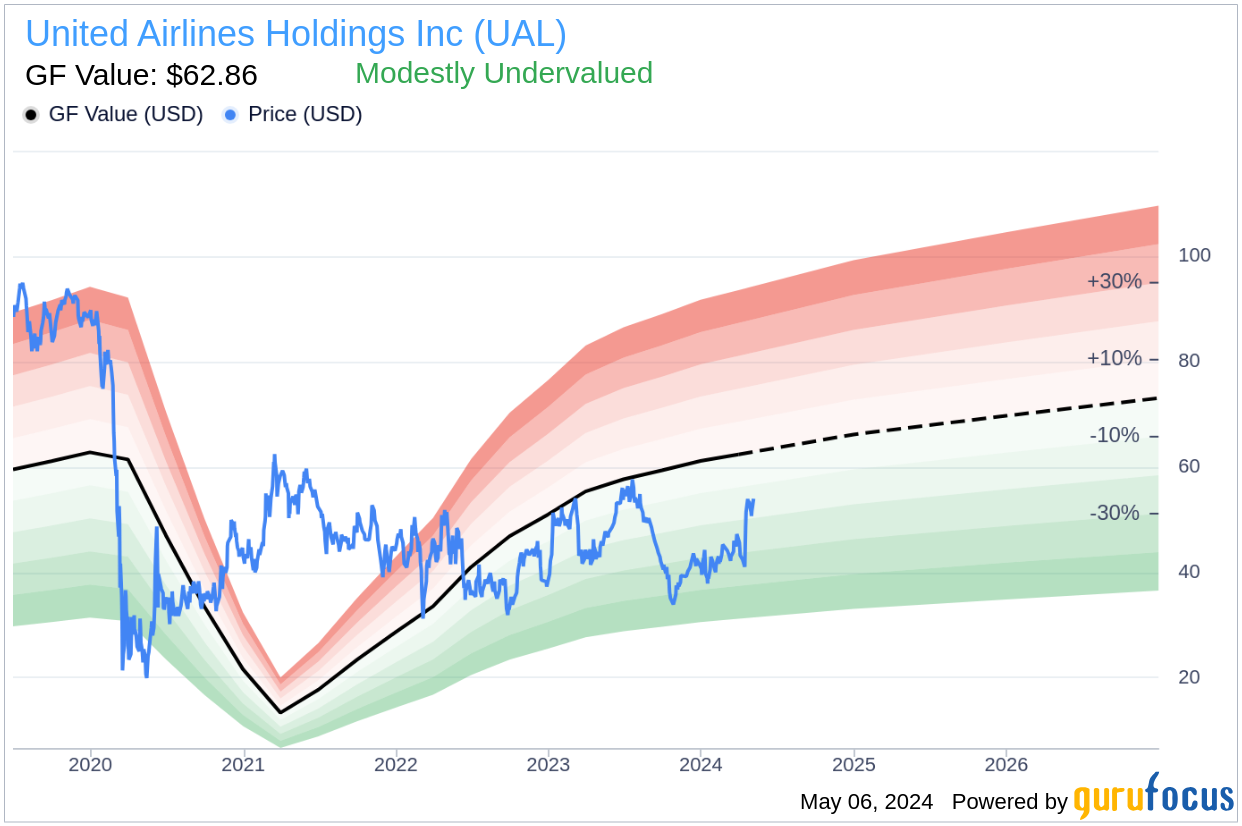

United Airlines Holdings operates a major network with hubs across major US cities, focusing significantly on international and long-haul routes. Comparing the current stock price of $53.95 to the GF Value of $62.86 suggests that the stock might be undervalued. This valuation is crucial as it combines financial data with a comprehensive understanding of the company's operations.

Understanding GF Value

The GF Value is a proprietary measure reflecting the true value of a stock, based on historical trading multiples, an adjustment factor from past performance, and future business performance estimates. For United Airlines Holdings, the GF Value suggests the stock is modestly undervalued. This assessment indicates that the stock's market price is less than its estimated fair value, potentially signaling a good buying opportunity for long-term investors.

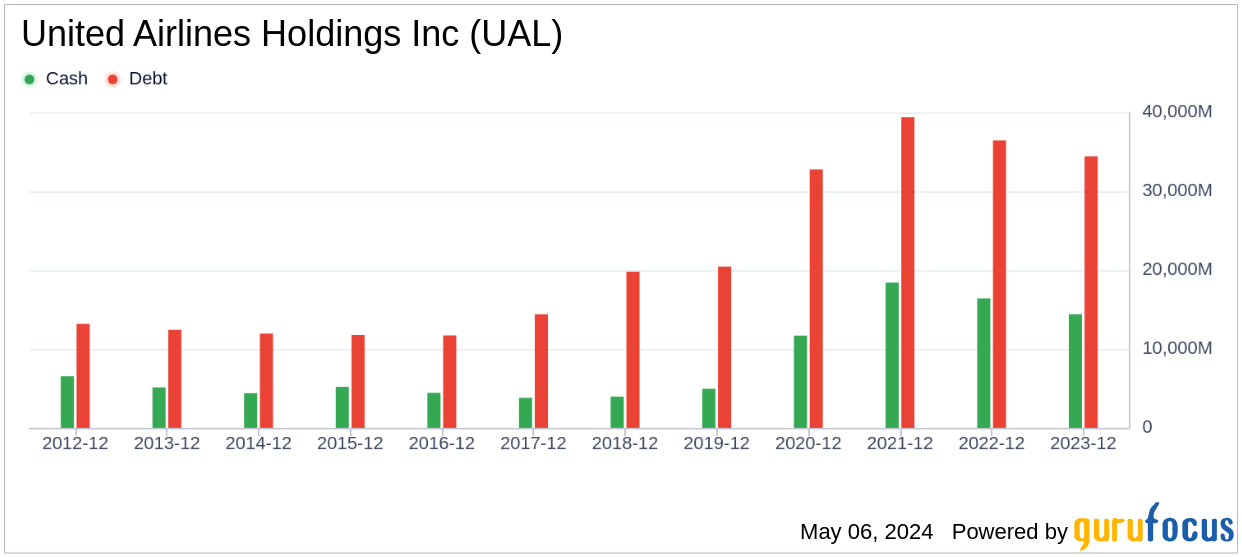

Financial Strength and Stability

Investigating a company's financial strength is vital to understand the risk of potential capital loss. United Airlines Holdings has a cash-to-debt ratio of 0.43, positioning it lower than 53.11% of its industry peers. The overall financial strength rating of 5 out of 10 suggests that United Airlines is in a fair position, though there are areas for improvement.

Profitability and Growth Prospects

United Airlines Holdings has maintained profitability over the last decade, with an operating margin of 9.67%, which ranks well within the industry. However, its 3-year average EBITDA growth rate of 0% is concerning, suggesting stagnation in earnings before interest, taxes, depreciation, and amortization compared to industry peers.

ROIC vs. WACC

An effective way to gauge a company's profitability and value creation is by comparing its Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC). For United Airlines, the ROIC is currently lower than the WACC, indicating that the company may not be generating sufficient returns on its investments.

Conclusion

In summary, United Airlines Holdings (UAL, Financial) appears modestly undervalued based on its current market metrics and GF Value. Although the company shows fair financial health and profitability, its growth and value creation metrics suggest caution. Potential investors should consider both the opportunities and risks associated with United Airlines Holdings. For a deeper dive into its financials, visit the 30-Year Financials here.

To discover other high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.