Zephyr18

Investment Thesis

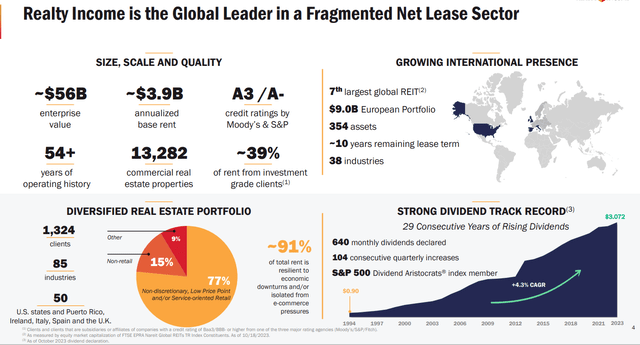

Realty Income Corporation (NYSE:O) is a prominent S&P 500 company and member of the S&P 500 Dividend Aristocrats index, recognized for consistently increasing dividends for over 25 years.

In my opinion, the worst is over for Realty Income: the current and forecast dividend yield points to a continuation of the recovery rally until 2024. My thesis is supported by both a favorable macroeconomic environment, the company's attractive valuation, and business development plans. I suggest not closing out long positions in O stock if you already hold it; if you're just thinking about buying the stock for a long-term portfolio, I don't think it's too late to lock in the yield now.

Why Do I Think So?

Operating as a real estate investment trust, Realty Income Corp. owns or holds interests in over 13,250 properties across the U.S., Puerto Rico, the U.K., Spain, Italy, and Ireland, totaling approximately 262.6 million square feet of leasable space. These properties operate under long-term net lease agreements with commercial clients, contributing to the monthly dividends. As of September 30, 2023, the company's diverse portfolio has a weighted average remaining lease term of ~9.7 years, with an annualized contractual rent of $3.87 billion. Approximately 39.0% of the annualized contractual rent comes from properties leased to investment-grade clients, showcasing the company's stability.

During Q3 FY2023, Realty Income demonstrated financial resilience by investing $2 billion in high-quality acquisitions and raising over $2 billion in long-term and permanent capital. Realty achieved a 2.2% same-store rental revenue growth and a rent recapture rate of 106.9% on re-leased properties. The company's disciplined capital allocation focused on international markets, with ~1/3 of its YTD investments originating from overseas. Despite challenging capital market conditions, Realty Income sustained a 4.1% growth in AFFO per share from the previous year to $1.02 per share, highlighting its commitment to delivering consistent shareholder value creation.

Realty Income's primary REIT niche can be described as net lease retail. This means they focus on acquiring and owning single-tenant properties leased to strong, national-brand retail chains under long-term, contractual lease agreements.

The company ended Q3 in a solid financial position with $4.5 billion in liquidity. Financially, the net debt to annualized pro forma adjusted EBITDAre stood at 5.2x, which is not bad.

Among the significant events, the announcement of the planned takeover of Spirit Realty Capital in a share swap worth $9.3 billion deserves special mention. This acquisition is set to significantly impact the company's financial landscape and market position. It's going to be >2.5% accretive to Realty Income's AFFO/sh., coming with expected annual cost synergies of ~$50 million. Notably, the acquisition is structured in a way that avoids the need for a new capital raise, leveraging Spirit's existing capital stack. From what I see, the combined portfolio enhances O's diversification, particularly in non-discretionary and service retail assets. It solidifies Realty Income's position as the fourth-largest REIT in the country.

Looking ahead, Realty Income emphasized its cautious yet optimistic approach to capital allocation, given the recent changes in the cost of capital. The company adjusted its investment guidance for 2023 to ~$9 billion, excluding the Spirit transaction, reflecting deals already in the closing pipeline before the surge in capital costs. According to the management's commentary, Realty Income remains highly selective in pursuing new opportunities, maintaining a focus on generating ample spreads to its cost of capital. With a healthy portfolio performance, strong financial discipline, and the pending merger with Spirit Realty, Realty Income positions itself favorably for continued stability and growth in the real estate investment landscape.

In my opinion, all the company needs to continue its development is a change in market sentiment and a softer macro environment for REITs. And it seems that Mr. Market has gradually started to fulfill this need in recent weeks.

The Market Gives An Opportunity

As Bank of America's analysts recently noted in their December research paper [proprietary source], the Real Estate sector in FY2024 looks like a "diamond in the rough" as ~30% of its constituents now offer yields higher than the 10-year yield, making them attractive income options.

Furthermore, the monetary policy paradigm shift, which is set to occur as early as 2024, makes today’s setup for REITs beyond the norm. Here is a clear example of how real estate stocks behave today compared to similar periods in past economic cycles:

This means that the potential for a positive reaction to the monetary policy turnaround is most likely not yet fully embedded in real estate stocks, providing a favorable backdrop for stock picking within the sector.

Despite expectations of a potential slowdown in consumer spending, Key Bank analysts support my finding and provide a relatively favorable outlook for retail REITs. Strong leasing demand, a significant leasing backlog, and robust renewal rent spreads contribute to an anticipated above-trend growth in 2024 and 2025. The Retail REIT sector performed well in 2023, achieving approximately 4% Same-Store Net Operating Income (SSNOI) growth, even in the face of major bankruptcies and closures from top tenants. While growth is expected to normalize from peak levels, elevated internal growth is projected as economic occupancy improves across the sector. Consumer weakness may pose a challenge, but unless there is a sudden increase in bankruptcies, significant changes in growth for the sector are not anticipated. Especially in the case of Realty Income, its competitive advantage of high-quality diversification should, in my opinion, help the company to withstand any headwinds of this kind.

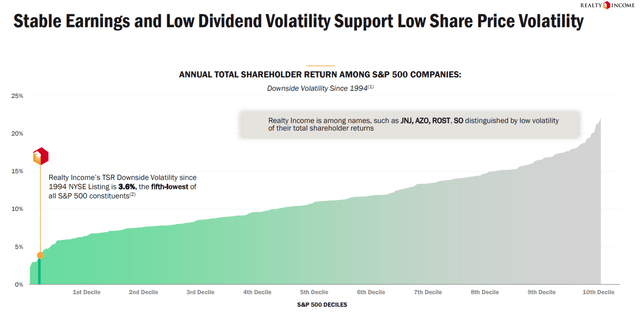

It's important to remember the company's market specialization as a net lease retail REIT, which benefits from its recession-resistant niche in essential goods and services, providing protection during economic downturns. The company maintains high occupancy rates due to long leases and strong tenants, ensuring consistent revenue generation. With predictable income, Realty Income offers steady dividend growth to investors, supported by low operating costs facilitated by triple-net leases and extended lease terms. However, potential drawbacks include limited growth potential in the mature and competitive net lease retail market, challenges in expansion, and sensitivity to rising interest rates that may impact property attractiveness. And I think the negative aspects have apparently already been reflected in the O stock price because a) the macro picture itself is changing before our eyes, and b) the period of high interest rates has not greatly affected the company's business in the recent past.

Despite the positive picture for retail REITs this year, the profitability of an individual trust will depend on the appropriateness of its valuation. What is the growth potential of the O stock's total return? Let's find out together.

Realty's Valuation Analysis

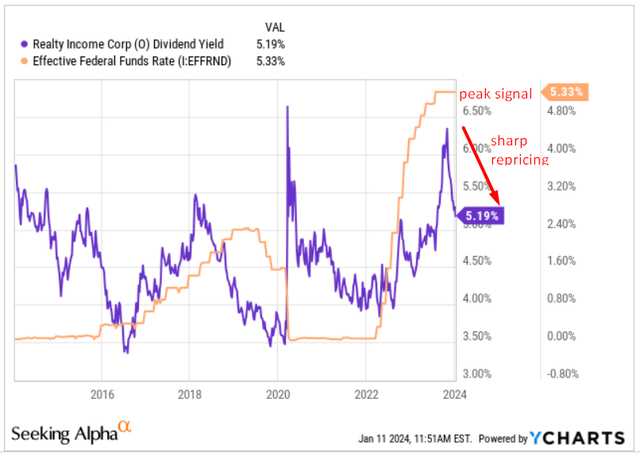

Like any other REIT, Realty Income is very sensitive to changes in the interest rates. As soon as the market priced in the peak in the fed funds rate, Realty Income's stock price reacted with a rapid rise, abruptly interrupting the growth of the dividend yield:

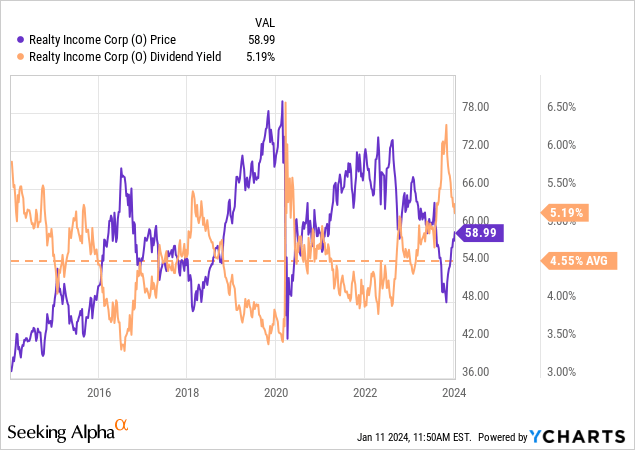

But has the company's dividend yield adjusted low enough to ensure that the long-standing correlation between the two percentage ratios continues to work? The average dividend yield over the last 10 years tells us that O's dividend yield should fall by a further 64 basis points following the principle of mean reversion:

But here one can rightly argue that we are most likely in a completely different macro regime, which implies that high interest rates in the economy should be maintained for longer due to a) a still strong labor market and b) additional risks of inflation spikes.

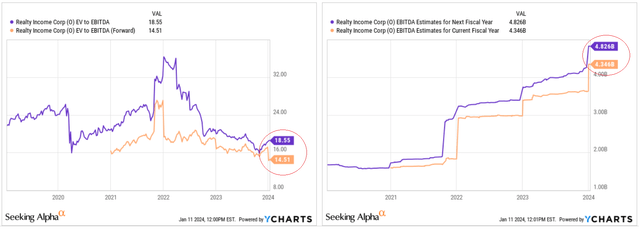

I assume that the 'higher for longer' interest rate environment will indeed take place. But then what to do with the EV/EBITDA ratios, which are pricing a sharp decline next year due to the predicted rapid growth in EBITDA? Is it really fair that Realty Income's EV/EBITDA will fall almost 22% due to 11% EBITDA growth (both year over year)?

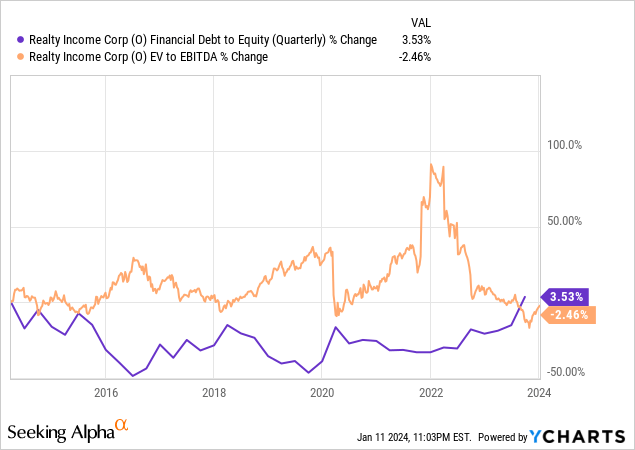

This growing discount to EV/EBITDA can be explained by the increase in leverage in recent quarters. Indeed, the valuation of Realty correlates very strongly with the degree of credit risk:

However, I think that as EBITDA rises, the O stocks should at least return to the lower end of its historical EV/EBITDA, which is around 16x. With a forecast EBITDA of $4.83 billion, I think that the fair equity value after adjusting for net debt is ~$56.7 billion. This results in an upside potential of 32.2%, not counting the dividend yield of over 5%.

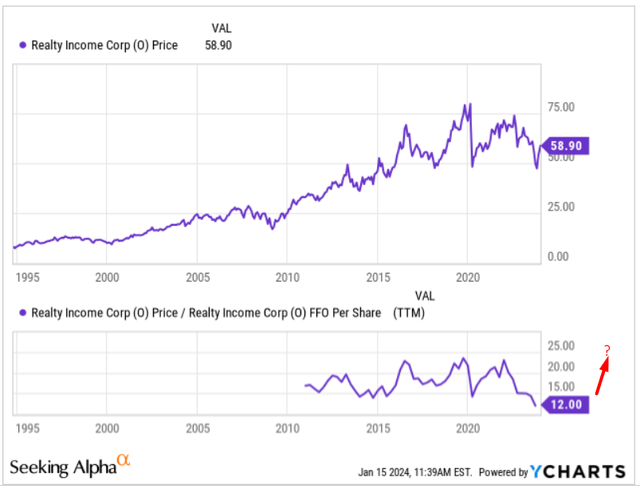

A look at the more classic metric for the valuation of a REIT - the price-to-FFO - confirms my conclusions above: O stock's price-to-FFO ratio of ~12x is currently well below its long-term average of 16-17x, giving us ~37.5% upside to the mean.

The Bottom Line

The main risk of my withdrawal is the company's growing credit risk. Although the acquisition of Spirit is structured in such a way that a new capital increase is not necessary, Realty Income's risk profile is nevertheless likely to become higher due to an increase in the absolute value of liabilities on the consolidated company's balance sheet. Although this should not affect the company's creditworthiness, the discount we see in O's valuation today will likely remain or even widen for some time. That may make my thesis irrelevant or delayed at best.

Economic downturns may lead to financial struggles for tenants, resulting in higher vacancies and lower rental income. Tenant risk is significant, and the financial stability of major tenants is crucial to Realty Income's performance.

But despite the existing risks, I still believe that Realty Income Corporation has good growth potential in the medium term. By the end of 2024, I expect the O stock to return to a sub-5% dividend rate, which will be explained by the Fed's rate cut and the logical mean reversion in the company's valuation multiples. If I'm right, investors should expect an astounding total return of over 30% based on my calculations above.

So I rate the O stock as a 'Buy' today.

Thanks for reading!

Hold On! Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

![BofA [December 2023]](https://static.seekingalpha.com/uploads/2024/1/11/49513514-17049903799984279.png)