It was shades of the Titanic in the cruise stock sector today. The big three in cruise lines—Royal Caribbean (NYSE:RCL), Carnival (NYSE:CCL), and Norwegian Cruise Line (NYSE:NCLH)—were all down in Tuesday afternoon’s trading. All three were hard-hit, with Carnival getting off the lightest, losing about 6.5% in trading. Royal Caribbean lost 7.5%, and Norwegian was down better than 8%.

The irony is that just a few days ago, things were looking a lot brighter for Carnival. It brought out an earnings report that was nothing short of phenomenal, turning in a loss that was about half as bad as analysts had expected. Better yet, it brought in record revenue, not only for the quarter but also for the year. Carnival even told some exciting tales about how it not only scuttled a large portion of its debt load but also built a solid cash cushion. Meanwhile, Norwegian got several price target hikes, as did Royal Caribbean. The idea that things might have turned around that fast and that badly, seems like a long shot at best, so this may be a temporary downturn.

Investors Grow More Cautious

So, what hit the cruise line market like an iceberg near steerage? A growing cautiousness by investors, who are looking at the overall macroeconomic conditions and do not like what they see. Investors. in general, were taking the defensive route, moving away from leisure and other discretionary purchases and instead, backing staples. With a cavalcade of earnings reports set to be released in the next few weeks, it seems clear that investors want to plan ahead and not be left holding the bag in sectors that may not be in line for good performance.

Which Cruise Stocks are a Good Buy Right Now?

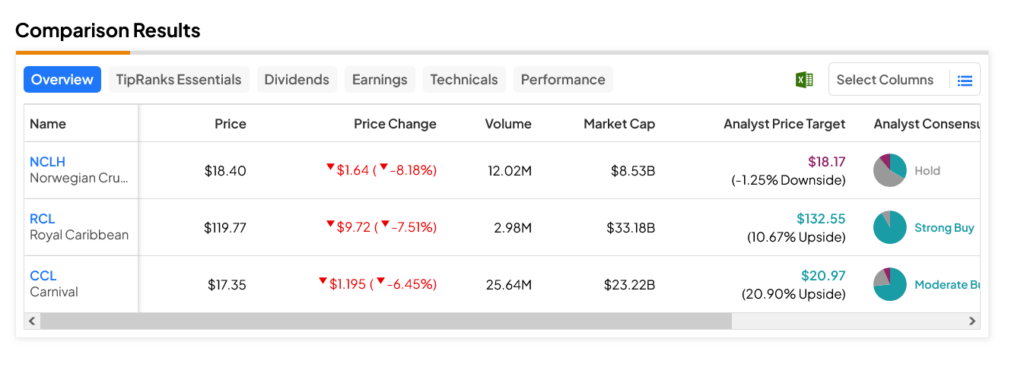

Turning to Wall Street, NCLH stock is the laggard, as this Hold-rated cruise line stock offers investors 1.25% downside risk with its average price target of $18.17 per share. Meanwhile, the leader is CCL stock, a Moderate Buy-rated stock with 20.9% upside potential thanks to its $20.97 average price target.