Target (NYSE:TGT), as a retailer, has commonly been regarded as one step above Walmart (NYSE:WMT). Target is where middle class shoppers who downgrade from department stores go in the face of potential economic hardship. And the latest word out of Target suggests that that hardship may be harder felt than many hoped. Despite disturbing news from the CEO, Target was still up nearly 2% in Thursday afternoon’s trading.

The word out of Brian Cornell, Target’s CEO, was that the worst-case scenarios are starting to kick in. Customers are pulling back their spending in literally every sector Target can track, and that includes groceries, a field formerly thought largely impervious to spending cuts. People have to eat, after all, and that generally keeps grocery purchases in tact in even the worst of times. But people are even making cuts in the grocery budget, and Target has seen declining sales in multiple discretionary categories—from clothes to toys—over the last seven quarters, and that’s expanded more recently to even cover food and beverage sales.

Target is not taking this lightly. It’s already prepared a range of early Black Friday deals to coax the skittish consumer out of hiding and back into a shopping mood. Currently, “tens of thousands” of items are on sale in advance of the biggest day of the holiday shopping season, and those sales will go up to 50% through Thanksgiving weekend. And yes, everything from toys to clothing to electronics and more will be on hand. The question, though, is whether or not shoppers will rise to the bait and start making purchases where they had previously backed off.

Is Target a Buy or Hold?

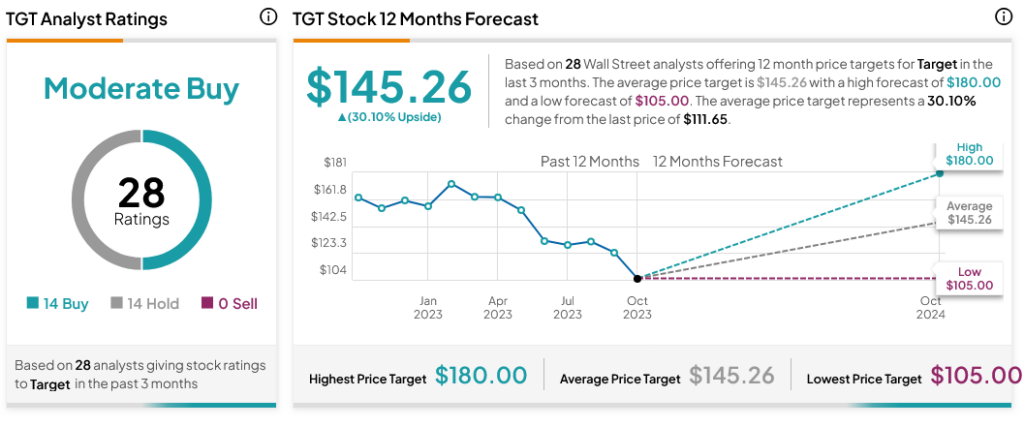

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TGT stock based on 14 Buys and 14 Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average TGT price target of $145.26 per share implies 30.1% upside potential.