Bitcoin Price Prediction Surges to $43,500 Amidst New ETF Launches and Fidelity Gains

In the dynamic world of cryptocurrency, the latest Bitcoin price prediction sees the digital asset making a notable surge, reaching $43,500 with an increase of approximately 2.75% on Tuesday. This uptick in Bitcoin’s value comes amidst a flurry of activity in the exchange-traded fund (ETF) sector, signaling a growing institutional interest in cryptocurrency.

In the dynamic world of cryptocurrency, the latest Bitcoin price prediction sees the digital asset making a notable surge, reaching $43,500 with an increase of approximately 2.75% on Tuesday. This uptick in Bitcoin’s value comes amidst a flurry of activity in the exchange-traded fund (ETF) sector, signaling a growing institutional interest in cryptocurrency.

Notably, Invesco has strategically reduced fees for its Bitcoin ETF in a bid to attract more investors. Meanwhile, the landscape of cryptocurrency investment is further expanded with the introduction of the first Bitcoin ETF application in Hong Kong.

In a significant development, Fidelity’s Bitcoin ETF has reported substantial gains of $208 million, effectively offsetting the impact of withdrawals from Grayscale, and underscoring the robust appetite for Bitcoin among investors.

Invesco Reduces Fees for Bitcoin ETF to Attract Investors

The Invesco Galaxy Bitcoin ETF (BTCO), a spot Bitcoin exchange-traded fund (ETF) from Invesco and Galaxy Asset Management, now has a fee of 0.25% instead of 0.39%.

With this modification, the sponsor cost is now in line with industry norms and can now compete with even lower fees offered by competitors like Ark, 21Shares, Bitwise, and Franklin Templeton.

Spot #bitcoin ETF issuers @InvescoUS and @galaxyhq have lowered the fee of its fund to 0.25% from 0.39%. @HeleneBraunn reportshttps://t.co/ok3rLdvUwA

— CoinDesk (@CoinDesk) January 29, 2024

For the first six months or until the ETF’s holdings exceed $5 billion, Invesco has promised to waive costs.

Even with the cost cut, Invesco’s Bitcoin spot ETF has trailed behind rivals like BlackRock and Fidelity in terms of inflows since its launch, coming in at just over $280 million.

Although the reduction in fees might make the ETF more appealing, it has improving Bitcoin values, which could increase market confidence in cryptocurrency investment products as a whole.

Hong Kong Witnesses Its First Bitcoin ETF Application

Harvest Global has signaled the possibility of a regulated investment path in the cryptocurrency market by submitting a request for a spot Bitcoin exchange-traded fund (ETF) to the Hong Kong Securities and Futures Commission.

Investors would be able to trade fund shares on conventional stock markets that are directly correlated with the price of Bitcoin if the spot Bitcoin ETF is approved. Hong Kong’s embrace of cryptocurrency is consistent with worldwide patterns.

NEWS: Hong Kong Securities and Futures Commission has reportedly received its first spot #Bitcoin ETF application.

📰 https://t.co/iJVTndtwvR pic.twitter.com/6LNSGHyb1Y

— CoinGecko (@coingecko) January 29, 2024

The Securities and Exchange Commission’s recent approval of 11 spot Bitcoin ETFs was a big step forward for the US economy.

The application from Harvest Global underscores a wider market need for investing solutions that provide exposure to digital assets without requiring actual asset ownership.

Although the effect on Bitcoin prices is becoming better, the approval might draw in new players and boost market confidence in cryptocurrency investments.

Fidelity’s Bitcoin ETF Compensates for Grayscale’s Withdrawals with $208M Gain

On January 29, Fidelity’s spot Bitcoin ETF, FBTC, reportedly had daily inflows of $208 million, exceeding withdrawals from Grayscale Bitcoin Trust (GBTC) for the first time since the fund’s inception.

With the exception of its ETF conversion day, GBTC’s daily outflows dropped by almost 25%, making it the second-lowest day overall.

The success of Fidelity coincides with a fee battle in the spot Bitcoin ETF market, since costs for ETFs have recently been lowered by Invesco and Galaxy Asset Management.

And @Grayscale's $GBTC maintains its liquidity crown — trading $570 million and ~$110 million more than second place $IBIT today https://t.co/WIAWKwDnqY pic.twitter.com/ma0CE5szLa

— James Seyffart (@JSeyff) January 29, 2024

ETFs domiciled in Europe may be impacted by this fee competition, leading traders to potentially transfer money to the United States.

As investor interest in and competition in the cryptocurrency market grows, the higher inflows into Fidelity’s ETF and the general fee competition may have a favorable effect on BTC prices.

Bitcoin Price Prediction

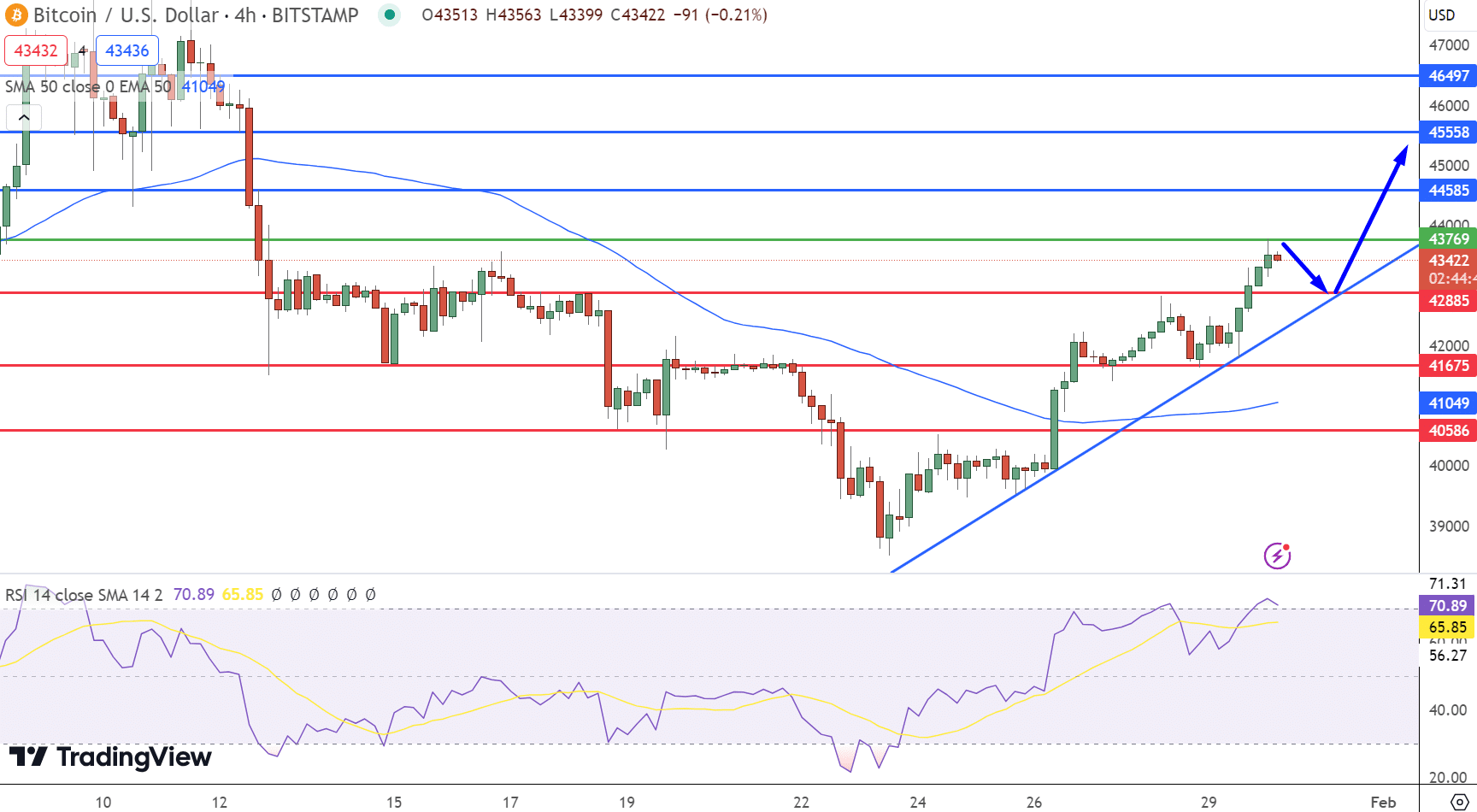

Bitcoin (BTC/USD)‘s key pivot point is identified at $43,769. The immediate resistance levels are placed at $44,585, $45,558, and $46,497, marking potential barriers for upward price action.

Conversely, support levels are established at $42,885, $41,675, and $40,586, providing potential floors that might halt any further decline.

The Relative Strength Index (RSI) is currently high at 70, indicating the market may be approaching overbought conditions. The Moving Average Convergence Divergence (MACD) shows a value of 98 and a signal of 586, suggesting the potential for continued bullish momentum.

The 50-Day Exponential Moving Average (EMA) is positioned at $41,049, bolstering the bullish stance as the current price stands above this level.

An upward trendline is observed, offering substantial support near the $42,885 level. A break above the pivot point could catalyze a significant upward move. The overall trend for BTC/USD is bullish above the $42,885 mark.

Short Term Bitcoin Price Prediction

The asset is expected to challenge the resistance at $44,585 in the upcoming days, contingent on maintaining its position above the critical support level.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.