At a recent industry conference, Eli Lilly’s (NYSE:LLY) presentation centered on the outlook for its commercial and clinical portfolios, and emphasized the company’s growth potential compared to other industry players.

Taking it all in, Bank of America analyst Geoff Meacham came away with 3 key takeaways. Firstly, Lilly is expanding its R&D efforts while “sustaining productivity” through a combination of internal investments and external innovation, with over 50% of current assets obtained externally. Lilly intends to boost business development by acquiring both talent and methodologies, a strategy that has historically led to “differentiated innovation,” as seen in the case of Lilly Gateway labs. Finally, Eli Lilly is targeting significant medical conditions with substantial unmet needs. The company is steering clear of ‘me too’ programs and is positioning itself as an early adopter of new modalities.

Looking ahead to 2024, given it will be the second full year of diabetes drug Mounjaro’s launch and the first for chronic weight management treatment Zepbound, the company expects this year to be a “year of commercial execution,” although Meacham also points out pivotal results in obstructive sleep apnea (OSA) and HFpEF are in the cards. “Notably,” explains the analyst, “these indications further expand the total addressable market and potentially allow for reimbursement through Medicare Part D as it currently excludes anti-obesity medications.” Although obesity has taken center stage, Alzheimer’s is another important vertical that should not be overlooked.

And while Meacham concedes the “incremental color for near-term dynamics” was not enough for him to raise any estimates, he firmly believes the pharma giant is in a league of its own. “Overall,” the analyst said, “we’d say that the color we received bolsters our confidence in upside potential for Lilly’s profile and as such, Lilly remains our favorite stock under coverage as it’s a ‘have’ in a sea of ‘have nots.’”

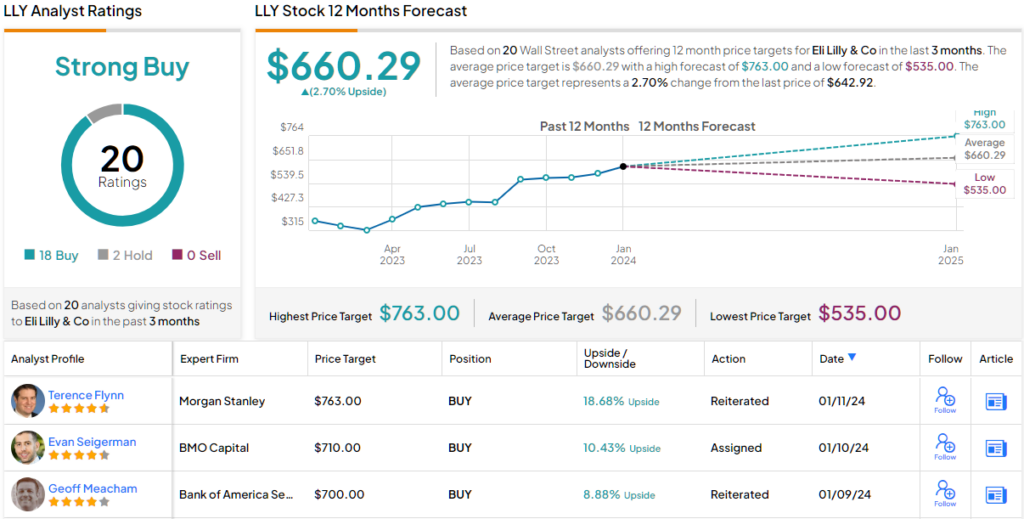

To this end, Meacham rates Eli Lilly shares a Buy, while his price objective of $700 represents potential gains of ~10% from current levels. (To watch Meacham’s track record, click here)

And what about the rest of the Street? Most are also backing LLY’s case. With an additional 17 Buys outnumbering 2 Holds, the analyst consensus rates the stock a Strong Buy. That said, the $660.29 average price target, makes room for only modest returns of ~3%. (See LLY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.