In comparison, graphics processing unit (GPU) specialist Advanced Micro Devices (NASDAQ:AMD) might seem like a bargain to key rival Nvidia (NASDAQ:NVDA). While that might be the case on paper, the attempt by both companies to milk the artificial intelligence (AI) wave might fall well short. Therefore, investors shouldn’t look to the smaller technology firm for their next AI trade. I am tactically bearish on AMD stock.

AMD Stock Risks Getting Dragged Down by Nvidia’s Vortex

To understand the risk factor associated with AMD stock, one only needs to look at Nvidia’s recent decline. While a competitor’s suffering might be a cynically bullish narrative for rivals, the problem is that many companies now want a piece of the AI and machine learning (ML) pie. As a result, Nvidia’s sinking could easily drag down the computer processor sector.

On the evening of October 16, I shared a cautionary tale about Nvidia, warning that investors must tread vigilantly as the underlying AI market appeared overhyped. Subsequently, by last Friday’s close, NVDA had lost about 6.7% of its equity value. To be fair, AMD didn’t incur as bad of a loss as its nemesis. Nevertheless, it still incurred a similar 6.1% erosion during the same period.

Again, it’s not difficult to understand why: both enterprises are fighting for the same AI niches, particularly processors designed to bolster generative AI protocols. In addition, AMD recently announced the acquisition of AI startup Nod.ai. Per TipRanks reporter Shrilekha Pethe, the move represented a bid to catch up to Nvidia.

So, with all the investment money being poured into the broader AI ecosystem, NVDA’s recent volatility is hardly good news for the sector. It’s quite possible that – as I argued earlier – Nvidia has already plucked the low-hanging fruit. With raised standards and new competition in the mix, astute investors saw the writing on the wall.

Unfortunately, that’s not a Buy signal for AMD stock because both enterprises are in the same boat.

Excessive Hype and an Export Crackdown Hurt AMD

Fundamentally, the overheated AI narrative wouldn’t be as big of a concern if the broader market operated decisively in a bullish cycle. Unfortunately, with inflation still substantially elevated and thus leaving monetary policy vulnerabilities (i.e. raised interest rates), investors are much more cautious about risk-on asset classes. Further, the geopolitical environment does little to help AMD stock.

First, excessive hype imposes anxieties over Advanced Micro’s forward progress in the charts. According to analyst firm CCS Insight, the generative AI industry might get “a cold shower in 2024.” That’s because the harsh realities of integrating digital intelligence – such as costs, risks, and complexities – in platforms to yield practical results may replace the hype underlining the innovation.

For clarification, the research firm advocates for AI, believing that it will have a long-term positive impact on the economy. However, CCS Insight chief analyst Ben Wood stated, “The hype around generative AI in 2023 has just been so immense, that we think it’s overhyped, and there’s lots of obstacles that need to get through to bring it to market.”

Second, on the geopolitical side, the U.S. Department of Commerce stated that it planned to curb exports to China of advanced processors that can be utilized to for AI-related applications. Naturally, this news diminishes the total addressable market of chip manufacturers.

According to market intelligence firm IDC, experts earlier this year projected that China’s AI sector could exceed $26 billion by 2026. Further, hardware would make up 56% of this burgeoning field. Now, the implied bullishness for AMD stock and its ilk comes under serious scrutiny.

Bad News for NVDA is Not Good News for AMD

Some might argue that the chip export ban disproportionately impacts Nvidia because it’s the leader in AI. Therefore, policymakers want to avoid giving China any advantages by supplying the nation with Nvidia chips. However, that’s not good news for AMD stock.

Undergirding the incredible rise of NVDA is the tech giant’s massive revenue growth. In contrast, AMD has absorbed a revenue decline. For example, in the second quarter of Fiscal 2023, Advanced Micro posted sales of $5.36 billion, down sharply from the $6.55 billion posted one year ago.

Basically, if Nvidia is hurting because of falling demand, the pain would be felt broadly for enterprises that pivoted toward AI.

Is AMD Stock a Buy, According to Analysts?

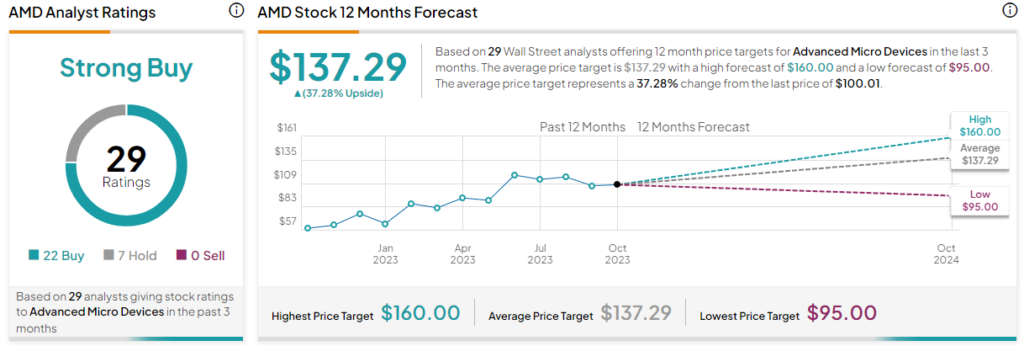

Turning to Wall Street, AMD stock has a Strong Buy consensus rating based on 22 Buys, seven Holds, and zero Sell ratings. The average AMD stock price target is $137.29, implying 37.3% upside potential.

The Takeaway: AMD Stock is No Discount

For anyone tempted to acquire AMD stock based on weakness in Nvidia, it’s time to rethink the proposition. Yes, NVDA is absorbing the brunt of the damage. However, with many semiconductor companies pivoting toward AI, Nvidia’s loss will probably not be Advanced Micro’s gain.